A single day. Five enquiries. A credit score in tatters. Victoria Coster of Credit Fix Solutions says it’s time for education reform

But for one teenager, a series of innocent financial decisions turned into a credit nightmare — and her story is a stark reminder of the urgent need for financial literacy education in schools.

Victoria Coster, CEO and Founder of Credit Fix Solutions and Co-Director of Credit Fix Lawyers, has made it her mission to improve financial literacy across Australia.

Your credit report and score is an important part when it comes to getting finance approved.

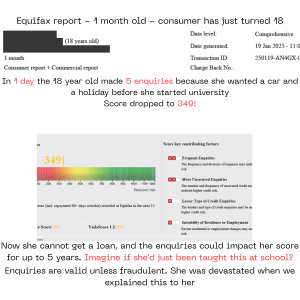

Recently, we came across an 18-year-old student had just celebrated her birthday. She had a part-time job, was getting ready to start university, and decided it was time to apply for a car loan and book a holiday.

On the same day, she applied for five different types of credit from a personal loan to car finance, believing that if one was declined, she’d try another.

But on the same day, after making the five enquiries, her Equifax credit report showed a dramatic drop in her score, falling to just 349, deep in the high-risk red zone.

Despite having no defaults, no missed payments, and no debts, her score plummeted purely due to the number and nature of her enquiries.

*For context you have 1200 points in total with Equifax. Anything lower than around 650, and potentially you cannot obtain personal finance, especially credit cards and personal loans, and secured lending gets very expensive.

“This young woman was devastated when we explained what had happened,” says Coster. “She thought she was doing the right thing. No one had ever told her that multiple credit applications in a short space of time can severely damage your credit score.”

What’s worse? These five simple enquiries — none of which resulted in an approved loan — may now affect her ability to access credit for up to five years. (Enquiry history information in Australia is 5 years).

A Systemic Problem: Australians Don’t Know the Rules

This isn’t an isolated incident. Every week, Coster and her team meet consumers who had no idea their credit score could be damaged by what seem like harmless actions — applying for a phone plan, clicking “pre-qualify” buttons online, or refinancing without checking their existing file.

The Push for Education Reform

Determined to stop this cycle, Victoria Coster is actively working with schools, finance brokers, and other firms in the finance industry such as Home Affordability Solutions (HAS) to bring real-world financial literacy education into the classroom.

In collaboration with Beth Comino, CEO of Home Affordability Solutions (HAS), Coster has submitted a pilot financial literacy program to the head office for Anglican Schools in New South Wales to deliver engaging, age-appropriate credit and finance education to Year 10 students.

“We’re not just teaching them what a credit score is,” explains Coster. “We’re teaching them how to avoid financial harm, how to recognise debt traps, how to read a credit report, and how to ask for help before it’s too late.”

Coster believes this kind of early intervention will improve outcomes for future borrowers — including those who will one day be clients of banks, brokers, and credit providers across Australia.

It is clear that education is the most powerful form of credit repair.

“We shouldn’t be waiting until someone’s been declined for a loan to teach them how their credit score works,” she says. "If this continues, the banks won't be lending to the next generation."

“The 18-year-old who came to us didn’t need a credit repairer. She needed a teacher."

Coster calls on policymakers to prioritise financial literacy as a core part of the high school curriculum and take urgent action on the Credit Reporting Framework Reform 2024 to prevent consumers damaging their credit reports.

For educational purposes only. Not deemed financial advice. Visit www.moneysmart.gov.au for money tips.

Victoria Jordan Coster

Credit Fix Solutions

victoria@creditfixsolutions.com.au

Visit us on social media:

LinkedIn

Facebook

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.