Significant JORC Reserve Increase for Isaac Plains Complex

Significant JORC Reserve Increase for Isaac Plains Complex

Brisbane, April 6, 2016 AEST (ABN Newswire) - Stanmore Coal Limited ( ASX:SMR) is pleased to announce a significant maiden JORC Reserve for the Isaac Plains East Project (Isaac Plains East) (together with Isaac Plains Coal Mine, the Isaac Plains Complex). As a result, total JORC Reserves for the Isaac Plains Complex have increased by more than 3 times since the assets were acquired in late 2015.

ASX:SMR) is pleased to announce a significant maiden JORC Reserve for the Isaac Plains East Project (Isaac Plains East) (together with Isaac Plains Coal Mine, the Isaac Plains Complex). As a result, total JORC Reserves for the Isaac Plains Complex have increased by more than 3 times since the assets were acquired in late 2015.

Highlights:

- Total JORC Reserve tripled from 5.0Mt to 15.3Mt

- Open-cut mine life expanded from 3 years to over 10 years with the maiden Isaac Plains East JORC Reserves

- Strip ratio at Isaac Plains East is significantly lower than current open-cut operations at Isaac Plains

- Indicative coal quality demonstrates improved coal rank and yield for coking product at Isaac Plains East relative to Isaac Plains

- The combination of the Isaac Plains mine and infrastructure with the neighbouring Isaac Plains East mine extension has created a low cost mining complex with significant life

The JORC Reserve upgrade follows the work carried out on the total JORC Resources for the Isaac Plains Complex, also announced today. A summary of the JORC Reserves by area is displayed in Table 1 and Table 2, see link below.

Open Cut Mine Life Extension for Isaac Plains Complex

The updated JORC Reserve for the Isaac Plains Complex increases the total open cut mining life from 3 years to 10 years based on a steady state production rate of 1.5Mtpa run of mine (ROM) coal (at least 1.1Mtpa of product coal). The mining conditions at Isaac Plains East are similar to those experienced at Isaac Plains and therefore amenable to a dragline operation. In utilising the existing Company-owned dragline currently deployed at Isaac Plains, the overall mining cost is minimised given the significant cost advantage over pure truck & shovel waste operations.

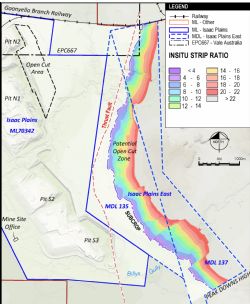

Attractive Mining Strip Ratio

JORC Reserves modelling at Isaac Plains East indicates a 7 year average prime strip ratio (bcm/ROM tonnes) of 11:1, with the first 2 years at 8:1 and first 4 years at sub 10:1. This compares favourably to the three year average strip ratio of approximately 13:1 for the current 3 year mining operation within Isaac Plains.

Significant Synergies with Existing Isaac Plains Mine

The Isaac Plains East extension will utilise the dragline currently operating at the Isaac Plains mine as well as the fixed infrastructure including the Coal Processing and Prep Plant, train load out, rail loop, offices and workshops. The replacement cost of this infrastructure is estimated at A$350m.

Due to the proximity of the two deposits, minimal additional infrastructure will be required to develop Isaac Plains East. A three kilometre haul road will be built to connect to the existing Isaac Plains road system.

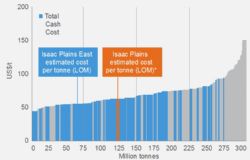

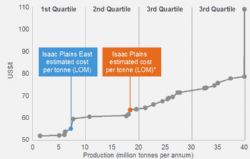

A Low Cost Mine Extension

Based on current contracted overburden removal and mining costs, the improved strip ratio at Isaac Plains East is estimated to result in an average free on board total cost reduction of around A$15-20 per product tonne in the first 4 years when compared to the existing Isaac Plains open cut. The cost curve information presented in Diagram 1and 2 below indicates that this level of cost reduction results in a shift from the second quartile to the first quartile for the Isaac Plains Complex.

Proposed Mining Method

It is planned to mine the coal using predominately the same open-cut method used at Isaac Plains. This method is based on nominal 55m wide strips. Topsoil is removed and stockpiled for later spoil rehabilitation. The overburden is drilled and blasted in one or two passes depending upon total depth. Overburden is then removed using a combination of cast blasting, dozing, dragline and truck / shovel methods followed by coal extraction.

In order to minimise waste removal costs, the emphasis will be on maximising the proportion of waste allocated to the dragline system (dragline, dozing and cast blasting). Waste exceeding the dragline horizon will be removed by excavator and trucked to the appropriate waste dump.

Coal will be loaded onto side tippers at top of ramp stockpiles for haulage to the Isaac Plains ROM hopper (or stockpile) where it will be crushed and conveyed to the coal preparation plant for processing. Product coal will be stockpiled separately by product type then loaded onto trains at the coal loadout and railed to Dalrymple Bay Coal Terminal.

Progressive rehabilitation of the spoil dumps would be undertaken when they reach planned height and final landform profile.

Isaac Plains East - Pathway for Approvals

The process for obtaining the required Mining Lease is underway with a top tier environmental consultant engaged by the Company to manage the various field activities and coordinate the ongoing baseline studies. The approval pathway requires the Company to submit a major amendment to the environmental authority for Isaac Plains once all requisite data is collated. The Company anticipates lodging the amendment documentation and application for Mining Lease in the December quarter of 2016, with the target for grant of the Mining Lease within the second half of 2017.

