Lithium Market Outlook

Perth, Mar 3, 2009 AEST (ABN Newswire) - Galaxy Resources Limited (ASX:GXY) attended the inaugural World Lithium Supply and Markets 2009 conference in Santiago, Chile earlier this month. Based on information presented at the conference and a recently published Economics of Lithium report by Roskill, the company wishes to provide a report on the market outlook for lithium.

The conference was the first occasion that the world lithium industry gathered collectively to discuss the outlook for the metal. In general, the outlook for lithium consumption appears positive.

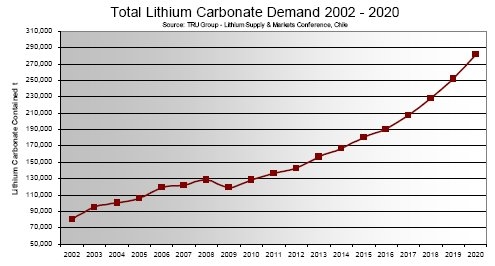

The forecast and outlook presented by the top three world lithium producers, SQM3, Chemetall4, FMC Lithium5 as well as research groups such as TRU Group2 and Roskill1 show world lithium demand is expected to grow around three fold in just over ten years driven by secondary (rechargeable) batteries and Electric Vehicle (EV) batteries. Current demand for lithium, measured as Lithium Carbonate Equivalent (LCE), is around 110,000 tpa. This is expected to rise to around 250,000 to 300,000 tpa in 2020 driven by secondary (rechargeable) batteries and Electric Vehicle (EV) batteries.

In general, the industry expects a slowdown in 2009 due to the world financial situation but strong growth of lithium demand is expected on the recovery of the world economy. Galaxy's project is timed to be part of this expected recovery with final lithium battery grade lithium carbonate product available in early 2011.

In a recently published Lithium Report, Roskill estimates overall growth of lithium demand to be between 5%-8%. Overall growth is estimated at 5-8%py in the base-case scenario, resulting in a rise in world consumption from 21,280t Li (112,784 t LCE) in 2008 to 28,240t Li (149,672t LCE) in 2013, although as the global economic slowdown continues, growth could be flat in 2009 and below 5.0% in 2010, followed by higher rates of growth from 2011 coinciding with any recovery in the global economy.

While all sectors are forecast to grow, the main drivers for growth in the next ten years will be the battery sector and Li alloy production. Lithium is increasingly used in light weight aluminium alloys for the aerospace industry. The battery sector will now include the emergence of energy storage for Electric Vehicles.

Roskill states the following:

Increased production of lithium secondary batteries is forecast to provide much of the growth in consumption of lithium to 2013. Demand for lithium carbonate, lithium hydroxide and lithium salts in lithium secondary batteries is projected to rise by 15%py from 3,940t Li (20,882 t LCE) in 2008 to 7,720t Li (40,916 t LCE) in 2013. Portable consumer goods will provide some growth in demand for lithium secondary batteries, however the start of mass production of hybrid, plug-in hybrid and electric vehicles using lithium secondary batteries by major automotive manufacturers such as BYD, Chevrolet, Hyundai, Mercedes and Mitsubishi presents the most significant upside potential for lithium demand in this end-use. It should be noted that forecast growth rates for production of hybrid and electric vehicles vary widely and there are many variables to consider. Lithium consumption in the battery market could therefore be significantly higher or lower than the 15%py forecast.

Copies of key presentations at the Lithium Markets & Supply conference are on the company's website for reference.

Galaxy Offtake Update

In a recent trip to Asia, Galaxy representatives met with key trading houses, battery and automobile manufacturers in Japan, Korea, and China to discuss potential offtake arrangements of battery grade lithium carbonate. The list of companies also included potential new entrant battery manufacturers.

The response received from the companies met on the trip was positive. Some indicated an interest in investing in Galaxy in addition to offtake agreements.

Once Galaxy has selected and finalised off-take security and partners, the Company will move to the funding phase of the project. The Company recently appointed risk advisory and fund management group, Noah's Rule, to assist in the project development and corporate debt raising and financial structuring.

Notes:

1. Roskill, Economics of Lithium 2009

2. TRU Group, Lithium Supply and Markets Conference, Santiago, Chile 2009

3. SQM Presentation, Lithium Supply and Markets Conference, Santiago, Chile 2009

4. Chemetall Presentation, Lithium Supply and Markets Conference, Santiago, Chile 2009

5. FMC Lithium Presentation, Lithium Supply and Markets Conference, Santiago, Chile 2009

About Galaxy Resources Limited

Galaxy Resources Limited (ASX:GXY) (OTCMKTS:GALXF) is an international S&P / ASX 200 Index company with lithium production facilities, hard rock mines and brine assets in Australia, Canada and Argentina. It wholly owns and operates the Mt Cattlin mine in Ravensthorpe Western Australia, which is currently producing spodumene and tantalum concentrate, and the James Bay lithium pegmatite project in Quebec, Canada.

Galaxy Resources Limited (ASX:GXY) (OTCMKTS:GALXF) is an international S&P / ASX 200 Index company with lithium production facilities, hard rock mines and brine assets in Australia, Canada and Argentina. It wholly owns and operates the Mt Cattlin mine in Ravensthorpe Western Australia, which is currently producing spodumene and tantalum concentrate, and the James Bay lithium pegmatite project in Quebec, Canada.

Galaxy is advancing plans to develop the Sal de Vida lithium and potash brine project in Argentina situated in the lithium triangle (where Chile, Argentina and Bolivia meet), which is currently the source of 60% of global lithium production. Sal de Vida has excellent potential as a low cost brine-based lithium carbonate production facility.

Lithium compounds are used in the manufacture of ceramics, glass, and consumer electronics and are an essential cathode material for long life lithium-ion batteries used in hybrid and electric vehicles, as well as mass energy storage systems. Galaxy is bullish about the global lithium demand outlook and is aiming to become a major producer of lithium products.

| ||

|