White Cliff Minerals Ltd (

White Cliff Minerals Ltd (![]() ASX:WCN) is pleased to provide the Company's Quarterly Reports for the period ended 31 December 2016.

ASX:WCN) is pleased to provide the Company's Quarterly Reports for the period ended 31 December 2016.

Highlights

- Drilling at Aucu Gold Project delivers high grade gold mineralisation and visible gold

- New gold zone identified at Ironstone Gold Prospect

- Lithium Anomalism identified at Lake Percy

- $2.55 Million placement and SPP completed

Summary

Kyrgyz Republic Exploration - Aucu Gold Project (89% owned)

During the December quarter the Company completed the 2016 drill program at the Aucu Gold deposit in Central Asia, targeting the high grade extension of the Upper Gold Zone. The drilling has identified a new mineralised zone containing visible gold in both the drill holes and in surface outcrop.

During the March quarter the Company will undertake a new JORC gold resource estimate in conjunction with detailed metallurgy. It is planned to use the new resource estimate in an open pit optimisation study.

Western Australian Exploration -Gold Projects (100% owned)

Drilling was undertaken at the Ironstone Gold prospect where a new zone of gold mineralisation was identified. Follow up drilling will be undertaken in 2017.

Extensive soil geochemical sampling programs have been completed along the Central gold trend near Ironstone. The Company is awaiting results.

Western Australian Exploration -Lithium Projects (100% owned-part reducing to 30%)

Liontown Resources Limited (![]() ASX:LTR) has completed an initial phase of exploration at the Lake Percy tenement which included collection of soil samples and reanalysis of historical samples. Liontown has identified several surface lithium anomalies associated with tin, tantalum and other elements typically hosted by rare metal pegmatites. Liontown is intending to conduct an initial drilling program in February.

ASX:LTR) has completed an initial phase of exploration at the Lake Percy tenement which included collection of soil samples and reanalysis of historical samples. Liontown has identified several surface lithium anomalies associated with tin, tantalum and other elements typically hosted by rare metal pegmatites. Liontown is intending to conduct an initial drilling program in February.

Liontown can earn up to a 70% interest in the Lake Percy tenement for expenditure of $1.75 million.

Corporate

During the quarter the Company secured a $2 million underwriting package from Novus Capital Limited. This enabled the Company to complete both a placement and a share purchase plan to raise $2.55 million by the issue of 339,966,667 ordinary shares at an issue price of $0.0075 each. Free attaching 31 December 2018 options exercisable at $0.013 were also issued. These options have been listed upon ASX.

1 The Aucu Gold Project, Central Asia (89%)

During the December 2016 quarter the Company continued drilling to test the high grade eastern section of the Upper Gold Zone of the Aucu Gold Project in the Kyrgyz Republic. Multiple high grade gold intersections have been encountered including:

- 12 metres at 15.6 g/t gold including 2 metres at 79.2 g/t gold

- 11 metres at 15.2 g/t gold including 1 metre at 149 g/t gold

- 3 metres at 11.2 g/t gold

- 3 metres at 11.9 g/t gold

- 5 metres at 7.6 g/t gold

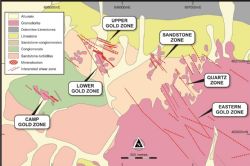

The high grade gold intersections occur within a newly discovered structure called the quartz zone. The Quartz Zone occurs at the eastern end of the Eastern Gold Zone adjacent to the main porphyry intrusion. High grade gold mineralisation is largely confined to the quartz reef which ranges from 1-5 metres wide and can be traced at surface over 265 metres length. Visible gold has been panned from the quartz reef in five road cuttings covering 350 metres length (see Figures 1 & 2 in the link below). The quartz reef extends north-west and interpreted to be the same reef encountered in drill hole UGZ15-35 which intersected 8 metres at 55 g/t gold (see Figure 1 in the link below).

Current Project Activities

Following the successful completion of the 2016 drilling campaign the Company is undertaking the following activities in the March quarter:

1. Conducting a new JORC compliant resource estimate to be conducted by highly regarded mining consultants CSA Global. Results are expected in March.

2. Conducting a substantial gold and copper metallurgical test work program to better outline potential processing options for the deposit.

3. Conducting a preliminary open pit mining optimisation study to establish the baseline economics of the project, to form part of an application for a mining license and to assist with optimising future drill programs.

4. Planning RC and diamond drilling for the commencement of field exploration in April 2017.

Provided the metallurgical test work produces the high gravity gold recoveries (88.8% gravity recoverable and 99% total recoverable gold) similar to that encountered in previous metallurgical test work the Company believes that a low cost simple gravity plant could allow the project to provide substantial cash flow within a short time frame.

