Bottle Creek Offers Potential for Re-Processing Tailings Dams

Bottle Creek Offers Potential for Re-Processing Tailings Dams

Canberra, Aug 10, 2018 AEST (ABN Newswire) - Alt Resources Ltd ( ASX:ARS) (Alt or 'the Company') is pleased to announce the results from preliminary testing of the historical Bottle Creek Mine Tailings Dams, WA. 66 shallow Aircore holes were drilled for 323m. The maximum hole depth was 12m with hole spacing of 20m. Alt drilled north-south and east-west fences across each of the dams. Samples were assayed for gold and silver, with values up to 1.28 g/t Au and 18.4 g/t Ag received. Average grade for the tailings material based on limited testing thus far is 0.16 g/t Au and 6.1 g/t Ag.

ASX:ARS) (Alt or 'the Company') is pleased to announce the results from preliminary testing of the historical Bottle Creek Mine Tailings Dams, WA. 66 shallow Aircore holes were drilled for 323m. The maximum hole depth was 12m with hole spacing of 20m. Alt drilled north-south and east-west fences across each of the dams. Samples were assayed for gold and silver, with values up to 1.28 g/t Au and 18.4 g/t Ag received. Average grade for the tailings material based on limited testing thus far is 0.16 g/t Au and 6.1 g/t Ag.

HIGHLIGHTS:

- 66 preliminary Aircore holes drilled into historical tailings dams at Bottle Creek

- Potential for near term gold production from tailings dam stripping

- Results up to 1.28 g/t Au and 18.4 g/t Ag, with an average of 6.1 g/t Ag

- The two tailings dams cover a combined area of 21.6 ha

- Systematic Aircore program and detailed survey planned to bring tailings into planned Bottle Creek Resource estimate

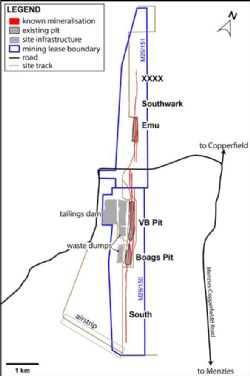

Bottle Creek was mined for gold by Norgold Ltd in 1988-1989. Two tailings dams endure from the previous operation, covering a combined area of 21.6 ha (see Figure 1 in link below). Alt's aim was to ascertain whether exploitable gold and silver remained within these tailings dams. Figure 1 (see link below) shows the maximum Au (left) and Ag (right) in each aircore hole across the tailings material. Contained mineralisation is patchy, particularly for gold, whereas silver shows a much more uniform distribution of higher grade (see Figure 1 in link below), giving an average of 6.1 g/t Ag across both tailings dams. A more comprehensive drill pattern is planned to cover the whole of each tailings area, to more effectively delineate a volume that can be incorporated in the overall Bottle Creek gold (+ silver) resource.

Within the same program, planned drilling will also include testing of surficial gold-mineralised laterite(see Note below) and pre-existing low grade stockpiles which remain from the previous mining operation.

Alt Resources CEO, James Anderson, stated; "Our objective with this program was to negate the cost of refurbishing the tailings dams. Given the right economics, in a future mining cycle we would strip the existing mineralised soil from the tailings dams, stockpile the soil for re-processing of the low grade gold and silver and refurbish the dams at the same time; it's a recycling concept to cover costs associated with development of the processing plant moving forward. The Company is also progressing towards mine design and pit optimisation for Bottle Creek. Minecomp have been engaged as the consulting mining engineers for this work. We are reinforcing our strategy to bring these assets into production as quickly and as efficiently as possible and we will continue to fast track this project."

Regional Setting and Exploration History

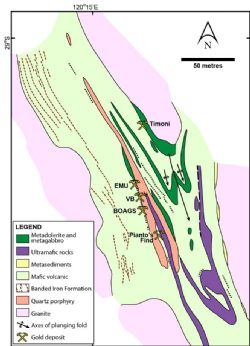

The Bottle Creek gold mine lies 100 km north east of Menzies in the Mt Ida gold belt (see Figure 2 in link below). The gold mine is located on the northern extremity of the Mt Ida-Ularring greenstone belt extending from Davyhurst to Mt Alexander (see Figure 2 in link below). The Ularring greenstone belt forms the western part of the Norseman-Wiluna Province of the Yilgarn Craton. The location of mineralisation and local geology, is shown in Figure 3(see link below).

During historical operation from 1988-1989, 90,000 oz Au was produced from two open pits (Boags and VB; see Figure 4 in link below). Significant historical drilling along a 9.8 km strike outlined the Emu, Southwark and Cascade (formerly XXXX) deposits. However these were never mined. The historical RC drill fences were spaced at 100m, with infill drill line spacing at 50m and 25m at various locations. The majority of drilling targeted oxide mineralisation and reached no deeper than 80m vertically below surface.

Alt's new drilling results throughout 2018 continue to provide confirmation of historical intercepts, improve confidence in historical data, prove the continuity and grade of mineralisation in key parts of the Emu and Southwark deposits. Further, gold mineralisation appears to continue at depth, with several drillholes ending in mineralisation. Resource estimation is underway for Emu and Southwark.

Note: See ARS ASX announcement, 6th August 2018, for description of laterite targets: http://www.abnnewswire.net/press/en/94150/

To view figures, please visit:

http://abnnewswire.net/lnk/7U6WOQ0M

About Aurenne Alt Resources Pty Ltd

Aurenne Alt Resources Pty Ltd is an Australian based mineral exploration company that aims to become a gold producer by exploiting historical and new gold prospects across quality assets and to build value for shareholders.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:ARS) (Alt or 'the Company') is pleased to announce the results from preliminary testing of the historical Bottle Creek Mine Tailings Dams, WA. 66 shallow Aircore holes were drilled for 323m. The maximum hole depth was 12m with hole spacing of 20m. Alt drilled north-south and east-west fences across each of the dams. Samples were assayed for gold and silver, with values up to 1.28 g/t Au and 18.4 g/t Ag received. Average grade for the tailings material based on limited testing thus far is 0.16 g/t Au and 6.1 g/t Ag.

ASX:ARS) (Alt or 'the Company') is pleased to announce the results from preliminary testing of the historical Bottle Creek Mine Tailings Dams, WA. 66 shallow Aircore holes were drilled for 323m. The maximum hole depth was 12m with hole spacing of 20m. Alt drilled north-south and east-west fences across each of the dams. Samples were assayed for gold and silver, with values up to 1.28 g/t Au and 18.4 g/t Ag received. Average grade for the tailings material based on limited testing thus far is 0.16 g/t Au and 6.1 g/t Ag.