Matilda Resource Grows to 6Moz

Matilda Resource Grows to 6Moz

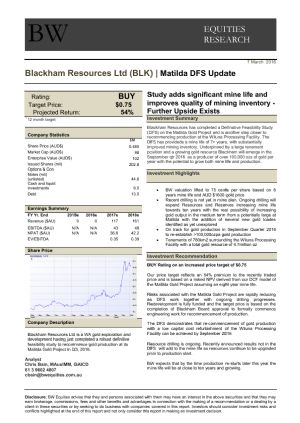

Perth, Dec 13, 2016 AEST (ABN Newswire) - Blackham Resources Ltd ( ASX:BLK) ("Blackham") is pleased to provide a revised Mineral Resource estimate for the Matilda/Wiluna Gold Operation. This is the first resource associated with the Stage 2 expansion study aimed at growing production beyond 200,000ozpa.

ASX:BLK) ("Blackham") is pleased to provide a revised Mineral Resource estimate for the Matilda/Wiluna Gold Operation. This is the first resource associated with the Stage 2 expansion study aimed at growing production beyond 200,000ozpa.

- Combined Matilda/Wiluna Measured, Indicated and Inferred Mineral Resources have grown to 6.0Moz (58Mt @ 3.2g/t)

- Open pit resources now 33Mt @ 2.0g/t for 2.1Moz

-- includes a Maiden East-West open pit resource of 8.6Mt @ 2.5g/t for 700koz (59% indicated)

-- Happy Jack - Creek Shear - Moonlight shear resources to be revised to include recently completed drill program

- Underground resources grow to 25Mt @ 4.9g/t for 3.9Moz

-- Golden Age Resource grows by 21%

-- Bulletin Resource now extends over 600m strike

-- High grade Essex Resource increases

- Growth in the open pit resources will underpin the base load feed and growth in the underground resources will provide important grade profile for Wiluna processing plant

- The significant growth in Mineral Resources confirms the need to expand the Wiluna plant gold production beyond 200kozpa.

Blackham's Managing Director, Bryan Dixon, said "The latest Wiluna resource upgrade is likely to add significant base load open pit and underground feed for the Wiluna expansion study currently underway. Very few gold operations in first class jurisdictions have the scale to be +200,000ozpa operations. Projects of this size generally sit in billion or multi-billion dollar producers."

Following successful drilling campaigns, Measured, Indicated and Inferred Resource estimates have been updated at several open pit deposits at Matilda, as well as at the East and West pits and the Bulletin, Golden Age and Essex underground deposits at Wiluna. Total resources at Matilda and Wiluna are now 58Mt @ 3.2g/t for 6.0Moz up from 48Mt @3.3g/t for 5.1Moz Au (ASX release 27th June 2016). All resources are within a 20km radius of the Wiluna Gold Plant. A breakdown of resources is given below in Table 1 (refer to link below).

Wiluna Resource Updates

East and West Lodes

A new open pit resource model has been completed for the East and West Lodes based on historic and recent drilling. Mineralisation was previously modelled using a 4.0g/t lower-cut focusing on high grade underground mining opportunities. However, significant lower grade mineralisation which potentially can be extracted from an open pit was not captured by the previous interpretation. This mineralisation has been re-modelled above a 0.3g/t lower-cut and incorporated into an updated resource and reported within an A$1,800/oz optimised pit shell. Total Indicated and Inferred (JORC 2012) open pit resources for the East and West Lodes within this shell comprise 8.6Mt @ 2.5g/t for 700,000oz (Table 2, refer to link below).

Underground resources have been modelled using a 4.0g/t lower cut and reported above a 2.0g/t outside the A$1800/oz shell.

The re-evaluation of the East and West lodes using open pit parameters has resulted in a significant increase in Mineral Resources at Wiluna. Pit optimisations using current open pit mining costs and historical sulphide ore processing costs (760,000tpa) indicates the potential for large pit cut backs on both the East and West pits (Figure 1, refer to link below). As outlined in an ASX release dated 7th December 2016, potentially economic mineralisation has been identified between the East and West pits during the latest drilling program.

