Updated Enmore Gold Project Drilling Results

Perth, Sep 16, 2021 AEST (ABN Newswire) - Okapi Resources Limited ( ASX:OKR) (

ASX:OKR) ( 26O:FRA) is pleased to report it has intersected significant, thick, shallow gold mineralisation in its maiden drilling program at its 100% owned Enmore Gold Project in northern New South Wales.

26O:FRA) is pleased to report it has intersected significant, thick, shallow gold mineralisation in its maiden drilling program at its 100% owned Enmore Gold Project in northern New South Wales.

Exceptional results have been returned, including 174m @ 1.83 g/t gold, from surface, with this hole, OSSRC06, ending in mineralisation, with the deepest interval returning 3m @ 8.86 g/t gold from 171m to EOH.

Okapi Resources Executive Director David Nour commented, "These results show the potential for a very large, shallow, high-grade gold deposit at our Enmore Gold Project, with mineralisation from surface with some of the highest grades returned below 170m. The depth potential is very encouraging and we have multiple prospects that remain untested".

Enmore Gold Project Drilling (OKR 100%)

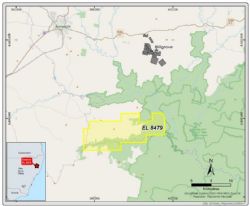

Okapi's Enmore Gold Project is located approximately 20km south of the operating Hillgrove Gold Mine ( ASX:RVR), where past production exceeds 730,000 ounces of gold.

ASX:RVR), where past production exceeds 730,000 ounces of gold.

Gold mineralisation at Enmore is believed to be controlled by northwest oriented structures, similar to those that control mineralisation at the Hillgrove deposit and particularly where they intersect northeast structures.

Okapi recently completed 10 drill holes for 1,257m across three prospects, being Sunnyside East, Sunnyside West and Bora. Assay results have been returned for all holes with significant results returned from all 10 of the holes.

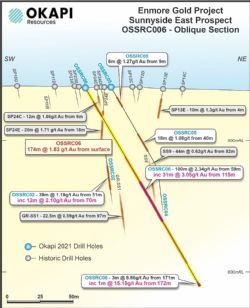

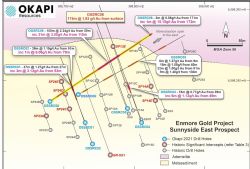

Sunnyside East Prospect

Significant, shallow mineralisation has been intersected at the Sunnyside Prospect, where gold mineralisation is present over some 400m between Sunnyside East and Sunnyside West along the district-scale Sunnyside fault. Mineralisation remains open at depth, with drill hole OSSRC06 being terminated at 174m depth, with the final 3m interval assaying 3m @ 8.86 g/t gold, including 1m @ 15.15 g/t gold from 172m. Significant results from recent drilling at Sunnyside East include;

o Hole OSSRC06

- 174m @ 1.83 g/t gold from surface including

- 100m @ 2.34 g/t gold from 59m, and including

- 31m @ 3.05 g/t gold from 115m, with the hole terminating in

- 3m @ 8.86 g/t gold from 171m, including

- 1m @ 15.15 g/t gold from 172m

o Hole OSSRC01

- 37m @ 1.27 g/t gold from 27m, including

- 3m @ 3.12 g/t gold from 53m

o Hole OSSRC02

- 39m @ 1.19 g/t gold from 51m, including

- 12m @ 2.10 g/t gold from 70m

o 2Hole OSSRC05

- 6m @ 1.24 g/t gold from 9m

- 18m @ 1.08 g/t gold from 40m

- 22m @ 1.00 g/t gold from 81m

- 9m @ 1.48g/t gold from 130m

Cross-cutting faults are known to have an important control on the location of high grade gold at Hillgrove. Okapi recognised evidence of similar cross cutting structures at Enmore, but there had been limited work targeting these structures.

Drill holes OSSRC05 and OSSRC06 targeted such cross-cutting structures at the Sunnyside East Prospect, with exceptional results returned from OSSRC06. Mineralisation in OSSRC06 appears to be improving with mineralisation and is open along strike and at depth.

