St Baker Group Strategic Investment and Associated Placement

Brisbane, Oct 10, 2022 AEST (ABN Newswire) - State Gas Limited ( ASX:GAS) (

ASX:GAS) ( STGSF:OTCMKTS) is pleased to advise that it has attracted strategic investment from leading energy sector experts and undertaken an associated equity raising to help accelerate production from its east coast gas projects.

STGSF:OTCMKTS) is pleased to advise that it has attracted strategic investment from leading energy sector experts and undertaken an associated equity raising to help accelerate production from its east coast gas projects.

Expert energy entrepreneurs, Trevor St Baker and Philip St Baker were attracted by the recent progress at the Company's 100%-owned gas projects in Central Queensland in the context of the unprecedented global opportunity in the natural gas market.

Under the strategic investment and associated placement (the Placement), $7,000,000 in new equity will be issued at a price of $0.28 per share (a 20% discount to the last-traded price of $0.35 and a 19.2% discount to the 10-day VWAP of $0.347) to the strategic investors and Sophisticated Investors. Managed by Morgan's Corporate Limited, State Gas Directors also participated in the placement, with their investments being subject to shareholder approval to be sought at the Company's Annual General Meeting in November.

The Placement will result in the issue of 25,000,000 new Ordinary shares in State Gas; of which 24,339,284 will be issued without shareholder approval using the Company's capacity under Listing Rule 7.1, and a further 660,716 new Ordinary shares will be issued to Directors, following receipt of Shareholder approval (to be sought at the forthcoming AGM).

Settlement of the Placement is expected to occur on Wednesday 12 October 2022 with allotment of New Shares expected to occur on Thursday 13 October 2022.

The net proceeds of the strategic investment and equity raising will be used to continue the horizontal well drilling and testing program at the Company's 100%-owned Rolleston-West Gas Project and support the previously announced Compressed Natural Gas Trucking project which will utilize the Company's conventional gas sourced from its 100%-owned Reid's Dome Gas Field.

The proceeds will also help fund planning and survey work for a proposed export pipeline to connect the Company's gas projects with the east coast gas pipeline network, along with additional working capital and drilling associated with its carbon sequestration joint-venture in Central Queensland.

The Board of State Gas is delighted to welcome the St Baker group's investment and new expert Board appointments. The St Baker family have historically developed billions of dollars of gas infrastructure in Australia to support reliability, stability, and affordability in the power grid. This involved the construction of over 2,500MW of new gas-fired power generation over the decade to 2009 - making it the largest power station developer in Australia during that era. During that period, the St Baker interests also built over 300km of gas pipeline infrastructure and entered gas purchase contracts in the order of $10 billion associated with its power station projects.

As Australia transitions from coal to renewables, the use of gas will provide critical support for intermittent renewable generation, such as solar and wind power. Gas will assist in providing reliability, stability and affordability of electricity. This, along with the global shortage of gas, means that the need for new gas sources in Australia, such as from State Gas's Central Queensland projects, has never been greater.

The St Bakers have advised that they are actively divesting from coal generation and investing in gas, renewables and electric vehicles, and associated supply chains and supporting technologies.

State Gas's portfolio of both conventional and coal seam gas projects provides flexibility to sell gas into demand peaks as the east coast gas shortage worsens from 2023 as predicted by the Australia Energy Market Operator (AEMO). As previously announced, the Company is planning to initially truck its conventional gas from the Reid's Dome Gas Field to the east coast pipeline network, commencing February 2023, while planning for a gas pipeline is underway.

As part of the strategic investment package, electricity and gas market executives, Jon Stretch and Philip St Baker will join the Company's Board of Directors.

The strategic investment in State Gas and additional Board expertise comes at a time of unprecedented gas prices both overseas and a home.

The St Baker group, headed by Trevor St Baker, has a strong track record of successful energy sector investments in Australia and overseas. Some of the Group's investments have included:

- ERM Power - successful electricity generation, electricity retailing and gas trading company acquired by Royal Dutch Shell PLC for $620 million

- Delta Electricity - owner of Vales Point Power Station and Chain Valley Coal Mine - in process of sale to Czech Sev.en Global Investments (undisclosed price)

- The St Baker Energy Innovation Fund, with investments including Tritium (a SPAC listing on NASDAQ), NOVONIX Limited (ASX and NASDAQ-listed) and Applied Electric Vehicles Ltd.