This mineralisation has not been included in the current Mineral Resource Estimate. It is likely to that this mineralisation will have a positive economic impact as it will lower the strip ratio and potential allow the East and West lodes to be mined further to the north encompassing the currently separate North pit. The areas shaded in pink in Figure 2 (refer to link below) show the mineralised intercepts within 300m of surface which have not been included in the latest Mineral Resource.

A Mineral Resource estimate is currently underway for the Happy Jack to Bulletin pits (Figure 1) and it is anticipated that this will result in additional open pit resources.

It is anticipated that both mining and processing costs per tonne will reduce if Blackham proceeds with its Stage 2 expansion plans which would potentially make more resources amenable to open pit mining. As part of the Expansion Study these mining and operating costs are being re-estimated.

Bulletin

Following the latest drilling program at Bulletin, the results of which were reported to the ASX on 16th August 2016, the Upper Bulletin resource estimate has been updated to 2.8Mt @ 4.3 g/t for 392,000oz Au (45% Indicated) (Table 3, refer to link below). This represents an increase of 81,000oz and includes new estimates for Bulletin, Bulletin South and Lennon. Indicated Resources for Bulletin are now 1.5 Mt @ 3.7 g/t for 180,000oz Au which represents an increase of 39,000oz over the previous resource. A long section through Bulletin showing existing development and average block model grades is shown in Figure 5 (refer to link below).

The Bulletin open pit was mined to a depth of approximately 70m during the 1990's, producing 70,000 ounces (660Kt of oxide ore at 2.8g/t and 83Kt of sulphide ore at 3.7 g/t); by 1994 the focus shifted to the high grade underground discovery underneath the pit. Mining studies are in progress which will focus on the Upper Bulletin underground with a view to revising the Mine Plan and Reserves in this area. As with the East and West Lodes significant mineralisation above a 0.3g/t lower-cut which could potentially be extracted from an open pit was not captured by the previous interpretations. Remodelling of this mineralisation is underway and could potentially result in open pit resources being defined for Bulletin.

Golden Age Resource

Golden Age mineralisation is free milling ore with gold mineralisation located within a quartz reef. Results from an additional 39 underground drill holes completed since the previous Mineral Resource estimate has resulted in an increase in JORC 2012 Measured, Indicated and Inferred Resources (JORC 2012) for Golden Age to 1.4Mt @ 4.3g/t for 191,000oz Au (previously 1.3Mt @ 3.8g/t for 158,000 oz Au). The high grade Golden Age middle resource of 290,000t @ 9.1g/t for 85,000oz is currently being mined. The Golden Age surface resource is currently being revised to include the latest drill program with a view to open pit mining.

A breakdown of the Golden Age Resource is given in Table 4 (refer to link below).

Essex Resource

A resource update has been completed for the Essex deposit based on a re-evaluation of the previous model and 3 new drill-holes completed by Blackham. Previously a resource of 148,000 t @ 7.4g/t for 35,000 ounces was reported at a 2g/t topcut.

The updated resource now has a total of 666,000 t @ 4.52g/t for 97,000oz. A breakdown of the resources is given in Table 5 (refer to link below). Mining studies are underway on the Essex open pit and underground which has an existing exploration drive within 15m of the underground deposit.

The current resource appears to have some continuity at depth with a number of the main shear structures associated with the Essex mineralisation continuing at depth to potentially interact with the Golden Age middle zone. Further drilling at depth, immediately below the resource is necessary to identify these structures as currently there is no drilling in this area. Along strike it Essex mineralisation has less continuity as a fault appears to truncate and/or shear the lodes to the north and mineralisation merges with the East Lode Shear to the south.

Matilda Resource Update

Recent exploration holes have targeted new resource areas due to improved access to the existing Matilda M3 and M4 Pits as well as along strike from the M6 deposit and between the M1 and M5 deposits. This drilling has enabled updates to existing resource estimates at the M1 to M5 and M6 deposits.

- Matilda Resource M1 to M5 now stands at 11,310,000t @ 1.74g/t for 631,000oz.

- M6 resource updated to include new drilling now stands at 536,000t @ 1.7g/t for 29,000oz Au Indicated and Inferred.