Aucu Gold Deposit Summary

As previously reported (ASX releases 24 Mar 15 and 02 Apr 15), the Company announced a maiden inferred resource for the Aucu gold deposit above a cut-off grade of 1 g/t gold of 1.15 Million tonnes grading 4.2 g/t gold for 156,000 ounces1 of contained gold.

In 2015, drilling identified exceptional gold mineralisation2 to the east of the Upper Gold Zone (UGZ) over a strike length of at least 500 metres (ASX releases 11 Nov 15, 1 Dec 15 and 7 Dec 15). Results included:

- 8 metres at 55.2 g/t gold from 66 metres including 1 metre at 89.9 g/t gold

- 4 metres at 59.9 g/t gold from 66 metres including 1 metre at 189 g/t gold

- 2 metres at 43.5 g/t gold from 86 metres

- 1 metre at 103.4 g/t gold from 74 metres

- 3 metres at 41.4 g/t gold including 1 metre at 71 g/t gold

- 4 metres at 23.8 g/t gold from 85 metres

- 2 metres at 22 g/t gold from 102 metres

- 1 metre at 58 g/t gold

In 2016, drilling east of the Upper Gold Zone identified further substantial mineralisation over an additional 300 metres of strike length. Results included:

- 11 metres at 15.2 g/t gold from 42 metres including 1 metre at 149 g/t gold

- 12 metres at 15.6 g/t gold from 82 metres including 2 metres at 79 g/t gold

- 12 metres at 5.1 g/t gold from 34 metres including 2 metres at 26.2 g/t gold

- 5 metres at 9.9 g/t gold from 3 metres

- 9 metres at 8.3 g/t gold from 96 metres

- 4 metres at 12 g/t gold from 49 metres

- 3 metres at 11.2 g/t gold from 13 metres

- 3 metres at 11.9 g/t gold from 45 metres

- 5 metres at 7.6 g/t gold from 93 metres

- 3 metres at 9.8 g/t gold from 9 metres

Substantial copper intersections include:

- 66 metres at 0.91% copper from 33 metres including 18 metres at 1.85% copper

- 24 metre at 1.34% copper from 71 metres including 7 metres at 5.1% copper

- 19 metres at 0.74% copper from 22 metres including 2 metres at 2.4% copper

In addition:

- Mineralisation outcrops at surface over an elevation of at least 600 metres,

- Mineralisation remains open in all directions and at depth,

- Overall metallurgical recovery of all mineralised zones is 99%, and

- Gravity recoverable gold averages 88.6% (gold that reports to the gravity concentrate).

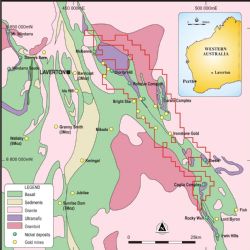

2 Merolia Gold and Nickel Project (100%)

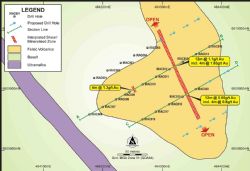

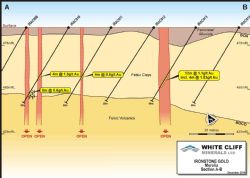

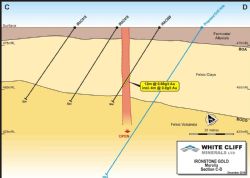

During the December quarter the Company conducted a 2,000 metre drill program to test the Ironstone and Burtville East gold prospects. In addition an extensive soil sampling campaign was conducted to test the Central gold trend located between Ironstone and Comet well.

At Ironstone, drilling identified multiple broad mineralised zones from shallow depths that remain open at depth and along strike. Results include:

- 4 metres at 1.8 g/t gold within 12 metres at 1.1 g/t gold

- 4 metres at 1.3 g/t gold and 5 metres at 0.6 g/t gold

- 4 metres at 0.79 g/t gold and 4 metres at 0.77 g/t gold within 12 metres at 0.66 g/t gold

In addition to the main mineralised intersections there are wide zones of +0.2 g/t gold mineralisation that indicates the presence of a large mineralised system and alteration halo.

The Company is particularly encouraged by the higher grade intersections in the weathered zone as drilling at the adjacent prospect identified substantially higher grades in the fresh rock below similar gold results in the weathered shallow zone. The Company has planned additional air core drilling to test the target further in 2017. The drilling will be carried out in conjunction with drilling testing the adjacent Comet Well gold in soil anomalies.

The Company is awaiting results from both the Burtville East drilling program and the Central Trend soil geochemical sampling program.

Comet Well Background

The Company reported the discovery of gold nuggets within the regional Ironstone Gold prospect in February 2016. Detailed metal detecting identified a significant number of gold nuggets at surface over a 3 kilometre long trend (the Comet Well trend) that coincides with a major regional fault structure. The nuggets were located by prospectors operating under a formal tribute agreement with the Company. Recent prospecting by the tribute group has identified visible gold from a 2 metre deep pit occurring adjacent to a quartz vein where 4 ounces of gold has been recovered (see Figure 8 in the link below). Along the 3 kilometre trend a total 40 ounces of gold has been recovered with the largest nugget weighing 20 grams.

