Authier Project Acquisition / A$7.1 Million Capital Raising

Brisbane, July 15, 2016 AEST (ABN Newswire) - Sayona Mining Limited ( ASX:SYA) ("Sayona" or "Company") is pleased to announce completion of the Authier due diligence and entry into formal transaction documents for the CAD$4 million acquisition of the Authier lithium Project. The completion date for the transaction is the 21 July 2016.

ASX:SYA) ("Sayona" or "Company") is pleased to announce completion of the Authier due diligence and entry into formal transaction documents for the CAD$4 million acquisition of the Authier lithium Project. The completion date for the transaction is the 21 July 2016.

HIGHLIGHTS

- Execution of formal transaction documents for the Authier lithium Project acquisition

- Completion of Authier lithium Project due diligence

- Firm commitments received for a A$4.2 million private placement, with A$3.6 million to be received on Monday 18 July 2016 and up to a further $600,000 conditional on shareholder approval

- Launch of fully underwritten Accelerated Non-Renounceable Rights Issue to raise an additional A$2.9 million, with A$1.9 million to be accelerated with receipt of funds in time to complete the Authier acquisition

CAPITAL RAISING

The Company has received firm commitments for a A$4.2 million Placement and commenced a fully underwritten A$2.9 million Rights Issue as outlined below in this announcement. Of these funds, a total of A$5,497,386 will be available by 20 July 2016 (Available Funds), with the balance of the underwritten Rights Issue proceeds of $996,682 to be received by mid August and a further $600,000 being subject to shareholder approval. The Company anticipates it will convene an Extraordinary General Meeting (EGM) to be held in early September 2016 for that purpose.

The Available Funds (together with the net proceeds from the Rights Issue and the Company's existing cash) will be applied to:

- acquisition of the Authier lithium Project;

- feasibility expenditure on the Authier lithium Project;

- exploration expenditure on the Company's Australian Projects and

- administration and working capital requirements.

PLACEMENT (A$4.2M)

The Company is pleased to announce that it has received firm commitments for a placement to sophisticated and institutional investors of Bizzell Capital Partners Pty Ltd to raise a total of AUD $4.2 million through the issue of:

Placement Shares (A$3.6M)

- 133,067,264 Placement Shares at an issue price of 2.7 cents ($0.027) per Placement Share to raise A$3,592,816, with (subject to shareholder approval) one (1) free attaching Placement Option for every two (2) Placement Shares subscribed.

- These funds will be available on Monday 18 July 2016, with the Placement Shares to be issued on 20 July 2016.

- The Placement Options will have an exercise price of 3 cents ($0.03), an expiry date of 30 December 2016, and will otherwise be on the same terms as the existing listed series of options.

Conditional Placement Shares (A$600,000)

- 22,222,222 Conditional Placement Shares at an issue price of 2.7 cents ($0.027) per Conditional Placement Share, to raise an additional A$600,000, with one (1) free attaching Placement Option for every two (2) Conditional Placement Shares subscribed.

- The issue of the Conditional Placement Shares is subject to shareholder approval at the EGM. As such, the funds will not be available until after the EGM. It is expected that the Conditional Placement Shares will be issued within 3 business days of the EGM.

- The Placement Options attaching to the Conditional Placement Shares will be on the same terms as those attaching to the Placement Shares.

Shareholder approval - Conditional Placement Shares and Placement Options

The Conditional Placement Shares and the Placement Options (attaching to both the Placement Shares and Conditional Placement Shares) will be subject to shareholder approval at the EGM and are expected to be issued within 3 business days of the EGM.

Placement Capacity

Of the 133,067,264 Placement Shares issued under the A$3.6M Placement, 79,440,359 were issued pursuant to the Company's 15% placement capacity under ASX Listing Rule 7.1 and 53,626,905 were issued pursuant to Sayona's additional 10% placement capacity under ASX Listing Rule 7.1A.

The Conditional Placement Shares are subject to shareholder approval and accordingly, will not be issued pursuant to the Company's placement capacity.

As such, the Company provides the below information under ASX Listing Rules 3.10.5A and 7.1A.4(b) in respect of the 53,626,905 Placement Shares issued under ASX Listing Rule 7.1A.

