Quarterly Activities Report

Quarterly Activities Report

Perth, Jan 31, 2022 AEST (ABN Newswire) - Monger Gold Limited ( ASX:MMG) is pleased to provide an update for the quarter ended 31 December 2021.

ASX:MMG) is pleased to provide an update for the quarter ended 31 December 2021.

Exploration Updates

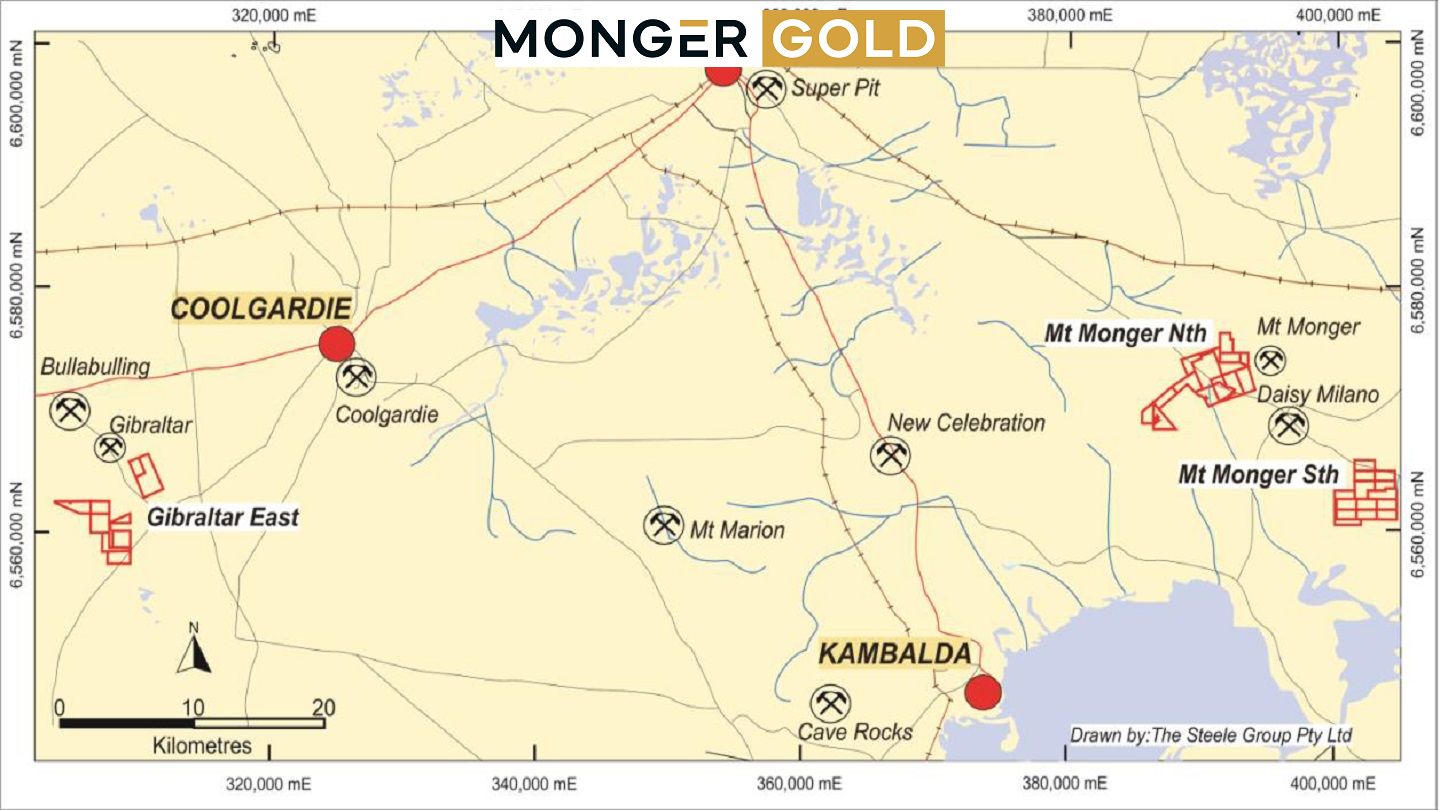

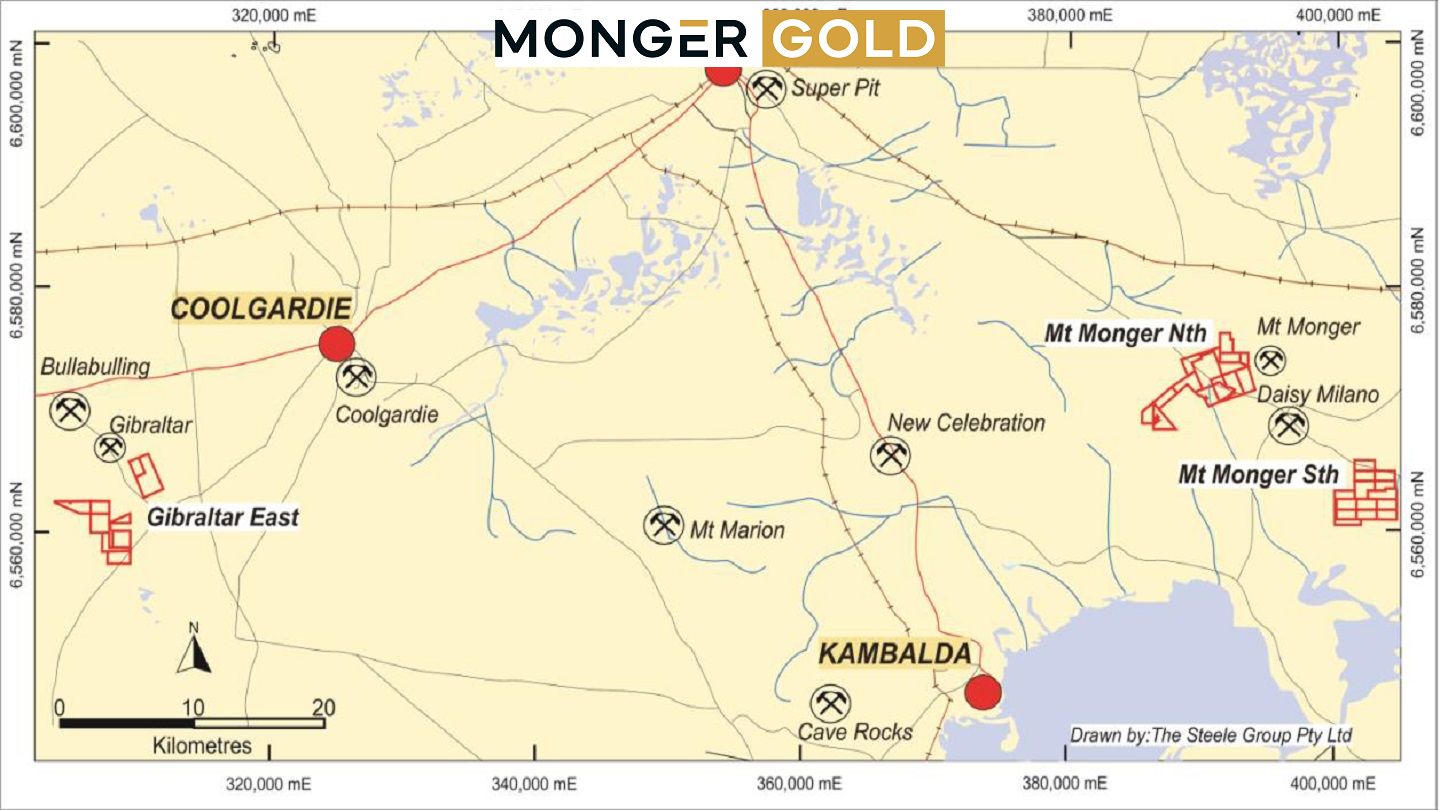

Mt Monger North

The Company received several auger vacuum assay results from drilling undertaken by Torian Resources in March 2021, at Mt Monger North (ASX 3 November 2021)

Significant intercepts included:

