Quarterly Activities Report

Sydney, April 28, 2017 AEST (ABN Newswire) - Lithium Power International Limited ( ASX:LPI) (

ASX:LPI) ( LTHHF:OTCMKTS) ("LPI" or "the Company") is pleased to submit its quarterly Activity Report for the period ended 31 March 2017.

LTHHF:OTCMKTS) ("LPI" or "the Company") is pleased to submit its quarterly Activity Report for the period ended 31 March 2017.

HIGHLIGHTS

- Maracunga drill program completed indicating the potential for greater size, and economies of scale, both laterally and at depth

- New JORC compliant resource estimate anticipated for 1H17

- Drilling program to commence at Pilgangoora, WA mid-May

- Successful capital raising oversubscribed

- New directors appointed to strengthen the board for the growth of the Company

CHILE

MARICUNGA - CHILE JOINT VENTURE

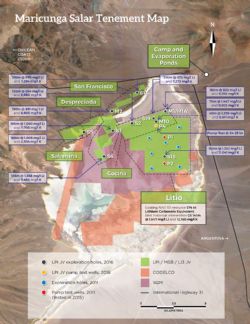

Early in the quarter the Company completed the drilling program at the Maricunga joint venture project in Chile (Figure 1, see link below) which was aimed at greatly expanding the known resource. The remaining assays from the drilling program were reported during this quarter.

These are summarised in Table 1 (see link below). The Company is currently progressing towards the estimation of a new resource for the project and other activities for the project feasibility study.

Maricunga assay results

The Maricunga JV is 50% owned by LPI. The project is regarded by LPI as one of the highest quality undeveloped pre-production lithium project globally, with a very high grade of both lithium and potassium (see Table 1). The Litio properties in the salar has been subject to significant past exploration by our JV partners, Minera Salar Blanco and Li3 Energy, in order to generate the existing lithium and potassium resource. The recently completed drilling (Figure 2, see link below) is targeting an expansion of that resource on the existing properties and additional properties acquired since the original resource, with a new JORC compliant resource estimate anticipated for 1H17.

Assays have now been received for all drill holes, with excellent lithium grades in all the drill holes across the tenements. The "old mining code" San Francisco, Salamina and Despreciada tenements were acquired by the Company directly from the landowners on 21 October 2016. The Cocina "old code" tenement in the joint venture had not been subject to previous drilling. The excellent drilling results (Figure 3, Table 1 - see link below) from the recent drilling validate the Company decision to acquire these tenements, potentially adding significant economic value and scale to the project. Figure 3 details the results of the recent exploration program by the Maricunga Joint Venture.

Overall drilling shows levels of ~1,000 mg/l or better lithium grades extend across the project tenements from east to west.

Maricunga drilling interpretation

Geological logging of sonic drill core has now been completed and a 3-dimensional geological model constructed for resource estimation. Porosity samples have been sent to laboratories for testing. Results are expected during May, with the drainable Porosity (Specific Yield) data a vital input to the resource estimate.

Drilling intersected units of sand, gravel, clay and halite, with a predominance of sandy to gravelly material intersected during this drilling program. The stratigraphy identified to date consists of an upper halite (salt) unit, a middle clay unit (absent in some holes) and a lower sand and gravel unit that extends to the lowest base of drilling at 360 m in hole S19 (Figure 3 and Figure 4 - see link below). The occurrence of predominantly sandy to gravelly material is considered to be very positive, with respect to the amount of drainable brine that could be sourced from these sediments. Drilling has not defined the base of the salt lake sediments hosting brine and they may continue to 500 m or even deeper (Figure 4), based on initial studies conducted by the joint venture.

The exploration program included the drilling of a 360 m (target depth 400 m) rotary hole to evaluate the sediments deeper in the salar basin and assess the potential for additional brine resources. This proof of concept test was extremely important for the project and supports significant exploration potential under 200 m, below the existing resource.

Brine flow measurement - pump testing

The 30 day pump test on the production well, P4, installed in the Cocina tenement as part of the drilling program, was completed during the quarter. This well produced brine at 24-25 l/s, from the lower sand and gravel aquifer, confirming the productivity of this lower stratigraphic unit. Results support the observations of previous pump testing where high brine flows of 37 and 38 l/s were obtained from wells installed in the upper and lower aquifers.

There was no change in the brine concentration over the 30 day pump test, with the concentration averaging 945 mg/l lithium and 6,924 mg/l potassium over the 30 days of test pumping. The performance of this pump test is another very positive outcome for the Maricunga project as the Company progresses to the pre-feasibility study.

Process test work

A further stage of process test work has been completed and the Company is now discussing with major equipment suppliers to carry out more specific test work in their global laboratory facilities. Field evaporation test work continues in ponds at the Maricunga project site, providing valuable information regarding brine evolution under insitu environmental conditions. The project weather station is providing important information on local evaporation conditions for future infrastructure design.

Infrastructure and environmental studies

Studies of the infrastructure required for the project are underway. The project is very well supported with existing infrastructure, being located beside a well maintained international road crossing to Argentina and by having cellular phone coverage. The project is 2.5 hours driving time from the mining support centre of Copiapo, where a wide range of support services to the mining industry are available. The project is also approximately 5 hours from a Chilean port which could potentially be used for shipping lithium and potassium products. These are advantages that very few lithium brine projects have, with many located in much more isolated locations, with minimal infrastructure.