The current St Baker group investment takes its combined holdings to approximately 12% of the Company's issued capital.

New Director Appointments

As mentioned, on completion of the strategic investment and associated capital raising, two additional energy sector experts will be appointed to the Board of State Gas - Jon Stretch and Philip St Baker. The new appointments bring significant additional expertise in the gas and electricity markets, along with further commercial acumen and valuable customer networks in the energy and industrial sectors.

John Stretch

- Former CEO of ERM Power, oversaw sale to Royal Dutch Shell

- Former EVP of EMEA - Landis + Gyr (Smart-Metering)

- Former Director of Telecom New Zealand Australia

Philip St Baker

- Current Director of St Baker Energy Holdings & Delta Electricity

- Former CEO of NOVONIX - instrumental in its move from mining to battery technologies and synthetic materials production in North America

- Former CEO of ERM Power - grew revenues from $10m to >$2b and led gas trading team

- Later a Non-Executive Director of ERM until acquisition by Royal Dutch Shell

- 16 years with BHP in operational, business improvement and executive roles covering minerals, petroleum and metals divisions

The Rougemont-3 Dual Horizontal Well

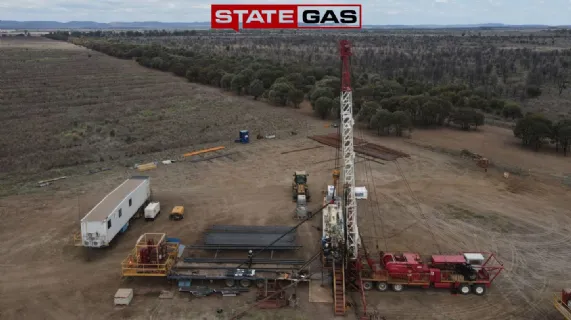

The Rougemont-3 horizontal well is currently being drilled in Central Queensland to confirm the gas for production in the Rougemont area within State Gas' 100%-owned Rolleston-West Project (ATP 2062) , and to provide gas for a future pipeline planned for 2024. The well is being drilled laterally through the coals of the Bandanna Formation (which are in commercial production at the Arcadia Valley to the south-east) to meet-up with the vertical Rougemont-2 well.

Excellent gas shows have been observed throughout the drilling of the first Rougemont-3 lateral, with gas peaks of 29.5% and an overall average throughout the lateral of 24%, of which 99% was methane.

About State Gas Limited

State Gas Limited (ASX:GAS) (OTCMKTS:STGSF) is a Queensland-based gas exploration and development company with highly prospective gas exploration assets located in the southern Bowen Basin. State Gas Limited's mission is to support east coast energy markets through the efficient identification and development of new high quality gas assets.

State Gas Limited (ASX:GAS) (OTCMKTS:STGSF) is a Queensland-based gas exploration and development company with highly prospective gas exploration assets located in the southern Bowen Basin. State Gas Limited's mission is to support east coast energy markets through the efficient identification and development of new high quality gas assets.

It will do this by applying an agile, sustainable but low-cost development approach and opportunistically expanding its portfolio in areas that are well located to gas pipeline infrastructure.

State Gas is 100%-owner of the contiguous Reid's Dome (PL-231) and Rolleston-West (ATP 2062) gas projects, both of which contain CSG and conventional gas. The Projects, together some 1,595km2 , are located south of Rolleston, approximately 50 and 30 kilometres respectively from the Queensland Gas Pipeline and interconnected east coast gas network. State Gas intends to accelerate commercialisation of these assets through the application of an innovative virtual pipeline ("VP") solution which will see the Company transport compressed gas by truck to existing pipeline infrastructure or to an end user.

State Gas also holds a 35% interest in ATP 2068 and ATP 2069 in joint venture with Santos QNT Pty Ltd (65%). These two new areas lie adjacent to or in the near vicinity of State Gas and Santos' existing interests in the region, providing for the potential of an alignment in ownership interests across the region over time and enabling synergies in operations and development.

State Gas is also participating in a carbon capture and sequestration initiative with minerals explorer Rockminsolutions Pty Ltd in respect of EPM 27596 which is located on the western border of ATP 2062. This project is investigating the potential of the unique basalts located in the Buckland Basaltic Sequence (located in EPM 27596) to provide a variety of in-situ and ex-situ carbon capture applications.

| ||

|