(a) Sayona issued 53,626,905 shares under ASX Listing Rule 7.1A which resulted in the following dilution to existing shareholders:

(b) The 53,626,905 Placement Shares that were issued under Sayona's 10% capacity under LR7.1A, are being offered in addition to the rights issue (details below) to ensure that existing shareholders have the ability to participate in the capital raising.

(c) Sayona confirms that there was no underwriter in respect to the Placement.

(d) The Placement (including the Conditional Placement) is being conducted as part of the overall capital raising (which includes the Rights Issue). The fees and costs in connection with the capital raising will be disclosed in a Prospectus to be released on the same date as this announcement. These fees include a placement fee payable to Bizzell Capital Partners Pty Ltd (BCP) (as Lead Manager to the offer) equivalent to 3% of funds raised from the Placement and Conditional Placement (being $125,784.50).

The Lead Manager will also receive additional fees, details of which are contained in the Prospectus.

ACCELERATED NON-RENOUNCEABLE RIGHTS ISSUE (A$2.9M)

In addition to the A$4.2 million Placement, the Company now commences an accelerated non-renounceable rights issue, comprising an Institutional Offer and Retail Offer on the basis of one (1) New Share for every five (5) existing Shares held at an issue price of 2.7 cents ($0.027) per New Share (Issue Price), together with one (1) free attaching New Option for every two (2) New Shares issued (Rights Issue).

Under the Rights Issue, Sayona may issue a maximum of 107,453,813 New Shares (subject to rounding) to raise up to A$2,901,252 (before the costs of the offer). A maximum of 53,726,906 New Options may be issued (for no additional consideration).

The New Options available under the Rights Issue, will be on the same terms as the Placement Options, having an exercise price of 3 cents ($0.03), an expiry date of 30 December 2016. They are exercisable on a 1:1 basis, are to be listed, and will otherwise be on the same terms as the existing listed series of options.

The Rights Issue is fully underwritten by Bizzell Capital Partners Pty Ltd, who are also acting as the Lead Manager to the Placement and Rights Issue. A summary of the key terms, fees and costs payable to BCP are outlined in the Prospectus to be released today.

Institutional Offer

The Institutional Entitlement Offer component of the Rights Issue (IEO) will account for up to a maximum of 70,539,643 New Shares at the Issue Price, to raise up to $1,904,570.36. A total of up to 35,269,822 New Options will be available under the IEO. These funds will be available on 18 July 2016 to ensure that the Company has sufficient funds to complete the Authier Project acquisition, with the shares to be issued the following day on 19 July 2016.

Retail Entitlement Offer

The Retail Entitlement Offer component of the Rights Issue (REO) will account for up to a maximum of 36,914,169 New Shares at the Issue Price, to raise up to $996,682.56. A total of up to 18,457,085 New Options will be available under the REO.

The REO will open on 21 July 2016 and close on 10 August 2016 (unless otherwise extended). Shareholders who hold shares at 7pm (Brisbane time) on Tuesday, 19 July 2016, and have a registered address in Australia, New Zealand, Hong Kong or Singapore will be eligible to participate in the REO. Eligible shareholders will be sent a Prospectus on 21 July 2016, together with a personalised entitlement and acceptance form. For further details of the entitlement offer and your eligibility to participate, please refer to the Prospectus lodged with ASX on 15 July 2016.

Shortfall and Underwriting

A commitment has been received by BCP to fully underwrite any shortfall under both the IEO and REO components of the rights issues. Further details of the underwriting arrangements are contained in the Prospectus.

Indicative Timetable

The current proposed timetable for the Rights Issue is documented below. The dates are indicative only and Sayona reserves the right to vary the dates (subject to the Corporations Act and the ASX Listing Rules).

To view the full timetable, please visit:

http://abnnewswire.net/lnk/N878IRF4

About Sayona Mining Limited

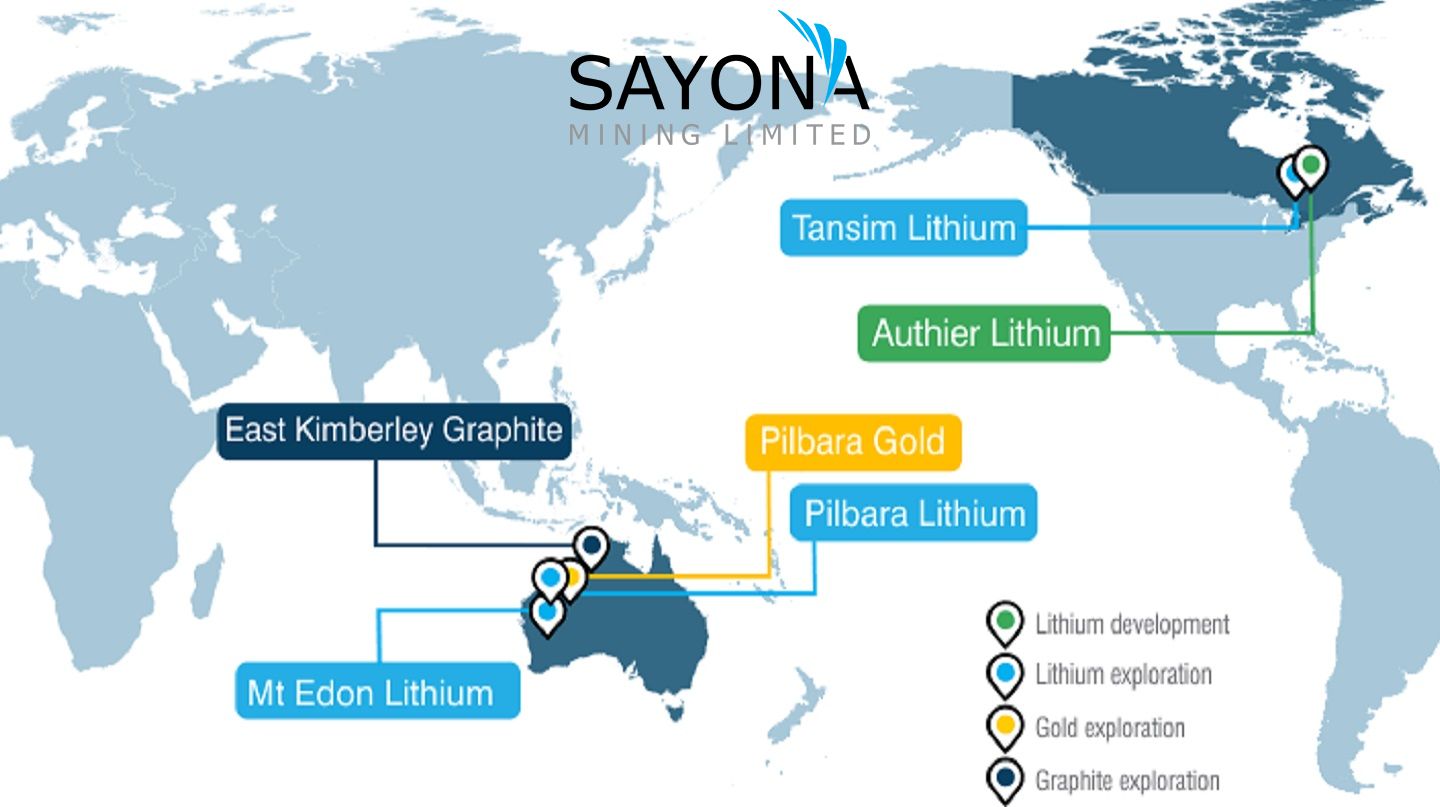

Sayona Mining Limited (ASX:SYA) (OTCMKTS:SYAXF) is a North American lithium producer with projects in Quebec, Canada and Western Australia. In Quebec, Sayona's assets comprise North American Lithium together with the Authier Lithium Project and its emerging Tansim Lithium Project, supported by a strategic partnership with American lithium developer Piedmont Lithium Inc. (ASX:PLL). Sayona also holds a 60% stake in the Moblan Lithium Project in northern Quebec.

Sayona Mining Limited (ASX:SYA) (OTCMKTS:SYAXF) is a North American lithium producer with projects in Quebec, Canada and Western Australia. In Quebec, Sayona's assets comprise North American Lithium together with the Authier Lithium Project and its emerging Tansim Lithium Project, supported by a strategic partnership with American lithium developer Piedmont Lithium Inc. (ASX:PLL). Sayona also holds a 60% stake in the Moblan Lithium Project in northern Quebec.

In Western Australia, the Company holds a large tenement portfolio in the Pilbara region

prospective for gold and lithium. Sayona is exploring for Hemi-style gold targets in the world-class Pilbara region, while its lithium projects include Company-owned leases and those subject to a joint venture with Morella Corporation (ASX:1MC).

| ||

|