The Company's environmental consultancy is advancing with environmental monitoring for the Environmental Impact Assessment to support the project feasibility study.

Project engineering design

Discussions have been held with a short list of four global tier 1 engineering design consultancies with experience in lithium and potash projects and following receipt of proposals. The Joint Venture is now close to selection of the contractor for pre-feasibility and feasibility stage project engineering.

WESTERN AUSTRALIA

PILGANGOORA, PILBARA

The 100% owned and granted Pilgangoora tenement (E45/4610) is situated adjacent to the Pilbara Minerals and Altura Mining Lithium pegmatite deposits (Figure 5, see link below) which combined form one of the largest global lithium pegmatite resources. LPI is exploring for lithium pegmatites in the same sequence of rocks immediately west of these tenements. During this quarter a number of important milestones were reached to allow an initial exploration drilling program to commence in mid May 2017.

The Program of Work (POW) submitted to the department of mining WA was approved on 14 March 2017, allowing for the drilling program to be carried out. A heritage clearance was successfully performed in early March, with representatives from the Njamal native title group clearing the areas that will be developed as access tracks and drill pads.

These tracks and drill pads are in the process of being cleared prior to the start of drilling in mid May 2017. This drill program is expected to be completed by mid June 2017.

TABBA TABBA AND STRELLEY, PILBARA

The Tabba Tabba tenement covers a prospective greenstone belt, with observed pegmatite outcrops along strike from the Wodgina mine, while the Strelley tenement covers the northern extent of the same greenstone belt under cover.

The activities on the Tabba Tabba tenement (E45/4637) and the Strelley tenement (E45/4638) during the quarter have consisted of development of heritage agreements between the Njamal group and LPI. These agreements are expected to be finalised in 2Q17, allowing these tenement to proceed to grant. Exploration programs will be planned once the tenements have been granted.

GREENBUSHES, SOUTHWESTERN WESTERN AUSTRALIA

Exploration of this highly prospective area (Figure 6, see link below) adjacent to the world's largest and highest grade hard rock lithium mine continued across the March quarter. Further structural and geophysical interpretation has highlighted areas in the magnetic and gravity surveys covering the project that have been prospected and sampled. The gravity feature observed in the southern Greenbushes tenement has similarities to that coincident with the Greenbushes mine.

A number of interesting areas have been identified for more in-depth soil surveys, commencing in early April 2017. A larger sampling program is in part based on the information gained from the in-house geochemical method developed during the Pilbara geochemical sampling program.

ARGENTINA

CENTENARIO - SALTA PROVINCE, ARGENTINA

There was no activity on this project during the quarter, due to the January to March wet season in northern Argentina.

Discussions are ongoing with a number of lithium companies following the decision by the board of LPI to consider divesting this asset for cash. This will allow the Company to focus efforts on the Maricunga lithium brine project in Chile.

CORPORATE UPDATE

APPENDIX 5B

The Appendix 5B quarterly cashflow report for the quarter ended 31 March 2017, is submitted separately.

As at 31 March 2017, the Company had a total of A$750k in local and oversea subsidiary bank accounts with a further A$2.35m funds available in the Maricunga Joint Venture bank accounts, giving a total of A$3.1m in funds available to the Company at 31 March 2017.

This amount is currently held in Company controlled bank accounts in Australia, Chile and Argentina, in Australian dollars, US dollars, Chilean pesos or Argentine pesos. The Australia dollar equivalent for these foreign currencies are converted at the closing foreign exchange spot rate on 31 March 2017.

CAPITAL RAISING

As previously announced, the Company, with the view of moving forward the development timeline to fast-track the Maricunga lithium brine project, successfully completed a capital raise of A$12m, before costs. The Company is pleased to have received strong support from high-profile domestic and international investors, including Toronto based International Resource Fund, Sprott Capital.

As a result of highly encouraging exploration results at Maricunga, the Joint Venture agreed to move forward a payment of US$5.5m to fast-track the development of the project. By moving forward this payment, the development timeline of the Maricunga project will be brought forward by approximately three to six months.

BOARD RESTRUCTURE

Consistent with the Company's strategy to strengthen the Board as the Company moves towards the development stage of the Maricunga lithium brine project, and as previously announced, two additional Non-Executive Directors have been appointed to LPI's Board of Directors.

On 9 February 2017, Mr David Hannon was appointed to the Board as Non-Executive Chairman. Mr Hannon adds a distinctive skill set to the Board, having a high profile in the domestic and international investor markets, along with listed mining company board experience.

On 6 April 2017, Mr Russell Barwick was appointed to the Board as Non-Executive Director. Mr Barwick is a highly experienced, internationally renowned mining executive and engineer, with strong development, operational and corporate background in Latin America.

To view the full Quarterly Report, please visit:

http://abnnewswire.net/lnk/2R72J8O3

About Lithium Power International Ltd

Lithium Power International Limited (ASX:LPI) is a pure play lithium company with three distinct project regions to provide diversification. One is located in South America's brine region and three are in Australia's spodumene hard rock areas of Western Australia.

Lithium Power International Limited (ASX:LPI) is a pure play lithium company with three distinct project regions to provide diversification. One is located in South America's brine region and three are in Australia's spodumene hard rock areas of Western Australia.

The primary focus is to develop of Chile's next high-grade lithium mine on the Maricunga Salar in an area known as the Lithium Triangle. The Company has also expanded its tenement holdings of lithium exploration prospects in Western Australia.

| ||

|