Philippines Offshore Oil and Gas Permit (SC 54) - 40% Participating Interest

Perth, April 30, 2009 AEST (ABN Newswire) - Kairiki Energy Limited (ASX:KIK)(PINK:KAIRF) Directors wish to report the following activities for the quarter ended 31 March 2009;

- Farm Out of SC 54 Inboard - US$13m consideration for 17%

- Independent Contingent Resources Confirmed for Tindalo and Yakal Discoveries

- Strategic focus on building value in the Philippines

- Farm Out of Mineral Properties

Oil & Gas Activities

During the quarter, the following progress occurred in respect of the company's Philippine oil and gas operations:

- Inboard

Independent Resource Assessment

In the current period the Joint Venture has undertaken significant technical work on both the Tindalo and Yakal discoveries both internally and through ongoing independent third party studies, to better understand the scale of the discovered resource, the impact on the remaining exploration portfolio and the possible options for development including full-field development and early production via a single jack-up rig based production facility.

In March 2009, the Joint Venture commissioned ISIS Petroleum Consultants Pty Ltd. ("ISIS") who have independently estimated the field size, reservoir quality and volumetrics of Yakal and Tindalo. ISIS has confirmed that the in-place probabilistic resource volumes (STOIIP) in the Yakal and Tindalo oil pools are as follows:

--------------------------------------------------- Tindalo Yakal--------------------------------------------------- P90 P50 P10 Mean P90 P50 P10 Mean---------------------------------------------------Oil inPlace(MMbbls) 5.0 11.0 24.5 13.4 2.4 5.1 10.7 6.0---------------------------------------------------

The resources discovered by the Tindalo-1 and Yakal-1 wells are defined as Contingent Resources in the Development Pending sub-class under the Petroleum Resources Management system approved by the Society of Petroleum Engineers.

Based on production histories of surrounding analogous oil fields (such as Nido and Matinloc), recovery factors for Tindalo and Yakal are expected to be 35% - 45%.

Inboard Farm-Out Process

In March 2009, Kairiki Energy announced that it had entered into a conditional agreement with a private oil and gas investment company ("Investors") to farm-out a 17% interest in the inboard portion of Service Contract 54 ("SC 54") in the Philippines. Kairiki will retain a 23% interest in the inboard portion of SC 54 (to be named SC 54A) and a 40% interest in the remainder of SC54 (to be named SC 54B).

The highlights of the transaction are as follows:

i) The Investors will earn a 17% interest in the inboard portion of SC 54 (SC 54A) by:

- reimbursing Kairiki US$7 million of its past costs; plus

- funding the next US$6 million of Kairiki's remaining 23% net share of the SC 54A work program (equivalent to a carry for Kairiki over the next US$26 million of work program in SC 54A).

ii) The transaction is effective from 1 March 2009.

iii) The farm-out is conditional upon:

- finalising a formal farm-out agreement and the private oil and gas investment company's investor contracts concluding by 30 April 2009, unless both parties agree to mutually extend;

- obtaining all necessary joint venture and joint operating agreement approvals; and

- obtaining any relevant government approvals.

The Investors are particularly experienced in drilling and engineering operations and strategically aligned to deliver First Oil by early 2010 from the inboard shallow water portfolio, in line with both Kairiki and the Joint Venture.

This transaction is consistent with our Company's strategy to acquire projects with relatively low risk, undertake extensive technical work and then introduce a partner of strategic value to assist in the development of those projects.

Commercialisation of Resources

Significant work was undertaken during the quarter to assess the commercialisation via either single well production through a jack up drilling rig or a "cluster" development option aggregating several fields.

Whilst the oil volumes identified at Tindalo and Yakal demonstrate favourable economics for a "cluster" style development option aggregating several fields, including Tindalo and Yakal, into a single production facility, for concurrent production, the project would be risk capital intensive and could result in earliest production in 2011.

A simpler and more cost effective solution, however, which also mitigates the productivity risk, and can deliver First Oil more rapidly, is to produce the Tindalo-1 well in the first instance through a simple system involving a jack-up drilling rig to appraise the well productivity during an initial period of, say, six months. Oil produced during this period would be collected in an offset tanker and sold to generate early cash flow from the area.

In the event of a successful test, Tindalo could either be suspended pending a "cluster" development in the area or continue to produce through the drilling rig until end of field life. Tindalo-1 could be potentially brought to production in this way by early 2010.

The next steps to progress this option (pending the appropriate approvals) are detailed subsurface modelling and reprocessing of the 3D seismic data which will refine volume estimates and, if considered necessary, allow for any reserves certification process. In parallel, engineering design work and contract tendering with a rig, tanker and ancillary service providers would also be completed prior to the Joint Venture making a final investment decision later this year.

