Total proceeds to date from Option Exercise and Underwriting Agreement total $1.52 million.

Option Exercise and Progress Update

Brisbane, Dec 22, 2016 AEST (ABN Newswire) - Sayona Mining Limited ( ASX:SYA) ("Sayona" or the "Company") is pleased to announce that it has secured another $1.07 million of funding from an extension of the previously announced underwriting agreement with SMSF Specialists (SA) Pty Ltd and further exercise of 3 cent options expiring on the 30 December 2016 ("Options").

ASX:SYA) ("Sayona" or the "Company") is pleased to announce that it has secured another $1.07 million of funding from an extension of the previously announced underwriting agreement with SMSF Specialists (SA) Pty Ltd and further exercise of 3 cent options expiring on the 30 December 2016 ("Options").

The new funds, include option exercise by:

- Directors totaling $145,000;

- Other supportive option and shareholders totaling $805,000; and

- Underwriting agreement extension from $450,000 to $570,000.

Total proceeds to date from Option Exercise and Underwriting Agreement total $1.52 million. The additional underwriting is an extension of the agreement previously announced to the ASX on the 12th December 2016 and is on the same terms and conditions. The agreement has been entered into with SMSF Specialists (SA) Pty Ltd and provides that the Underwriter will underwrite the exercise of $570,000 of Options, by subscribing for shares in Sayona at 3 cents each (the same terms as the Options that are not exercised) following the expiry of the Options on the 30 December 2016. The agreement provides for the payment of an underwriting fee of 6% of the value of the underwritten amount.

The proceeds from the option exercise and underwriting, together with existing cash reserves, will be used to accelerate the development of the Authier project, including the planned drilling program for early 2017, and completion of the Pre-Feasibility Study.

The Company is very pleased with the substantial progress made at the Authier project since completing the acquisition in late July 2016, including:

- Completion of a drilling program that substantially increased the level of JORC resources (see Table 1). The deposit remains open in all directions and the Company believes the resource can be significantly expanded in the planned early 2017 drilling program;

- Comprehensive metallurgical testing program using drill core representative of the entire deposit geometry;

- Advanced progress towards completing a Pre-Feasibility Study to assess the Authier project economics and optimisation potential;

- Received a very positive response from potential lithium carbonate converters for sale of the concentrates produced from a future operation; and

- Progression of permitting and environmental activities.

The Company also notes that the lithium pricing environment has changed dramatically with the recent announcement by Galaxy Resources Ltd ("Galaxy") on pricing for lithium concentrates in 2017. Galaxy announced it entered into contracts for all of 2017 production of 120,000 tonnes at a base price of US$830 per tonne FOB for 5.5% Li20 concentrate. The contract terms provided a payment bonus of US$15 per tonne for every 0.1% improvement in the concentrate grade above the 5.5% Li20 base rate or US$905 per tonne FOB for a 6% Li20 concentrate. The new pricing regime reflects the much tighter market for concentrates as new projects commission slower than forecast and financing constraints slow the planned development timetables for other advanced projects.

Despite the solid progress in 2016, the Company still trades on one of the lowest enterprise value per tonne of Measured and Indicated Resource multiples in the global sector - $154 per tonne, which is more in line with lithium explorers than an advanced project. The Company sees significant re-rating potential as the pre-feasibility study comes out and phase II drilling commences in early 2017.

Western Australia. On 21 December 2016, The Company announced the option to acquire 871 km2 package of tenements in the world-class Pilgangoora lithium district of Western Australia. Recent reconnaissance exploration conducted on the Mallina tenement has located significant zones of visible spodumene mineralisation within a pegmatite. Sample results include rock chip assays up to 2.13% Li2O within a pegmatite which has been mapped over 500 metres of strike extent. The average of the 10 rock chip samples collected to date is 1.28% Li2O. The Mallina area is a new spodumene discovery and has never been previously explored for its lithium potential. The new project compliments the Company's other 1,000 km2 lithium exploration portfolio in the Pilbara region.

