Mezzanine Debt Due Diligence Update

Perth, Oct 10, 2018 AEST (ABN Newswire) - Altech Chemicals Limited (Altech/the Company) ( ASX:ATC) (

ASX:ATC) ( A3Y:FRA) is pleased to provide an update on the progress of detailed project due diligence by an independent technical consultant appointed by the proposed mezzanine debt and steam facility providers.

A3Y:FRA) is pleased to provide an update on the progress of detailed project due diligence by an independent technical consultant appointed by the proposed mezzanine debt and steam facility providers.

Highlights

- Due diligence commenced end of July 2018

- Advisian appointed as independent technical consultant

- Due diligence is well advanced and on track

- CRU Consulting appointed as HPA market due diligence consultant

- Construction to run concurrent to project finance close

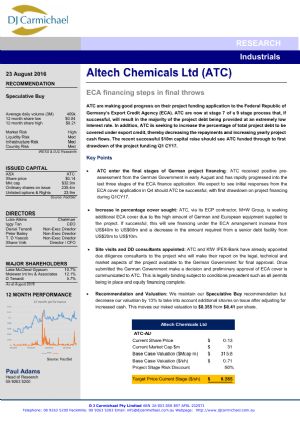

On 11 May 2018 Altech announced that it had received an indicative non-binding mezzanine debt term sheet for a drawdown facility of US$90 million from a global investment bank for its proposed Malaysian high purity alumina (HPA) project. On 15 June 2018 Altech announced that it has executed an indicative non-binding term sheet for a US$60 million stream finance facility with a US based global alternative investment group.

The proposed mezzanine debt provider and the proposed stream facility provider appointed Advisian, the independent consulting arm of WorleyParsons Group, as independent technical adviser in July 2018. Project due diligence commenced on 27 July 2018 with a kick-off meeting in Frankfurt, Germany, which was attended by Altech management and representatives from m.Plan International (technical consultant to the senior lender - KfW IPEX-Bank); SMS group (Altech's appointed EPC contractor); the proposed mezzanine lender; the proposed stream facility provider; and Advisian.

Whilst Advisian has benefited from the extensive amount of information generated during senior lender due diligence, it is currently anticipated that Advisian will require until the end of November 2018 to finalise its work, resulting in a 4-month due diligence process. In comparison, senior debt due diligence took approximately 15 months to complete.

Assuming a positive result from the Advisian due diligence, the next step for both the proposed mezzanine lender and the stream finance facility provider will be to present the project to respective internal investment committees for final approval. An updated HPA market report from CRU Consulting is also likely to be commissioned prior to respective investment committee consideration. Upon investment committee approval, a binding term sheet and an exclusive mandate can be executed for each proposed facility. The processes of final loan documentation and the negotiation of inter-creditor arrangements with the senior lender can then proceed, then ultimately project finance close.

HPA plant construction in parallel to project finance close

The decision by the Company to equity fund Stage 1 construction of its proposed Malaysian HPA plant in parallel with project finance close, rather than wait for close to occur, is allowing project momentum to be maintained which is considered important by the Company given the forecast near-term surge in HPA demand. At the Company's Johor HPA site, clearance of the site is now complete, a ground-breaking ceremony was conducted on 8 August 2018 and geotechnical drilling is now also complete - allowing for the submission of a site development order application to local Johor authorities. Once the development order is approved, site earth works, drainage, foundation piling and the construction of a workshop building and of an electrical substation will commence.

Altech managing director, Mr Iggy Tan said "the mezzanine debt and stream facility technical due diligence is on track and proceeding as planned. Detailed project due diligence is a requirement of the respective proposed lenders internal credit approval processes and will take time to complete. Altech is working very closely with the proposed lenders to ensure a detailed evaluation of the project is successfully concluded. Importantly, the time taken to complete due diligence and to reach finance close will not hinder construction progress, as Stage 1 construction is already funded and will commence imminently. Construction of the Company's HPA plant will run in parallel to finance close."

About Altech Batteries Ltd

Altech Batteries Limited (ASX:ATC) (FRA:A3Y) is a specialty battery technology company that has a joint venture agreement with world leading German battery institute Fraunhofer IKTS ("Fraunhofer") to commercialise the revolutionary CERENERGY(R) Sodium Alumina Solid State (SAS) Battery. CERENERGY(R) batteries are the game-changing alternative to lithium-ion batteries. CERENERGY(R) batteries are fire and explosion-proof; have a life span of more than 15 years and operate in extreme cold and desert climates. The battery technology uses table salt and is lithium-free; cobalt-free; graphite-free; and copper-free, eliminating exposure to critical metal price rises and supply chain concerns.

Altech Batteries Limited (ASX:ATC) (FRA:A3Y) is a specialty battery technology company that has a joint venture agreement with world leading German battery institute Fraunhofer IKTS ("Fraunhofer") to commercialise the revolutionary CERENERGY(R) Sodium Alumina Solid State (SAS) Battery. CERENERGY(R) batteries are the game-changing alternative to lithium-ion batteries. CERENERGY(R) batteries are fire and explosion-proof; have a life span of more than 15 years and operate in extreme cold and desert climates. The battery technology uses table salt and is lithium-free; cobalt-free; graphite-free; and copper-free, eliminating exposure to critical metal price rises and supply chain concerns.

The joint venture is commercialising its CERENERGY(R) battery, with plans to construct a 100MWh production facility on Altech's land in Saxony, Germany. The facility intends to produce CERENERGY(R) battery modules to provide grid storage solutions to the market.

| ||

|