Outboard

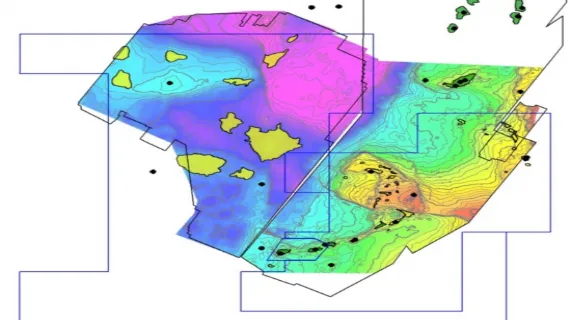

During the quarter the Joint Venture commissioned CGG Veritas to undertake prestack depth migration (PSDM) processing over the entire Abukay 3D volume. PSDM is widely recognised as a high-end processing product which requires many iterations and significant manpower effort but which delivers substantial image clarity and reduced uncertainty in depth imaging, critical to further de-risk the leading targets including the Gindara and Lapu Lapu prospects.

Preliminary products were received from CGG Veritas early January 2009 with final products received in April 2009. Although interpretation to date is based upon provisional products, significant image quality improvement is very encouraging for more robustly defining trap presence and further prospect-specific de-risking. Final interpretation and results are expected in the second quarter.

Sicily Channel - Italy/Tunisia

During the quarter, Kairiki entered into agreements, through its wholly owned subsidiaries, to sell its 30% interest in each of the Sicily Channel exploration permits, Pantelleria and Kerkouane, to AuDAX Resources Limited (AuDAX). AuDAX, either directly or indirectly via subsidiary companies, operates and holds a 70% interest in those permits.

The divestment of the Sicily Channel permits has eliminated Kairiki's financial obligations in 2009 and 2010 to a 2D seismic program on Kerkouane and a well commitment on each permit with a total estimated cost, net to Kairiki, of US$14 million (US$47 million gross). As consideration, AuDAX will pay Kairiki US$280,000 cash for each permit approximately equating to our acquisition cost. The payment will be made when AuDAX disposes of an interest in these permits. As a result of this divestment, Kairiki is now free of any further obligations in respect of these permits.

Romanian AMI

As an extension to this strategic drive, Kairiki has also assigned its 33.33% interest in its Romanian AMI to New Zealand Oil and Gas (NZOG) for a cash consideration to Kairiki of 235,000 Euros (A$ ) and payable on certain milestones being achieved.

The financial obligations in respect of maturing the Sicily Channel and Romanian exploration ventures would require significant funding in the near term and given the current economic conditions for funding exploration activities we believe that our funds and resources are much better leveraged towards developing our lower risk Philippines asset base in order to provide a much greater certainty of generating shareholder value.

Mineral Projects

In March 2009, the company announced that it has entered into term sheet agreements to farm out its minerals tenements to third parties effective immediately. The third parties will earn a 90% interest in the mineral tenements by funding 100% of the cost of all the exploration work required to maintain the tenements in good standing with the Department of Mines and Petroleum. Kairiki will receive as consideration the following:

- 10% of the net proceeds on certain tenements up to a sum of A$250,000 and a 1% net smelter royalty thereafter; and

- for the remaining tenements, 10% of the net revenue after 5,000 ounces of gold has been produced.

These transactions, which are subject to executing farm-out agreements, will provide Kairiki with a 10% free carry interest on its mineral tenements.

Corporate Summary

During the quarter, the following occurred:

- Convertible Note

IMC elected not to exercise its option to farm-in to the inboard portion of SC 54.

In January 2009, IMC and Kairiki agreed to the following amendments to the convertible note;

i) To extend the ability for IMC to use all or part of any cash balance held in a special repayment account established for the option conversion monies from 15 January 2009 to 30 April 2009; and

ii) Extend Kairiki's right from 31 January 2009 to 30 April 2009 to repay up to 50% of the outstanding amount in respect of the Notes.

Change in Substantial shareholders

During the quarter the following changes in substantial shareholders occurred:

- RAB increased holding from 32,009,400 to 41,509,400;

- AMP increased holding from 21,429,329 to 27,849,703; and

- New City Investment Managers decreased holding from 29,500,000 to 23,500,000.

Resignation of Non Executive Director

In January 2009 Mr Chris Swarbrick resigned as a Director of the company to pursue other opportunities in the oil and gas industry. We thank Chris for his contribution over the past two years.

Cash Position

At 31 March 2009, Kairiki had approximately A$2.04 million in cash, including A$1,015,356 held in a trust account relating to the options exercised for the period through to 31 December 2008. Under the convertible note agreement with IMC, these funds were restricted at 31 March 2009 pending notification form IMC whether to use those proceeds to redeem a portion of their note. The expiry date for IMC to decide whether to sweep those funds has been deferred until 30 April 2009. In the interim the funds will be held in a trust account for the benefit of IMC.

For the complete Kairiki Quarterly Report, please see the link below;

http://www.abnnewswire.net/media/en/docs/60561-ASX-KIK-444989.pdf

Contact

Laurie Brown

Managing Director

Kairiki Energy Limited

TEL: +61-8-9388-6711

| ||

|