Drilling Confirms Potential for Wiluna Open Pit Mining

Drilling Confirms Potential for Wiluna Open Pit Mining

Perth, Nov 9, 2016 AEST (ABN Newswire) - Blackham Resources Ltd ( ASX:BLK) ("Blackham") is pleased to announce initial results from the initial 15,000m of drilling completed as part of a 25,000m RC and diamond drilling program undertaken to support the mill expansion study at Wiluna.

ASX:BLK) ("Blackham") is pleased to announce initial results from the initial 15,000m of drilling completed as part of a 25,000m RC and diamond drilling program undertaken to support the mill expansion study at Wiluna.

Drilling has defined mineralisation along strike and beneath existing pits, highlighting the potential for cutbacks at several pits:

- East and West Pits northern extensions confirmed

-- WURD0005: 23m @ 3.74 g/t from 119m 86 gm

-- WURC0047: 6m @ 7.65 g/t from 175m & 46 gm

5m @ 2.01g/t from 195m 10 gm

-- WURC0103: 6m @ 8.75g/t g/t from 88m 52 gm

-- WURC0083: 7m @ 3.17g/t g/t from 38m 22 gm

- Gap Pit drilling confirms extensions to Bulletin deposit along Eastern Shear

-- WURC0104: 10m @ 2.03g/t from 79m & 20gm

19m @ 2.74 g/t from 158m 52 gm

-- WURC0108: 9m @ 4.08g/t from 106m & 37gm

10m @ 2.37 g/t from 131m 24 gm

-- WURC0106: 19m @ 2.66 g/t from 6m 51 gm

- Golden Age North drilling suggests more high grade free milling reef mineralisation amendable to open pit mining

-- WURC0126: 11m @ 5.87 g/t from 50m 65 gm

-- WURC0114: 7m @ 4.90 g/t from 109m 34 gm

The Resources at the Matilda and Wiluna Gold Operation currently stand at 48Mt @3.3g/t for 5.1Moz Au (48% indicated) (ASX release 27th June 2016). The Project resources are currently being re-estimated to include the successful drilling since June 2016.

An update of the Wiluna resource model has commenced and will be finalised once all results from this drill program have been received. There is the potential for a significant reduction in operating costs if sufficient additional resources can be identified to justify a mill expansion.

Blackham's Managing Director, Bryan Dixon, said "The latest Wiluna extensional drilling has demonstrated the potential to add significant base load open pit mining feed. Updated Wiluna open pit resources are likely to compliment the recent drilling success in extending the Bulletin underground mineralisation. Both feed sources will be integrated into the Wiluna expansion study currently underway."

Since the mid 1990's, previous operators at the Wiluna Mine have focused on the underground resources and have not explored the potential of open pit cutbacks. Preliminary mining pit optimisations of mineralisation at Wiluna indicate the potential to profitably extract shallow higher grade mineralisation beneath and along strike from existing pits. Pit optimisations completed on historical drilling results and using an A$1800 gold price result in a single pit from Bulletin to Happy Jack. Review of these mining optimisations has shown that pit shells are constrained by lack of drilling data along strike and at depth at a number of deposits (see Figure 5 and Figure 6 in the link below). Mineralisation intersected along strike and beneath the existing pits is likely to result in an expansion of these pits.

Analysis of the drilling data has also shown that there are alternative interpretations for the strike of the mineralisation which have not been previously tested in a number of areas. If additional open pit resources can be identified there is significant potential to extend the mine life, underpin a plant expansion and reduce operating costs.

During September Blackham commenced a 25,000m RC and diamond drilling program at Wiluna as part of a mill expansion study. The Wiluna deposits all lie within 3km of the refurbished Wiluna Gold Plant (see Figure 1 in the link below). In the current Blackham mine plan only underground mining is scheduled for these deposits, however recent conceptual pit optimisation work has indicated the potential for additional ore to be sourced from open pit cutbacks.

Intercepts from all holes drilled as part of this program are given in Table 1 (in the link below).

