Feasibility Study "Confirms Citronen as One of the World's Largest & Premier Zinc-Lead Projects".

Company Presentation

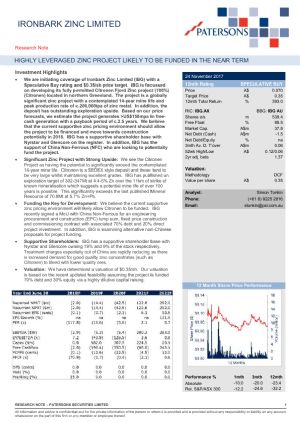

Perth, Sep 18, 2017 AEST (ABN Newswire) - Ironbark Zinc Limited ( ASX:IBG) (

ASX:IBG) ( IRBGY:OTCMKTS) provides the Company's latest Presentation on Feasibility Study.

IRBGY:OTCMKTS) provides the Company's latest Presentation on Feasibility Study.

ZINC -THE TIME IS NOW!

The world is running out of Zinc (the fourth most consumed metal by volume)

- Major mine closures in recent years due to depletion

o Century (500,000 tpa)

o Brunswick (200,000 tpa)

o Perseverance (128,000 tpa)

o Lisheen(167,000 tpa)

- Yet at the same time demand is growing -forecast at 2.5-3% pa (or approximately an extra required 400,000tpa) to 14.7Mt zinc over 2017

- The falling supply against rising consumption is driving a price rise

- Ironbark has the rare opportunity to rapidly bring on a large scale zinc operation

Ironbark Snapshot

- Market Capitalisation of ~$50M

- Major investors and strategic partners include

o Glencore International AG -world's largest zinc trader, major zinc miner and smelter

o Nyrstar NV -major global zinc smelter group

o China Nonferrous -major Chinese construction and engineering firm

- Over 12.8 billion pounds of zinc identified at 100% owned Citronen

o Current zinc prices are very strong

o Provides extraordinary leverage to base metal prices

Project Summary

- Feasibility Cost Update demonstrates compelling economics

o NPV US$1,035M (US$ 909M post tax)

o Annual EBITDA up to +US$270M

- Mining Licence Granted for 30 years

- Advancing with NFC towards production -under Financing and Engineering, Procurement and Construction (EPC) MoU

- Over $50M expended on the Citronen project to date

- Greenland has a zinc mining history

- Feasibility Study work to date confirms the world class scale of Citronen project

o long life base metal mining operations

o excellent recoveries

o simple process flow sheet

- Pathway to funding under the MOU with China Nonferrous (NFC)

o Ironbark has an MOU with NFC for an EPC lump sum, fix priced construction and commissioning contract with an associated 70% debt funding and 20% direct project investment

- Poised to be a Globally Significant Zinc Miner in a low sovereign risk location between North America and Europe

To view the full presentation, please visit:

http://abnnewswire.net/lnk/5EDV829B

About Ironbark Zinc Limited

Ironbark Zinc Limited (ASX:IBG) (OTCMKTS:IRBGY) is listed on the Australian Securities Exchange and is seeking to become a base metal mining house. Ironbark has an undrawn US$50M funding facility provided by Glencore to expand its project base through acquisition.

Ironbark Zinc Limited (ASX:IBG) (OTCMKTS:IRBGY) is listed on the Australian Securities Exchange and is seeking to become a base metal mining house. Ironbark has an undrawn US$50M funding facility provided by Glencore to expand its project base through acquisition.

Ironbark seeks to build shareholder value through exploration and development of its projects and also seeks to actively expand the project base controlled by Ironbark through acquisition. The management and board of Ironbark have extensive technical and corporate experience in the minerals sector.

The wholly owned Citronen base metal project currently hosts in excess of 13.1 Billion pounds of zinc (Zn) and lead (Pb). For full details refer to ASX announcement 25 November 2014 –Citronen Project Resource Update – JORC 2012 compliant resource.

| ||

|