- MMWV0101 1m @ 1.37 g/t Au from 38-39m (EOH), Hoffmann North Prospect

- MMWV0103 1m @ 6.80 g/t Au from 39-40m (EOH), Hoffmann North Prospect

- MMWV0106 1m @ 2.18 g/t Au from 20-21m

In the next quarter, one reverse circulation drill hole is planned at Hoffmann North Prospect to test the end-of-hole vacuum drilling interval 1m @ 6.80g/t Au. The adjacent vacuum drill hole, to the northeast, has anomalous support of 1.37g/t Au at end-of-hole. Elevated arsenic along strike towards the northwest suggests a structure runs into this area where gold anomalism occurs. Other notable trace elements associations at Hoffmann North Prospect are bismuth, molybdenum, tellurium and tungsten. The molybdenum is interesting from the vacuum drilling as a porphyry was found towards the northwest with elevated chromium, that may be a mix of porphyry and ultramafic and/or fuchsite alteration in porphyry. Commonly in the Wombola and Bulong Structural Domains gold mineralisation is associated with porphyry as these intrusives have exploited important structures.

The vacuum drilling assay results were quiet low values in areas with previous drilling. This appears to be because there is not significant horizontal dispersion of gold in the saprolite at Monger North. Gold is generally leached and removed in the regolith profile and the base of oxidation or REDOX front is very close to the semi-oxidised rock and saprock therefore any drilling that stops at blade refusal will only encounter gold where it is very close to the primary source. This is why we can directly target sporadic high-grade gold values in blade refusal drill holes as there is limited horizontal gold dispersion on the REDOX front.

Mt Monger North (Providence)

The Company completed a first stage RC drilling campaign at Mt Monger North's Providence Divine and Canista Prospects, of nine holes for 596m, returning high-grade gold intersections. (ASX 9 November 2021) Significant intercepts included:

- MNRC001 3m @ 7.07 g/t Au from 14-17m including 1m @15.99 g/t Au from 14-15m

- MNRC004 8m @ 16.15 g/t Au from 60-68m including 1m @ 111.4 g/t Au from 61-62m and 1 m @15.01 g/t Au from 63-64m

- MNRC007 8m @ 31.84 g/t Au from 66-74m including 1m @ 37.03 g/t Au from 68-69m; 1m @ 18.2 g/t Au from 69-70m and 1m @ 190.06 g/t Au from 70-71m

The Company has planned a 3000m RC drill program at Providence to test the Stage One results at depth and along strike, scheduled to begin in late January. Testing of gold mineralisation is planned to deeper levels (new drill holes have -60deg/-55deg dip and 130deg magnetic azimuths) over a total of 250m extent to the southwest, towards old surface workings also with a southwest strike. No historical drill holes have been completed in the proposed new MMG drill program extension area, both at depth and along strike. The parallel drill traverses are spaced at 25 metre intervals in the northeast drilling beneath shallow historical holes (grid of historical drilling by other mining companies) and 40 metres towards the southwest (new extension step-out grid) with drill holes 20 metres apart along each traverse. This drill hole spacing will test the extents and continuity of steeply dipping gold mineralisation discovered by MMG. Subject to results from the Stage Two RC Drill program, the planned drill hole spacing will enable a maiden Resource Estimate at Providence, following the completion of the program. (ASX 20 December 2021)

Providence Prospect is located within the Wombola structural domain, bounded to the east by the Wombola Fault and west by the regional scale Mt Monger Fault. It is characterized by NE-SW trending layering and bedding including thick (>150m) dolerite sills gently folded by SSE-plunging upright folds where gold is mineralised in NE-SW and ENE-WSW quartz veins cutting these sills. Dolerites with thin units of sedimentary rock at Providence are consistent with both extrusive basaltic lavas and shallow sub-volcanic sills. Felsic dykes have exploited structures that have been reactivated and host gold mineralisation. The primary targets are narrow quartz vein and sericite-silica-pyrite high-grade gold deposits within an amphibolite facies metamorphosed mafic sill. Quartz veins dip steeply towards 290deg to 330deg magnetic. The observed steep vein dip to the northwest is parallel with bedding/layering of the northern limb of an F2 fold. There are indications that a plunge component to mineralisation is controlled by the western limb of an F2 fold. Because the F1 and F2 fold axis are sub-perpendicular, at almost 90deg, they form a basin & dome type pattern. The sediment is in an orientation that conforms to the leading edge of a refolded fold. Sill layering dips into an underlying thrust fault on sediment-mafic contact. These basin & dome folds are then carved up by NW-striking strike slip faults. Mapping on the NE side of one of these NW-striking faults found a porphyry along the 430m length of a structure. Because the fault offset is sinistral this may be the same large porphyry MMG discovered that hosts mineralisation, the porphyry lode at Providence.