Coal Quality

Coal washability and product laboratory analysis was carried out on the cored-holes drilled recently within the Isaac Plains East area. The indicative coal quality results and processing yield analysis are displayed in Table 2 (see link below) along with the current Isaac Plains specifications.

The initial analysis was focused on maximising overall yield and the coking fraction. The increase in rank at Isaac Plains East illustrates the potential to further enhance coking properties by mining the seam in two passes and optimising the washing yield.

Nick Jorss, Managing Director of Stanmore, said "This is a major upgrade to the scale of Isaac Plains as it increases open-cut mine life from three years to more than ten years.

Combining two neighbouring Bowen Basin assets, stripping out significant costs and undertaking a comprehensive exploration program has created a low cost coking coal complex at Isaac Plains with significant mine life. Upon grant of the mining lease at Isaac Plains East we will be a first quartile producer located in the world's premier export quality coking coal basin.

We are currently evaluating the potential to increase production further via underground mining within the Isaac Plains Complex. We have identified substantial JORC Measured and Indicated Resources which may be economic to extract by bord and pillar or highwall mining methods. These opportunities would require very little in the way of capital expenditure as they utilise access from the existing highwall and surplus capacity within our wash plant and rail loadout infrastructure.

This important milestone for the Company reaffirms our commitment to building a larger mining enterprise based around the strategic infrastructure position at Isaac Plains as we supply some of the world's top steel mills with our high quality coking coal.

Our confidence in the outlook for coking coal is underpinned by the fact it remains a relatively scarce resource. The world's best deposits are depleted by over a billion tonnes every year as coking coal is extracted to create the steel required for housing, transport, infrastructure, consumables and household goods. We are also encouraged by the recent June quarter settlement for Japanese benchmark coking coal prices at a US$ 3-4 increase over the previous quarter.

To view tables and figures, please visit:

http://abnnewswire.net/lnk/6GDB7890

About Stanmore Coal Limited

Stanmore Coal (ASX:SMR) is an operating coal mining company with a number of additional prospective coal projects and mining assets within Queensland's Bowen and Surat Basins. Stanmore Coal owns 100% of the Isaac Plains Coal Mine and the adjoining Isaac Plains East Project and is focused on the creation of shareholder value via the efficient operation of Isaac Plains and identification of further local development opportunities. Stanmore continues to progress its prospective high quality thermal coal assets in the Northern Surat Basin which will prove to be valuable as the demand for high quality, low impurity thermal coal grows at a global level. Stanmore’s focus is on the prime coal bearing regions of the east coast of Australia.

Stanmore Coal (ASX:SMR) is an operating coal mining company with a number of additional prospective coal projects and mining assets within Queensland's Bowen and Surat Basins. Stanmore Coal owns 100% of the Isaac Plains Coal Mine and the adjoining Isaac Plains East Project and is focused on the creation of shareholder value via the efficient operation of Isaac Plains and identification of further local development opportunities. Stanmore continues to progress its prospective high quality thermal coal assets in the Northern Surat Basin which will prove to be valuable as the demand for high quality, low impurity thermal coal grows at a global level. Stanmore’s focus is on the prime coal bearing regions of the east coast of Australia.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:SMR) is pleased to announce a significant maiden JORC Reserve for the Isaac Plains East Project (Isaac Plains East) (together with Isaac Plains Coal Mine, the Isaac Plains Complex). As a result, total JORC Reserves for the Isaac Plains Complex have increased by more than 3 times since the assets were acquired in late 2015.

ASX:SMR) is pleased to announce a significant maiden JORC Reserve for the Isaac Plains East Project (Isaac Plains East) (together with Isaac Plains Coal Mine, the Isaac Plains Complex). As a result, total JORC Reserves for the Isaac Plains Complex have increased by more than 3 times since the assets were acquired in late 2015.  Stanmore Coal (ASX:SMR) is an operating coal mining company with a number of additional prospective coal projects and mining assets within Queensland's Bowen and Surat Basins. Stanmore Coal owns 100% of the Isaac Plains Coal Mine and the adjoining Isaac Plains East Project and is focused on the creation of shareholder value via the efficient operation of Isaac Plains and identification of further local development opportunities. Stanmore continues to progress its prospective high quality thermal coal assets in the Northern Surat Basin which will prove to be valuable as the demand for high quality, low impurity thermal coal grows at a global level. Stanmore’s focus is on the prime coal bearing regions of the east coast of Australia.

Stanmore Coal (ASX:SMR) is an operating coal mining company with a number of additional prospective coal projects and mining assets within Queensland's Bowen and Surat Basins. Stanmore Coal owns 100% of the Isaac Plains Coal Mine and the adjoining Isaac Plains East Project and is focused on the creation of shareholder value via the efficient operation of Isaac Plains and identification of further local development opportunities. Stanmore continues to progress its prospective high quality thermal coal assets in the Northern Surat Basin which will prove to be valuable as the demand for high quality, low impurity thermal coal grows at a global level. Stanmore’s focus is on the prime coal bearing regions of the east coast of Australia.