Annual Report and Full Year Statutory Accounts

Perth, Sep 29, 2016 AEST (ABN Newswire) - Altech Chemicals Ltd ( ASX:ATC) (Altech/the Company) is pleased to provide the company's Annual Report and Full Year Statutory Accounts for 2016.

ASX:ATC) (Altech/the Company) is pleased to provide the company's Annual Report and Full Year Statutory Accounts for 2016.

Altech is aiming to become one of the world's leading suppliers of 99.99% (4N) high purity alumina (HPA) (AI2O3) through the construction and operation of a HPA processing plant located in Johor, Malaysia. Feedstock for the plant will be sourced from the Company's 100%-owned kaolin deposit at Meckering, Western Australia and shipped to the processing plant in Malaysia.

Altech's production process will employ conventional "off-the-shelf" plant and equipment to extract HPA using a hydrochloric (HCl) acid-based process. Production costs are anticipated to be considerably lower than established HPA producers - in the bottom quartile of the production cost curve. The Company's HPA project is a high margin, high value proposition, requiring a relatively low level of capital investment.

HPA is a high-value, highly demanded product as it is the critical ingredient required for the production of synthetic sapphire.

Synthetic sapphire is used in the manufacture of substrates for LED lights, semiconductor wafers used in the electronics industry, and scratch-resistant sapphire glass used for wristwatch faces, optical windows and smartphone components. There is no substitute for HPA in the manufacture of synthetic sapphire.

Global HPA demand was estimated at approximately 25,315tpa in 2016 (Persistence Market Research) and is expected to reach 86,831tpa by 2024, growing at a CAGR of 16.7% (2016-2024).

Current HPA producers predominantly use expensive and highly processed feedstock materials such as aluminium metal to produce HPA.

Altech has completed a bankable feasibility study (BFS) for the construction and operation of a 4,000tpa HPA plant at Tanjung Langsat, Malaysia. The plant will produce HPA directly from kaolin clay, which will be sourced from the Company's 100%-owned kaolin deposit at Meckering, Western Australia.

HPA Demand

GLOBAL HPA DEMAND

According to Persistence Market Research, global consumption of HPA for 2015 was 21,309tpa, and by the end of 2016, HPA consumption is estimated at 25,315tpa. This demand is expected to increase to 86,831tpa by 2024, growing by 16.7% (CAGR) over the forecast period (2016-2024).

The consumption of HPA is concentrated predominantly in electronics production hubs such as China, Japan, South Korea, and Taiwan (Asia Pacific region). The largest market for global HPA consumption in 2015 was the Asia Pacific region, accounting for nearly 72% of the global HPA market.

Demand for HPA has witnessed a strong growth over the last decade fuelled primarily by the increasing demand for and proliferation of LEDs - televisions, general purpose lighting, automotive lighting for example.

REVIEW OF OPERATIONS

During the year the Company made considerable progress on advancing the commercialisation opportunity for its kaolin deposit at Meckering. The proposed route to commercialisation is the construction of a high purity alumina (HPA) plant at Johor, Malaysia for the production of 99.99% (4N) HPA (AI2O3) and the associated development of a kaolin quarry and container loading facility at Meckering.

In March 2016 Altech released the results of an update to its positive bankable feasibility study (BFS) (29 June 2015). The financial and technical outcomes of the updated BFS confirm the results of the 2015 BFS.

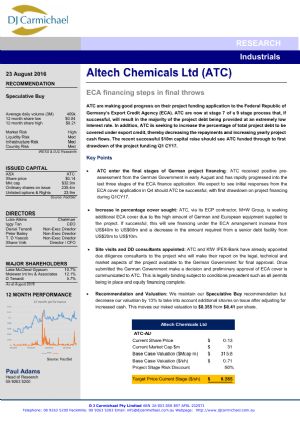

The Company has made significant progress towards securing the requisite debt financing for its HPA project. In December 2015 Altech announced the appointment of German bank KfW IPEX-Bank Gmbh (KfW IPEX) to provide advisory and structuring services in relation to the provision of debt financing. The senior debt structure contemplates maximising the use of available German Export Credit Agency (ECA) insured debt, as interest charged by lenders is typically on attractive terms and long loan tenure.

Altech is targeting total maximum project debt of US$70m, of which US$60m is ECA cover, with the balance of up to US$10m at normal commercial terms. The finalisation of project finance, the debt structure and the availability of debt finance remains subject to ongoing due diligence by KfW IPEX and the ECA. Due diligence consultants were appointed in August 2016 and the work is progressing.

Where possible, the Company has continued to rationalise tenement holdings, which resulted in the sale of surplus tenement E70/3923 for $2m cash.

Other noteworthy achievements during the year included:

- the grant of Meckering mining lease (ML) M70/1334;

- execution of an off-take sales arrangement with Mitsubishi Corporation appointing them exclusive buyer of Altech's full HPA plant capacity;

- the reservation of the HPA plant site within the Tanjung Langsat Industrial Complex, Johor, Malaysia;

- the appointment of M+W Group as the EPC contractor for the Malaysian HPA plant; M+W Group commenced detailed design in March 2016;

- the addition of board members Tunku Yaacob Khyra and Mr Uwe Ahrens as his alternate, which followed the subscription by Melewar International of $1m of shares;

- a well-supported share purchase plan (SPP) in April 2016; raising ~$0.750m followed by a share placement of ~$1.2m to sophisticated investors;

- appointment of Dr Jingyuan Liu as general manager (operations) and Mr Martin Ma as marketing manager (China); and

- an updated Indicated Mineral Resource (JORC 2012) for M70/1334.

I look forward to updating you on the progress that the Company makes in the 12 months ahead, next year.

To view the report, please visit:

http://abnnewswire.net/lnk/2FU29898

About Altech Batteries Ltd

Altech Batteries Limited (ASX:ATC) (FRA:A3Y) is a specialty battery technology company that has a joint venture agreement with world leading German battery institute Fraunhofer IKTS ("Fraunhofer") to commercialise the revolutionary CERENERGY(R) Sodium Alumina Solid State (SAS) Battery. CERENERGY(R) batteries are the game-changing alternative to lithium-ion batteries. CERENERGY(R) batteries are fire and explosion-proof; have a life span of more than 15 years and operate in extreme cold and desert climates. The battery technology uses table salt and is lithium-free; cobalt-free; graphite-free; and copper-free, eliminating exposure to critical metal price rises and supply chain concerns.

Altech Batteries Limited (ASX:ATC) (FRA:A3Y) is a specialty battery technology company that has a joint venture agreement with world leading German battery institute Fraunhofer IKTS ("Fraunhofer") to commercialise the revolutionary CERENERGY(R) Sodium Alumina Solid State (SAS) Battery. CERENERGY(R) batteries are the game-changing alternative to lithium-ion batteries. CERENERGY(R) batteries are fire and explosion-proof; have a life span of more than 15 years and operate in extreme cold and desert climates. The battery technology uses table salt and is lithium-free; cobalt-free; graphite-free; and copper-free, eliminating exposure to critical metal price rises and supply chain concerns.

The joint venture is commercialising its CERENERGY(R) battery, with plans to construct a 100MWh production facility on Altech's land in Saxony, Germany. The facility intends to produce CERENERGY(R) battery modules to provide grid storage solutions to the market.

| ||

|