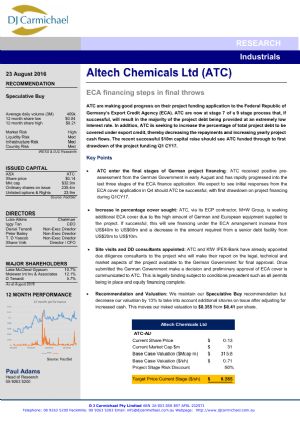

Receives First Mezzanine Debt Term Sheet

Perth, May 11, 2018 AEST (ABN Newswire) - Altech Chemicals Limited (Altech/the Company) ( ASX:ATC) (

ASX:ATC) ( A3Y:FRA) is pleased to announce that it has received an indicative mezzanine debt term sheet for up to US$ 120 million from an international investment bank, for its proposed Malaysian high purity alumina (HPA) plant and associated kaolin mine in Meckering, Western Australia (the Project).

A3Y:FRA) is pleased to announce that it has received an indicative mezzanine debt term sheet for up to US$ 120 million from an international investment bank, for its proposed Malaysian high purity alumina (HPA) plant and associated kaolin mine in Meckering, Western Australia (the Project).

Highlights

- US$120 million indicative mezzanine debt term sheet received

- Follows extensive preliminary project due diligence

- Global investment banking group

On 2 February 2018 the Company announced that it had executed commitment and final terms for a US$ 190 million senior debt package with German government-owned KfW IPEX-Bank. Since then, the Company has been working with a number of advisors to secure the balance of funds for the Project, which is one of the conditions precedent to draw-down on the senior debt. One of the work streams being pursued by the Company and its advisors is a mezzanine debt facility of up to US$ 120 million, which will be subordinate to the senior debt.

The Company has now received an indicative mezzanine debt term sheet from a global investment bank equal to US$120 million, representing a facility amount of US$ 90 million plus accrued interest during construction and plant commissioning. The investment bank has already conducted extensive preliminary due diligence on the Project, including accessing the Company's data room, which contains detailed project information and various due diligence reports commissioned by the senior lender, KfW IPEX-Bank.

The investment bank is a diversified financial services group with a global presence and more than US$ 300 billion in assets under management. As is customary with these types of transactions, the public disclosure of the bank's name and the proposed lending terms remain confidential at this point in time. The Company expects similar term sheets from other potential lenders currently in due diligence and evaluation during the course of the month.

Altech managing director Iggy Tan said, "From the outset the Company has been targeting 'vanilla' mezzanine debt from top-tier lenders. This approach does take longer and involves a higher level of scrutiny (due diligence), however securing mezzanine debt from top tier providers will be a far better outcome for the Company and shareholders. We are now starting to see some reward from this strategy and our efforts," Mr Tan concluded.

About Altech Batteries Ltd

Altech Batteries Limited (ASX:ATC) (FRA:A3Y) is a specialty battery technology company that has a joint venture agreement with world leading German battery institute Fraunhofer IKTS ("Fraunhofer") to commercialise the revolutionary CERENERGY(R) Sodium Alumina Solid State (SAS) Battery. CERENERGY(R) batteries are the game-changing alternative to lithium-ion batteries. CERENERGY(R) batteries are fire and explosion-proof; have a life span of more than 15 years and operate in extreme cold and desert climates. The battery technology uses table salt and is lithium-free; cobalt-free; graphite-free; and copper-free, eliminating exposure to critical metal price rises and supply chain concerns.

Altech Batteries Limited (ASX:ATC) (FRA:A3Y) is a specialty battery technology company that has a joint venture agreement with world leading German battery institute Fraunhofer IKTS ("Fraunhofer") to commercialise the revolutionary CERENERGY(R) Sodium Alumina Solid State (SAS) Battery. CERENERGY(R) batteries are the game-changing alternative to lithium-ion batteries. CERENERGY(R) batteries are fire and explosion-proof; have a life span of more than 15 years and operate in extreme cold and desert climates. The battery technology uses table salt and is lithium-free; cobalt-free; graphite-free; and copper-free, eliminating exposure to critical metal price rises and supply chain concerns.

The joint venture is commercialising its CERENERGY(R) battery, with plans to construct a 100MWh production facility on Altech's land in Saxony, Germany. The facility intends to produce CERENERGY(R) battery modules to provide grid storage solutions to the market.

| ||

|