A breakdown of the Matilda Mineral Resources is given in Table 6 (refer to link below).

The resource for the M6 deposit has also been updated to include recent infill drilling and now stands at 536,000t @ 1.7g/t for 29,000oz Au Indicated and Inferred. The exploration team is still investigating the potential of the M6 deposits both along strike and down plunge.

The Matilda M1 to M5 resource is now being reported at a 0.6g/t cut-off above 950mRL and 2g/t below 950mRL. The 950mRL represents the depth of the current pit design. Below this is considered the UG portion of the deposit. Previously resources were reported above and below the 900mRL.

Wiluna Gold Deposit Summary

The Wiluna and Matilda gold deposits are located within the Wiluna Goldfield, close to the town of Wiluna at latitude 26deg 38'S, longitude 120deg 15'E on the Wiluna (SG 51-9)1:250 000 scale map. Perth, the nearest capital city, lies 750km to the southeast. The closest regional centres are Kalgoorlie, 540km to the south and Meekatharra, 183km to the west.

The gold deposits are categorised as orogenic gold deposits, with similarities to many other gold deposits in the Yilgarn region. The deposits are hosted within the Wiluna Domain of the Wiluna Greenstone Belt. Rocks in the Wiluna Domain have experienced greenschist-facies regional metamorphism and brittle deformation. The Wiluna Domain is comprised of a fairly monotonous sequence of foliated basalts and high-magnesium basalts, with intercalated felsic intrusions, lamprophyre dykes, metasediments, and dolerites.

Wiluna ores are typically oxide, refractory or free milling quartz mineralisation. The refractory ore has most gold occurring in either solid solution or as sub-microscopic particles within fine-grained sulphides. Mineralisation at Wiluna is principally controlled by the shear zones which have variable strike and dip orientations and typically flex along strike and down dip. These flexures in conjunction with favourable host rock composition act to form the best ore zones.

Gold mineralisation in the East and West lode is predominantly hosted within a series of theoletic and high magnesium basalts and generally strikes north-west. In East Lode there is one dominant shear with numerous hangwall splays which are north to north-northeast striking and easterly dipping (80DEG ). These mineralised shear zones range in thickness from approximately 5m to 40m. Mineralisation at West Lode is hosted within a wide (up to 70m), steeply dipping, north-south striking anastomosing shear zone. This is characterised by two main shears linked by cross cutting shears of varying orientations.

The interpretation of the mineralisation was carried out using a methodical approach to ensure continuity of the geology and estimated mineral resource using Surpac software. For the East and West Lode open pit resource a lower cut-off grade of 0.3g/t was used where previous models had focused on the high grade underground mineralisation and was modelled to a 4g/t lower cut.

All available geological data was used in the interpretation including mapping, drilling, oxidation surfaces and interpretations of high grade ore shoots. Only diamond and reverse circulation drilling samples were used in the final estimate however all available grade control data was used in the geological assessment.

A range of criteria were considered when addressing the suitability of the classification boundaries to the resource estimate.

- Geological continuity and volume models;

- Drill spacing and available mining information;

- Modelling technique

- Estimation properties including search strategy, number of informing composites, average distance of composites from blocks, number of drillholes used and kriging quality parameters.

The classification for this model was predominantly based on the estimation pass. With the first pass relating to an indicated resource and the second pass being inferred. The classification of the blocks was also visually checked and adjusted to remove any "spotted dog" effects. No measured resources were calculated. Estimated blocks that have been informed by predominantly historical drilling where QA/QC data has not been reviewed were assigned as inferred.

To view tables and figures, please visit:

http://abnnewswire.net/lnk/DY9UES6Y

About Wiluna Mining Corporation Ltd

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:BLK) ("Blackham") is pleased to provide a revised Mineral Resource estimate for the Matilda/Wiluna Gold Operation. This is the first resource associated with the Stage 2 expansion study aimed at growing production beyond 200,000ozpa.

ASX:BLK) ("Blackham") is pleased to provide a revised Mineral Resource estimate for the Matilda/Wiluna Gold Operation. This is the first resource associated with the Stage 2 expansion study aimed at growing production beyond 200,000ozpa.  Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.