Quarterly Activities Report

Brisbane, Oct 29, 2015 AEST (ABN Newswire) - Sayona Mining Limited ( ASX:SYA) ("Sayona" or the "Company") is pleased to announce activities for the quarter including securing options on two graphite projects and completing a $2.6 million capital raising.

ASX:SYA) ("Sayona" or the "Company") is pleased to announce activities for the quarter including securing options on two graphite projects and completing a $2.6 million capital raising.

Highlights

- Strategic entry in the graphite market via two option-to-purchase agreements

- $2.6 million raised through an underwritten accelerated rights offering

Strategic Entry into the Graphite Market

During the quarter, the Company announced a strategic entry into the natural flake graphite market by securing option-to-purchase agreements over two graphite projects, including Itabela in Brazil, which has near-term development potential, and the earlier stage East Kimberley project in Australia, which is planned to be drilled in late 2015.

Both projects offer an attractive entry into the graphite market, as they are:

- Situated in proven districts for high-value, high purity and large flake graphite;

- Simple geology and large resource potential;

- Well-established mining districts with excellent infrastructure;

- Close to end-user markets; and

- Tier one mining jurisdictions with stable taxes and royalties, and mining law.

East Kimberley, Western Australia

The East Kimberley project is located within the East Kimberley region of Western Australia, 240 kilometres south of Wyndham Port and 220 kilometres south-south-west of the regional centre, Kununurra.

The Company's East Kimberley project includes one granted tenement and three separate tenement applications, subject to two option-to-purchase agreements. The project covers 278 km2 and comprises two areas, Keller and Corkwood (See Figure 1 in link below).

These areas have never been previously explored for their graphite potential.

Terms of the two option-to-purchase agreements, include:

- Attgold Pty Ltd ("Attgold") - SYA paid Attgold $5,000 on signing and is required to make payments of $30,000 within 6 months and $170,000 within 18 months of signing of the agreement, respectively, to acquire a 100% interest in the tenements E80/4915, E80/4948 and E80/4949; and

- Western Iron Pty Ltd ("Western Iron") - SYA paid Western Iron $5,000 on signing and is required to pay $200,000 on or before the six month agreement anniversary to exercise its option to acquire 100% of the graphite interests in tenement E80/4511. Western Iron will also receive a 1% gross production royalty. Western Iron retains a Back-in Right to the nickel, copper and iron mineralisation by the payment of $100,000 within 12 months.

The Company's initial field reconnaissance has identified a number of graphite outcrops which closely correspond with geophysical targets reported in search literature. The graphite has a recessive weathering profile and poorly outcrops.

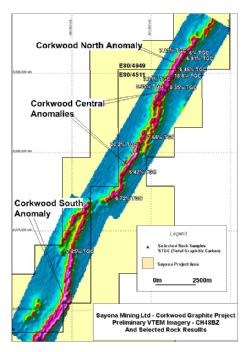

Geological and geophysical information in the Corkwood area has defined graphite prospective anomalism along a 20 kilometre strike extent. An initial field reconnaissance program has confirmed the prospectivity of the area with the discovery of graphite mineralisation at surface.

A total of 19 rock grab samples were collected and submitted for graphite analysis, with 9 returning higher than 5% TGC (total graphitic carbon) including a peak assay of 7.71% TGC.

The Corkwood graphitic horizon has limited outcrop but in road cuttings and creek exposures, is commonly 10 metres or more, and ranges up to 35 metres in true thickness.

The broad thickness, extensive strike extent and good grade highlights the potential for significant graphite mineralisation within the project area.

A follow up program was completed in July 2015 to map and sample the central portion of the Corkwood anomaly on the Western Iron granted Exploration License E80/4511, where there has been no previous graphite exploration.

Mapping has identified outcropping graphite mineralisation along a 10 kilometre strike extent within the 20 kilometre long geophysical anomaly at Corkwood. A total of 110 rock grab sample have been submitted for assay, with results ranging from 0.65% to 20.2% TGC, including:

- Seventeen of the samples returned 5% TGC or greater; and

- Two of the highest samples included 20.2% TGC and 16.8% TGC.