Mt Monger South

The Company completed a geological mapping and sampling program at the underexplored Mt Monger South prospect. (ASX 18 January 2022)

Gold assay results received for rock chip samples taken during the program returned significant assay values:

- 89.79 g/t gold (MMS0032) quartz vein, east Three Emus Prospect

- 9.65 g/t gold (MMS0027) quartz vein in small old workings shaft

There were also some gossanous rockchip samples with anomalous above background bismuth, tellurium, copper, zinc, nickel and cobalt (MMS0015). More sample assays are awaited and the interim results are still being analysed with more samples planned to be taken to understand the extent and significance of elevated trace elements in rockchip samples.

Based on the geological mapping program, target areas were defined to focus further work. A major geochemical sampling program in 2022 is planned to utilise CSIRO's Ultrafine+(TM) (UFF+) sample assays, landform analysis and artificial intelligence algorithms. MMG is a sponsor of the CSIRO UFF+ program (ASX 11 August 2021).

MMG is looking at completing ground geophysical programs at Monger South currently consulting with Gap Geophysics and Southern Geoscience on Sub-Audio Magnetics (SAM) parameters for potential work programs. Consultations have started with Model Earth Structural Geology and 3D Consultants to build an advanced structural geology model of the project.

Gibraltar

Based on historical surface soils and historical drilling, target areas were defined to focus further work. A major geochemical sampling program in 2022 is planned to utilise CSIRO's Ultrafine+(TM) (UFF+) sample assays, landform analysis and artificial intelligence algorithms.

MMG is looking at completing ground geophysical programs at Gibraltar consulting with Gap Geophysics and Southern Geoscience on Sub-Audio Magnetics (SAM) parameters of potential work programs.

Corporate and Financial Position

Cash available to the Company at the end of the Quarter ended 31 December 2021 was $3,641,000 Payments for the quarter included:

- Payments to related parties over the Quarter were $25,000, included CEO, Executive remuneration and non-executive director fees. All payments were made in the ordinary course of business; and

- Payments for Exploration expenditure over the quarter was $220,000.

The Company's disclosures required by ASX Listing Rule 5.3.4 regarding a comparison of its actual expenditure to 31 December 2021 since listing on 6 July 2021 against the "Use of Funds" statement in its prospectus dated 16 April 2021 is included in the attached Appendix 5B.

The Company confirms that, in the six months since listing on the ASX, it has incurred expenditures largely in line with the Use of Funds set out on page 12 of its Prospectus dated 16 April 2021.

*To view the full Quarterly Report with tables and figures, please visit:

https://abnnewswire.net/lnk/9BXE481F

About Loyal Lithium Limited

Loyal Lithium Limited (ASX:LLI) is a well-structured listed resource exploration company with projects in Tier 1 North American mining jurisdictions in the James Bay Lithium District in Quebec, Canada and Nevada, USA. Through the systematic exploration of its projects, the Company aims to delineate JORC compliant resources, creating value for its shareholders.

Loyal Lithium Limited (ASX:LLI) is a well-structured listed resource exploration company with projects in Tier 1 North American mining jurisdictions in the James Bay Lithium District in Quebec, Canada and Nevada, USA. Through the systematic exploration of its projects, the Company aims to delineate JORC compliant resources, creating value for its shareholders.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

Related Industry Topics:

ASX:MMG) is pleased to provide an update for the quarter ended 31 December 2021.

ASX:MMG) is pleased to provide an update for the quarter ended 31 December 2021.  Loyal Lithium Limited (ASX:LLI) is a well-structured listed resource exploration company with projects in Tier 1 North American mining jurisdictions in the James Bay Lithium District in Quebec, Canada and Nevada, USA. Through the systematic exploration of its projects, the Company aims to delineate JORC compliant resources, creating value for its shareholders.

Loyal Lithium Limited (ASX:LLI) is a well-structured listed resource exploration company with projects in Tier 1 North American mining jurisdictions in the James Bay Lithium District in Quebec, Canada and Nevada, USA. Through the systematic exploration of its projects, the Company aims to delineate JORC compliant resources, creating value for its shareholders.