Matilda Mine Scoping Study Demonstrates Robust Economics

Matilda Mine Scoping Study Demonstrates Robust Economics

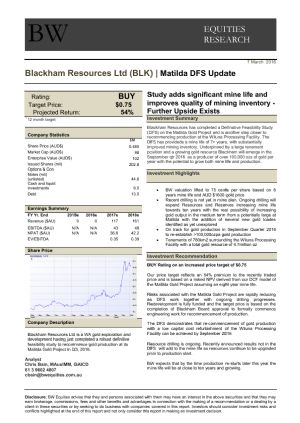

Sydney, Nov 28, 2012 AEST (ABN Newswire) - Blackham Resources Limited ( ASX:BLK) is pleased to announce its initial open pit mine designs and scoping study results at the Matilda Mine in Western Australia. The initial scoping study has been prepared by Entech Mining on the assumption the Matilda Mine ore is processed through the Wiluna Gold Plant owned by Apex Minerals NL, which is 19km by existing haul road from the Matilda Gold Mine. These studies do not take into account the pending resource upgrades at Matilda which Blackham believes will add further upside to the Project.

ASX:BLK) is pleased to announce its initial open pit mine designs and scoping study results at the Matilda Mine in Western Australia. The initial scoping study has been prepared by Entech Mining on the assumption the Matilda Mine ore is processed through the Wiluna Gold Plant owned by Apex Minerals NL, which is 19km by existing haul road from the Matilda Gold Mine. These studies do not take into account the pending resource upgrades at Matilda which Blackham believes will add further upside to the Project.

Blackham is also investigating the economics of building a gold plant at the Matilda Mine on the old plant site. A Matilda Plant could be used to process all its free milling ore including Williamson and Regent deposits. Pacer Corporation has been engaged to assess the requirements and costs of installing a gravity and carbon in leach (CIL) plant on the existing Matilda plant site. Blackham's three main deposits are all within 12kms by existing haul roads of the Matilda plant footprint.

Scoping Study - Wiluna Gold Plant (WGP) Option

The Mine design and schedule for the WGP processing option has been prepared by Entech Mining, an independent mining consultant with significant experience in mining engineering in Western Australia. This initial mine plan at the Matilda Mine is based on mining and processing 2.45Mt of ore over a 4.1 years. This mine plan assumes contract mining and haulage to the WGP.

Processing via the WGP provides a very low capital option of $10 million which leads to a short payback period of 7 months and a very high IRR of 300% due to the strong cash flows.

The WGP and Matilda Plant studies both assume mining will be conducted on a contract basis comprising of a standard goldfields mining fleet. The operation will be a conventional truck and shovel arrangement utilising 120 tonne diggers matched to 100 tonne trucks with all the associated ancillary equipment.

The WGP processing costs have been determined after consulting a number of industry and processing professionals, reviewing publically available data and applying a processing margin. The WGP is currently believed to have excess capacity to process ore and an agreement will need to be negotiated. The cash cost also included general and administrative site costs and rehabilitation. The Matilda Plant Option assumes a standard crushing circuit, a single stage grinding circuit followed by gravity and carbon in leach circuits.

Entech Mining have also rescheduled the Matilda Mine plan for an 850,000tpa plant at the Matilda site. The C1 cash cost per ounce decrease to $942/oz due mainly to the elimination of the processing margin and above ground haulage. Blackham now plans to re-evaluate the mining economics on the Matilda Plant option after updating the resources for recent positive Matilda drilling results and assess the economics of processing Williamson and Regent deposits.

Matilda Resource to be updated

Blackham has recently completed an infill and extension RC programme at the Matilda Mining Centre focussing on the M1, M3 and M4 Deposits. A total of 3,200m of RC was completed. Latest results from this drilling have defined further high-grade zones of mineralisation with significant intercepts of 10m @ 5.47 g/t from 120m including 2m @ 12.4 g/t from 121m (MARC0063) and 5m @ 5.30 g/t from 125m (MARC0062) including 1m @ 20.4 g/t from 127m. These results have extended mineralisation approximately 50m down dip (Figure 1). Together with the earlier reported intercept of 31m @ 2.32 g/t in MARC0051, Blackham has identified a gently plunging (approximately 30 DEG northwards), high-grade shoot with a strike of approximately 200m that remains open at depth (Figure 2). Many of the holes from this programme returned thicker and higher tenor results than intercepted by previous explorers closer to surface, possibly indicating depletion zones in the weathered profile. A large amount of historical drilling at Matilda failed to penetrate past the base of oxidation, thereby raising questions about its effectiveness.

In light of these excellent results the Company will be updating the resource model to determine what effect they may have on the open-pit mining economics. The high-grade nature of these results may also support an underground mining operation which will be investigated in due course.

Blackham's resource inventory at the Matilda Gold Project is currently 23Mt at 1.9g/t for 1.4Moz Au (see Table 3) which includes 12Mt @ 1.7g/t for 683,000oz Au at the Matilda Mining Centre.

"We are very encouraged by the results of the Matlida scoping study. When we acquired the Matilda Mine a year ago there were only 80,000oz of gold resource. With very limited expenditure we have moved the Matilda Mine forward very rapidly with the Scoping Study demonstrating robust economics. With further drilling of the stacked gold lodes at the Matilda Mine we expect further improvement to these economics." Managing Director Bryan Dixon was quoted.

View the complete Blackham Resources announcement including Tables and Figures at the link below:

http://media.abnnewswire.net/media/en/docs/ASX-BLK-615858.pdf

About Wiluna Mining Corporation Ltd

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:BLK) is pleased to announce its initial open pit mine designs and scoping study results at the Matilda Mine in Western Australia. The initial scoping study has been prepared by Entech Mining on the assumption the Matilda Mine ore is processed through the Wiluna Gold Plant owned by Apex Minerals NL, which is 19km by existing haul road from the Matilda Gold Mine. These studies do not take into account the pending resource upgrades at Matilda which Blackham believes will add further upside to the Project.

ASX:BLK) is pleased to announce its initial open pit mine designs and scoping study results at the Matilda Mine in Western Australia. The initial scoping study has been prepared by Entech Mining on the assumption the Matilda Mine ore is processed through the Wiluna Gold Plant owned by Apex Minerals NL, which is 19km by existing haul road from the Matilda Gold Mine. These studies do not take into account the pending resource upgrades at Matilda which Blackham believes will add further upside to the Project. Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.