The graphite mineralisation is contained in units commonly 10 metres or more in thickness and up to 50 metres in thickness.

Geophysical Surveying

The Company has completed a review of historical exploration data in the district, including airborne and ground electromagnetic surveying ("EM") targeting conductive base metal mineralisation. Graphite is also strongly conductive and many explorers interpreted graphite as the likely cause of the identified anomalism.

Geophysics in the Corkwood area has defined a conductive anomaly over a 20 kilometre strike length, which correlates with surface graphite mineralisation recently discovered in the tenement). Surface rock samples collected from the geophysical anomaly area, include:

- Northern Area - up to 6.91% Total Graphitic Carbon ("TGC"); and

- Southern Area - up to 7.25% TGC.

Geophysics in the Keller area has also defined several conductive anomalies, including one over 5 kilometres in strike extent, coincident with several high-grade graphite occurrences.

Subsequent to the end of the quarter, The Company successfully completed a 320 line kilometre Versatile Time Domain Electromagnetic ("VTEM") geophysical survey over the Corkwood Graphite project. The helicopter borne VTEM system is designed to identify conductive features in the bedrock, such as flake graphite mineralisation.

Preliminary VTEM survey data clearly defines robust and coherent conductive anomalies along a corridor extending for some 25 kilometre strike extent within the project tenements (preliminary survey data is displayed in Figure 3 in link below - the areas of high intensity and potential high grade graphite mineralisation are highlighted as purple).

The VTEM anomalies coincide with areas where graphite has been identified at surface, providing encouragement that all the survey anomalies relate to bedrock graphite mineralisation.

The principle anomalous area at Corkwood Central is 9 kilometres in strike length and is coincident with graphite mineralisation identified at surface which returned up to 20.2% TGC. Within this area six prospects have been outlined with the best combination of flake size, conductance, thickness and grade for a proposed drilling program.

The survey also identified a robust southern extension to the known mineralisation which totals over 8 kilometres in strike extent and is totally untested by any exploration to date.

Final survey data is anticipated to be received in early November.

Petrography

Seven East Kimberley project surface rock samples were submitted to Townend Mineralogy Laboratory for polished thin section preparation and petrographic description. Five of the samples were collected from the northern portion of the Corkwood lease, one from the southern portion and one from the Keller area. Sample locations are shown in Figure 6 in link below.

The Corkwood rocks are classed as graphite marbles, with the calcite as a replacement mineral of metosomatic origin and related to alteration during weathering. Original feldspar, mica and sulphide have also changed during weathering causing the graphite flakes to be disrupted. The graphite shows good orientation with flakes frequently in excess of 500 micron in length and with widths typically up to 50 micron or more, with a population of finer material within the marble.

The Keller lease sample is a quartz arenite with fine flake graphite identified in the one sample tested.

Next Steps

The Company is planning to drill test the prospective Corkwood leases during the fourth quarter, calendar 2015 once statutory and Native Title requirements have been completed.

Itabela, Brazil

During the quarter, the Company signed an option-to-purchase contract for the advanced Itabela graphite project in Brazil.

Brasil Grafite S.A. ("Brasil Grafite"), is a privately owned Brazilian exploration and development company which owns 100% of the Itabela graphite project, comprising 13 exploration permits with a total area of 13,316 hectares. Sayona has signed a fourmonth, exclusive binding term sheet to acquire the Itabela project. Key terms, include:

- Monthly option payment of US$15,000 during the four month due diligence period;

- US$3.5 million purchase price should Sayona elect to acquire Itabela; and

- Vendor retains a 2% NSR over all mineral rights.

During the due diligence period, Sayona intends to complete independent technical reviews of the drilling and resource, and metallurgical test work.

Location

Itabela is located in the north-eastern state of Bahia, Brazil, 800 kilometres north of Rio de Janeiro and 500 kilometres south of the state capital, Salvador. The nearest town, Itabela, is situated 5 kilometres to the south-east and has an estimated population of 28,500.