To view tables and figures, please visit:

http://abnnewswire.net/lnk/20B1CZ9J

About Sayona Mining Limited

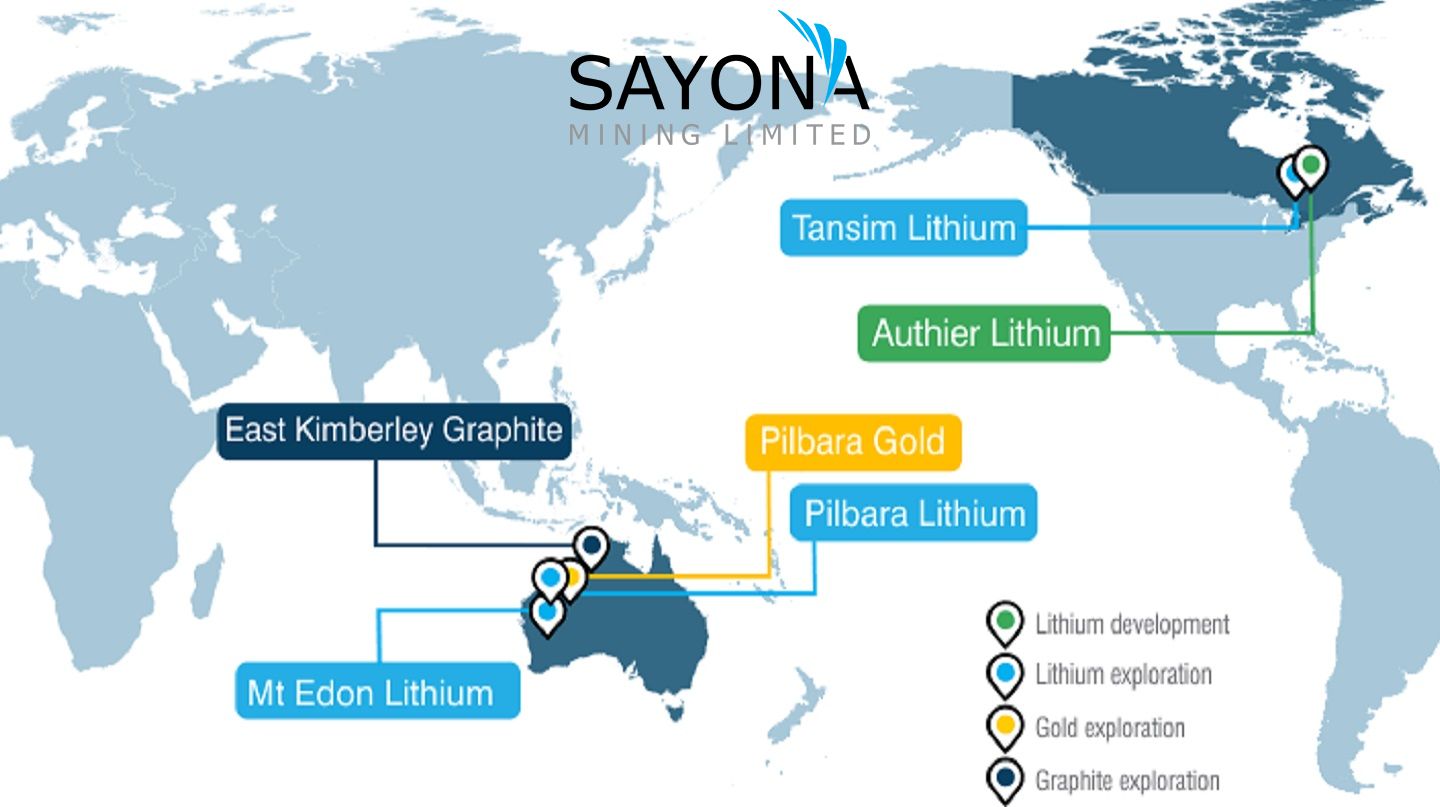

Sayona Mining Limited (ASX:SYA) (OTCMKTS:SYAXF) is a North American lithium producer with projects in Quebec, Canada and Western Australia. In Quebec, Sayona's assets comprise North American Lithium together with the Authier Lithium Project and its emerging Tansim Lithium Project, supported by a strategic partnership with American lithium developer Piedmont Lithium Inc. (ASX:PLL). Sayona also holds a 60% stake in the Moblan Lithium Project in northern Quebec.

Sayona Mining Limited (ASX:SYA) (OTCMKTS:SYAXF) is a North American lithium producer with projects in Quebec, Canada and Western Australia. In Quebec, Sayona's assets comprise North American Lithium together with the Authier Lithium Project and its emerging Tansim Lithium Project, supported by a strategic partnership with American lithium developer Piedmont Lithium Inc. (ASX:PLL). Sayona also holds a 60% stake in the Moblan Lithium Project in northern Quebec.

In Western Australia, the Company holds a large tenement portfolio in the Pilbara region

prospective for gold and lithium. Sayona is exploring for Hemi-style gold targets in the world-class Pilbara region, while its lithium projects include Company-owned leases and those subject to a joint venture with Morella Corporation (ASX:1MC).

| ||

|