Evaluation of the regional magnetic data over the Ironstone gold project has identified several NW-SE trending shear systems that have the potential to host substantial gold mineralisation (see Figure 9 in the link below). The Comet Well trend and associated regional structures extend at least 30 kilometres north to the A1 Minerals Bright Star deposit and only limited historical exploration has been undertaken over these structures.

3 Lake Percy Lithium Project (100%) and Joint Venture (100% reducing to 30%)

On 11 January 2017 the Company announced the grant of a new lithium tenement (E63/1793) north of the Lake Percy Lithium Joint Venture tenement (E63/1222i). Historical exploration on the tenement E63/1793 (see Figure 9 in the link below) identified pegmatites both in outcrop and on drill holes but no lithium assaying was undertaken.

Given the recent discovery of lithium containing pegmatites at Mt Day and the highly anomalous lithium soil geochemistry reported at the Lake Percy Joint Venture Tenement (see Figure 10-11 in the link below) by Liontown Resources Ltd ("Liontown") (![]() ASX:LTR) the Company will undertake a comprehensive soil sampling program over its 100% owned tenement in February.

ASX:LTR) the Company will undertake a comprehensive soil sampling program over its 100% owned tenement in February.

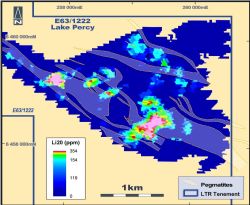

Also post quarter end Liontown announced the discovery of a 2 kilometre long Lithium trend on the Lake Percy JV tenement. Liontown expect to drill the lithium anomalies in early 2017.

Liontown Resources Ltd identifies 2km Long Lithium trend at Lake Percy

The anomalous trend identified by Liontown, which contains values of up to 354ppm Li2O, has been outlined over a strike length of 2km and is coincident with pegmatites which locally exceed 100 metres true thickness (see Figure 10 in the link below).

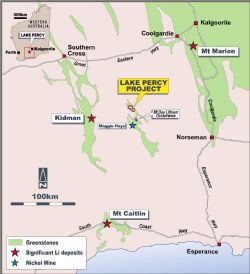

Lake Percy is located ~440km east of Perth near Poseidon Nickel's Lake Johnson/Maggie Hayes treatment plant in WA. It is also just 60km from the world-class Earl Grey lithium deposit discovered by Kidman Resources.

This emerging Forrestania Lithium Province also includes the Mt Cattlin spodumene mine (currently being commissioned by Galaxy Resources) and the Mount Day lithium discovery, which is located 20km to the south in the same greenstone belt as Lake Percy (see Figure 11 in the link below).

In light of the strong anomaly identified at Lake Percy, Liontown has scheduled a maiden RC drilling program to start in early February.

Lake Percy Joint Venture Agreement

In June 2016 WCN secured a joint venture agreement with Liontown to explore the Company's Lake Percy tenement (E63/1222) for lithium and other minerals in a rapidly emerging lithium province in the Lake Johnson-Forrestania district of Western Australia.

Under the joint venture, Liontown can earn up to 70% equity in the 41km2 Lake Percy tenement (EL63/1222i) located approximately 430km east of Perth Western Australia (see Figure 11 in the link below) by:

- spending A$1,000,000 on exploration within 3 years to earn 51% equity;

- at Liontown's election, it can increase its equity to 70% by spending an additional A$750,000 before the 4th anniversary of the JV Agreement execution; and

- by committing to spending $50,000 on exploration before having the right to withdraw from the joint venture.

4 Other Projects

The Company has conducted extensive soil sampling programs over several nickel and gold prospects during the June quarter including the Ghan Well and the Bremer Range projects. Analysis of these samples has been deferred to the March quarter and results will be reported as they become available.

5 Corporate

During the quarter the Company secured a $2 million underwriting package from Novus Capital Limited. This enabled the Company to complete an underwritten placement and a partially underwritten share purchase plan (SPP).

The placement to professional and sophisticated investors was over-subscribed raising $1.5 million by the issue of 200 million shares at an issue price of $0.0075 each with a 1:3 free attaching option exercisable at $0.013 on or before 31 December 2018.

Under the SPP an additional $1.05 million was raised by the issue of 139,966,667 ordinary shares at an issue price of $0.0075 each, with a 1:3 free attaching option exercisable at $0.013 on or before 31 December 2018.

A total of 151,322,273 December 2018 were issued and these December 2018 options have been listed and are trading upon ASX.

To view tables and figures, please visit:

http://abnnewswire.net/lnk/03K04359

| ||

|