Itabela is located in a major graphite district with three operating graphite mines. Brazil is the second largest graphite producer in the world and home to the largest producer of high quality graphite outside of China with a history of over 60 years of continuous production.

The district has a well-developed mining culture and excellent project development infrastructure, including:

- 90 kilometres by sealed road to an international airport at Porto Seguro;

- 270 kilometres by sealed road to the deep-water port of Iiheus (export for final product); and

- Power, labour, water and gas within 5 kilometres of the project area.

Resource Estimate

Approximately 8,000m of drilling has been undertaken at Itabela by Brasil Graphite out of which approximately 4,000m are used for an internal resource estimation. This is currently being converted to a JORC complaint mineral resource, with completion due in November 2015. The average hole depth is 9 metres with a maximum depth to 44 metres.

Metallurgical test work

The Itabela project has been subject to extensive metallurgical testing at bench and pilot scale. More than 31,000 kilograms (31 tonnes) of sample has been pilot tested at Fundação Gorceix, a major mineral research centre located in Ouro Preto, State of Minas Gerais. Several other major Brazilian and peer ASX listed graphite and mining companies utilize Fundação Gorceix as a pilot plant testing facility.

The metallurgical test work was managed by Mr Placido Campos, a registered professional mining and process engineer in Brazil. Mr Campos has more than 30 years' experience and expertise in graphite processing. Mr Campos was previously employed by Nacional de Grafite Ltda, the world's largest graphite producer. Responsibilities included production supervision for major operating units of the company, project management, research development, reaching General Manager of the company.

He has also previously worked for Grafite de Brasil (private Brazilian graphite producer) helping optimize their process circuit as well as several other private and listed graphite companies.

The objectives of the pilot test work program were to optimise the positive results from the bench scale test work, including:

- Achieve a high-grade graphite concentrate of greater than 93% and maintain a large flake size distribution;

- Demonstrate that ultra-high purity graphite could be produced from Itabela concentrate; and

- Design a feasibility standard, simple, low cost flotation circuit.

A total of 31,000 kilograms of run-of-mine ore ("ROM"), selected from three locations within the deposit, was mined and sent to the Fundação Gorceix pilot plant for processing.

The Company believes this is one the largest bulk samples and pilot plant tests undertaken by an ASX or TSX listed graphite explorer based on a review of published reports, providing a high quality, reliable set of data that can be used in a feasibility study.

Development plan

Sayona intends to fast track Itabela towards production by completing a Feasibility Study during 2016 followed by construction and production.

Capital Raising

During the quarter, the Company completed a fully underwritten, accelerated rights offering to raise $2.6 million. The terms of the capital raising, included:

- a 1 for 4 entitlement offer at an issue price of $0.025 per share;

- 1 free attaching option, exercisable at $0.03 and expiring 30 December 2016, for every new share applied for;

- the placement of 1,224,116 shares and listed options in respect of underwriting oversubscriptions; and

- the issue of 1,603,522 shares and 6,808,666 listed options in part settlement of raising management and underwriting fees.

To view all tables and figures, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-SYA-888308.pdf