Sunnyside West Prospect

Previous drilling at Sunnyside West Prospect, located 400m west of Sunnyside East, intersected shallow gold mineralisation. Further mineralisation was intersected in recent drilling, with both holes returning significant results including:

o OSSRC07

- 7m @ 1.25 g/t gold from 30m, including

- 1m @ 5.61g/t gold from 36m

o OSSRC08

- 17m @ 0.69 g/t gold from 20m, including

- 7m @ 1.10 g/t Au from 20m

Significant mineralisation has now been delineated over 400m between Sunnyside East and Sunnyside West, with mineralisation remaining open at depth and along strike in both directions. 144 holes have been completed at Sunnyside with only 9 greater than 100m and 2 greater than 126m deep.

Further work is required at Sunnyside, including follow up on these new drill intercepts to try and understand the geometry of the primary mineralisation and to further locate potential high grade shoots that may be associated with cross cutting structures.

Previous drilling at Sunnyside has yielded shallow but significant drilling results as reported to the market on December 17, 2020 "Okapi Signs Agreement to Acquire Highly Prospective Enmore Gold Project and Raises $2.5M" and includes;

o 4m @ 11.94g/t Au from 0m in hole SP3B

o 20m @ 1.7g/t Au from 18m, inc 4m @ 4.4g/t Au in hole SP24E

o 2m @ 14.6g/t Au from 46m in hole SP13E

o 8m @ 3.0g/t Au from 0m, inc 2m @ 2.8g/t in hole SP4C

o 12m @ 1.9 g/t Au from 6m, inc 6m @ 2.4g/t Au in hole SP24C

o 10m @ 2.8g/t Au from 0m, inc 2m @ 6.2g/t Au in hole SP18B

Bora Prospect

Okapi's RC drill program also included two holes at the Bora Gold Prospect 4km west of Sunnyside, the holes targeted a small-scale historic mine. Drilling intersected several siliceous veins within the host adamellite. Further work is required to assess the significance of these results and plan follow up work. The better intercepts from the recent program include;

o Hole OBARC01

- 3m @ 0.51g/t gold from 53m

- 2m @ 0.52g/t gold from 69m

o Hole OBARC02

- 2m @ 0.58g/t gold from 67m

To view tables and figures, please visit:

https://abnnewswire.net/lnk/I440ETEU

About Okapi Resources Limited

Okapi Resources Limited (ASX:OKR) recently acquired a portfolio of advanced, high grade uranium assets located in the United States of America and in the Athabasca Basin, Canada.

Okapi Resources Limited (ASX:OKR) recently acquired a portfolio of advanced, high grade uranium assets located in the United States of America and in the Athabasca Basin, Canada.

Assets include a strategic position in one of the most prolific uranium districts in the USA - the Tallahassee Creek Uranium District in Colorado. The Tallahassee Uranium Project contains a JORC 2012 Mineral Resource estimate of 27.6 million pounds of U3O8 at a grade of 490ppm U3O8 with significant exploration upside. The greater Tallahassee Creek Uranium District hosts more than 100 million pounds of U3O8 with considerable opportunity to expand the existing resource base by acquiring additional complementary assets in the district.

The portfolio of assets also includes an option to acquire 100% of the high-grade Rattler Uranium Project in Utah, which includes the historical Rattlesnake open pit mine. The Rattler Uranium Project is located 85km from the White Mesa Uranium Mill, the only operating conventional uranium mill in the USA hence provides a near term, low-capital development opportunity.

In January 2022, Okapi acquired a portfolio of high-grade exploration assets in the world's premier uranium district, the Athabasca Basin. The Athabasca Basin is home to the world's largest and highest-grade uranium mines.

Okapi's clear strategy is to become a new leader in North American carbon-free nuclear energy by assembling a portfolio of high-quality uranium assets through accretive acquisitions and exploration.

| ||

|