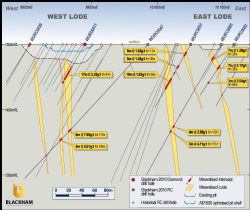

East and West Lodes

The East and West Lodes at Wiluna have historically produced over 1.5Moz predominately from underground mining. Mineralisation has been intersected below and along strike from the East and West pits (see Figure 2 and Figure 3 in the link below) and results to date from the East Lode indicate good continuity of mineralisation between the East and North Pits. Better intercepts from the East and West Lodes include:

- 10m @ 2.62 g/t from 97m 26 gm (WURC0060)

- 6m @ 7.65 g/t from 175m & 5m @ 2.01g/t from 195m 56 gm (WURC0047)

- 7m @ 3.17g/t g/t from 38m 22 gm (WURC0083)

- 19m @ 1.83 g/t from 59m & 6m @ 1.32g/t from 168m 43 gm (WURC0091)

- 23m @ 3.74 g/t from 119m 86 gm (WURD0005)

- 6m @ 8.75g/t g/t from 88m 52 gm (WURC0103)

The Figure 3 (in the link below) cross section is 300m north of the historical East pit at the start of North pit. The good continuity of mineralisation between the historical East and North Pits has increased the likelihood of the planned North and East pits merging together which would result in improved mining economics from a lower stripping ratio. The northern extensions of the East and West Lode mineralisation are likely to result in further oxide mineralisation for the Stage 1 operation as the base of oxidisation is approximately 50m deep in this area.

Gap and Golden Age North Lodes

The Gap pit lies between the Happy Jack and Bulletin open pits (see Figure 1 in the link below). Recent re-interpretation based on recent underground drilling at Bulletin suggests that the Bulletin Lode and the eastern Gap Lode may be the same mineralised structure. Drilling testing the Gap lode has identified significant mineralisation in three separate lodes beneath and along strike from the Gap pit. (see Figure 4 and Figure 5 in the link below). Figure 5 (in the link below) highlights how the limited depth of historical drilling has constrained the pit optimisation. Better results include:

- 10m @ 2.03g/t from 79m & 19m @ 2.74 g/t from 158m 72 gm (WURC0104)

- 9m @ 4.08g/t from 106m & 10m @ 2.37 g/t from 131m 60 gm (WURC0108)

- 19m @ 2.66 g/t from 6m (including 1m @ 6.98g/t) 51 gm (WURC0106)

Significant mineralisation has also been intersected along strike from the Golden Age open pit. Results received to date include:

- 7m @ 4.90 g/t from 109m (including 2m @ 12.9g/t) 34 gm (WURC0114)

- 11m @ 5.87 g/t from 50m (including 3m @ 17.6g/t) 65 gm (WURC0126)

Mineralisation intersected in the current program at Golden Age is associated with quartz and is likely to represent a continuation of the Golden Age quartz vein. The Golden Age orebody currently being mined in the underground is hosted within higher grade free milling quartz veins. WURC0126 and WURC0114 have intercepted the Golden Age structure 200m and 350m north of the historical Golden Age pit and have significantly upgraded the mining potential in this area. Review of historical data suggests that Golden Age may be wrapping into the Gap pit (Eastern Shear) as we are seeing in the underground at 400m depths. WURC0114 is located only 100m from the historical Gap pit and there is the potential that the Bulletin, Gap and Golden Age North pits may merge which will have a favourable effect on the mining economics in these areas.

Magazine

The Magazine gold deposit has not been mined previously and is located 400m south of the East Pit. Better results include:

- 12m @ 2.00 g/t from 10m (including 1m @ 5.69g/t) (WURC0069)

- 6m @ 1.92g/t from 41m (including 1m @ 7.42g/t) (WURC0054)

- 3m @ 3.67g/t from 29m (WURC0073)

The shallow modest mineralisation intercepted has confirmed the potential of Magazine for future open pit mining.

To view the press release, please visit:

http://abnnewswire.net/lnk/T1LH29O2

About Wiluna Mining Corporation Ltd

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:BLK) ("Blackham") is pleased to announce initial results from the initial 15,000m of drilling completed as part of a 25,000m RC and diamond drilling program undertaken to support the mill expansion study at Wiluna.

ASX:BLK) ("Blackham") is pleased to announce initial results from the initial 15,000m of drilling completed as part of a 25,000m RC and diamond drilling program undertaken to support the mill expansion study at Wiluna.  Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.