About Sayona Mining Limited

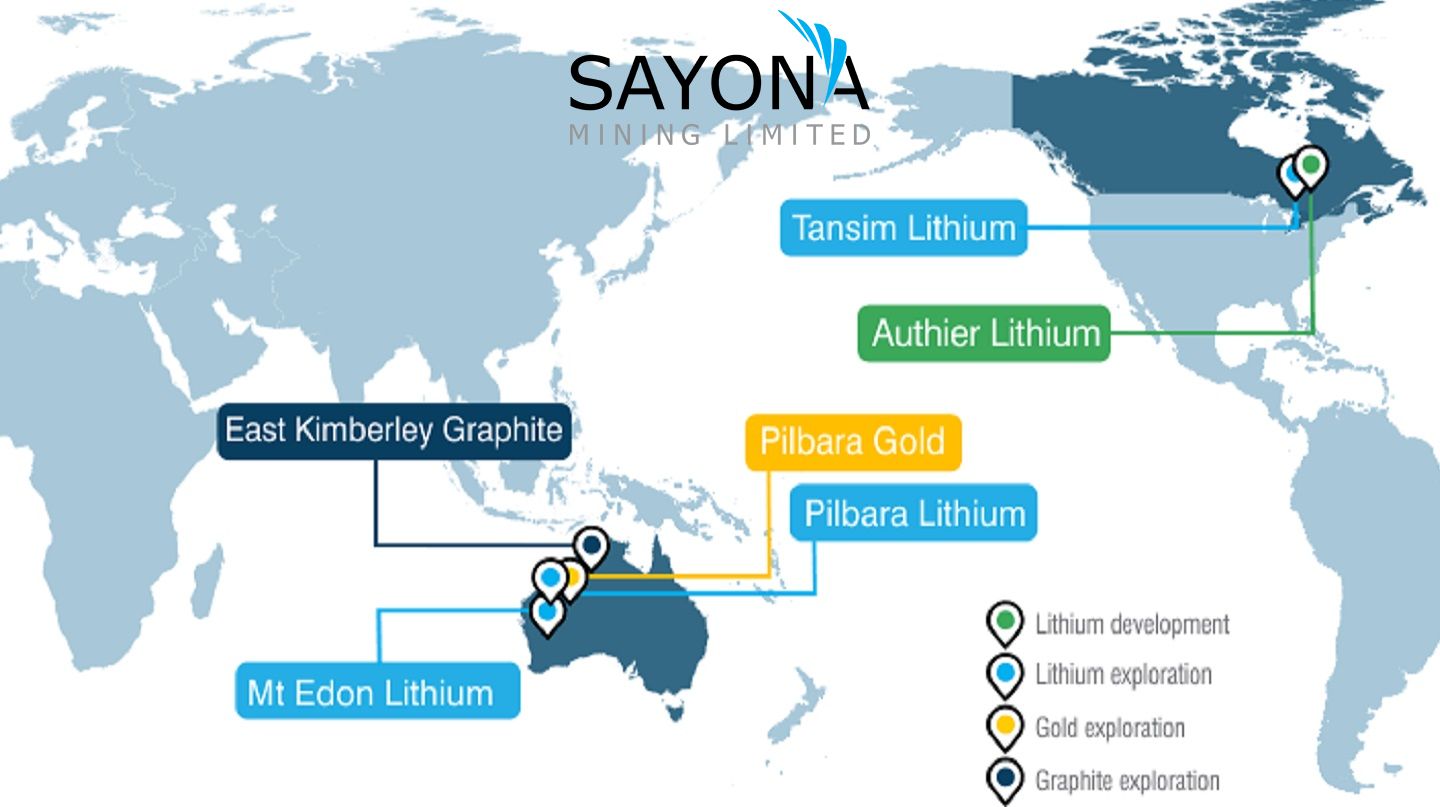

Sayona Mining Limited (ASX:SYA) (OTCMKTS:SYAXF) is a North American lithium producer with projects in Quebec, Canada and Western Australia. In Quebec, Sayona's assets comprise North American Lithium together with the Authier Lithium Project and its emerging Tansim Lithium Project, supported by a strategic partnership with American lithium developer Piedmont Lithium Inc. (ASX:PLL). Sayona also holds a 60% stake in the Moblan Lithium Project in northern Quebec.

Sayona Mining Limited (ASX:SYA) (OTCMKTS:SYAXF) is a North American lithium producer with projects in Quebec, Canada and Western Australia. In Quebec, Sayona's assets comprise North American Lithium together with the Authier Lithium Project and its emerging Tansim Lithium Project, supported by a strategic partnership with American lithium developer Piedmont Lithium Inc. (ASX:PLL). Sayona also holds a 60% stake in the Moblan Lithium Project in northern Quebec.

In Western Australia, the Company holds a large tenement portfolio in the Pilbara region

prospective for gold and lithium. Sayona is exploring for Hemi-style gold targets in the world-class Pilbara region, while its lithium projects include Company-owned leases and those subject to a joint venture with Morella Corporation (ASX:1MC).

| ||

|