"Confirms Citronen as One of the World's Largest & Premier Zinc-Lead Projects".

Citronen Feasibility Study Update

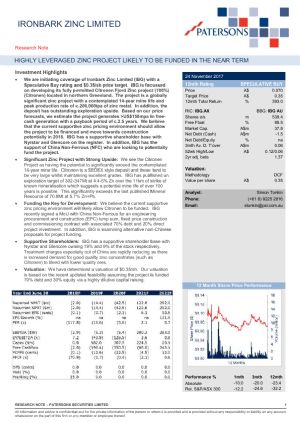

Perth, Sep 12, 2017 AEST (ABN Newswire) - Ironbark Zinc Limited ("Ironbark") ( ASX:IBG) (

ASX:IBG) ( IRBGY:OTCMKTS) is pleased to provide results from the Feasibility Study Update of Ironbark's 100% owned Citronen Project:

IRBGY:OTCMKTS) is pleased to provide results from the Feasibility Study Update of Ironbark's 100% owned Citronen Project:

- NPV8 US $1,034 Million (US $909 Million post tax*)

- IRR 36% (35% post tax*)

- Capital Cost US $514 Million**

- Large Scale Production 3.3Mtpa Mine Rate/Production up to 200,000tpa zinc metal

- Site Cost US$0.52/lb Zn (Payable, Net of by-product credits)***

- Mine Life 14 years (open ended and with further inferred resources that could potentially be converted to reserves)

- Life of Mine Revenue US$6,364 Million

- Life of Mine Operating Costs US$3,025 Million

- Life of Mine NPAT US$1,836 Million*

There is a low level of geological confidence associated with inferred mineral resources and there is no certainty that further exploration work will result in the determination of indicated mineral resources or that the production target itself will be realised.

PROJECT HIGHLIGHTS

- 100% Owned Exploitation Licence 2016/30 (Mining Permit) Granted by the Greenland Government - 30 year term

- Open-Ended, Simple, Consistent Resource

- Simple Mining, Simple Processing using Standard Technology

- Ironbark is Working with China Nonferrous under a MOU to Deliver an EPC Fixed Price Contract and Assist in Project Financing

- Major Industry Shareholders - Glencore International AG & Nyrstar NV

Notes:

* Excluding dividend withholding tax (Corporate tax rate of 30%, dividend withholding tax 37%). All costs and prices indexed at a CPI rate of 2.5% pa

** Compared against the last Western Calculation dated 2011 is a 2.4% increase. NFC are currently working on a Chinese Feasibility study which is expected to have a lower Capital Cost

*** Smelter fees an additional US$0.14/lb Zn payable

To view the full Feasibility Study, please visit:

http://abnnewswire.net/lnk/47FEM886

About Ironbark Zinc Limited

Ironbark Zinc Limited (ASX:IBG) (OTCMKTS:IRBGY) is listed on the Australian Securities Exchange and is seeking to become a base metal mining house. Ironbark has an undrawn US$50M funding facility provided by Glencore to expand its project base through acquisition.

Ironbark Zinc Limited (ASX:IBG) (OTCMKTS:IRBGY) is listed on the Australian Securities Exchange and is seeking to become a base metal mining house. Ironbark has an undrawn US$50M funding facility provided by Glencore to expand its project base through acquisition.

Ironbark seeks to build shareholder value through exploration and development of its projects and also seeks to actively expand the project base controlled by Ironbark through acquisition. The management and board of Ironbark have extensive technical and corporate experience in the minerals sector.

The wholly owned Citronen base metal project currently hosts in excess of 13.1 Billion pounds of zinc (Zn) and lead (Pb). For full details refer to ASX announcement 25 November 2014 –Citronen Project Resource Update – JORC 2012 compliant resource.

| ||

|