Issues Shares for Option Over Large Lithium Pegmatite Leases in Argentina

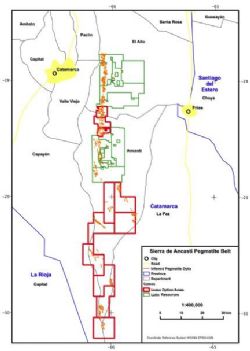

Brisbane, Mar 1, 2017 AEST (ABN Newswire) - Lake Resources N.L. ( ASX:LKE) ("Lake") is pleased to announce that it has issued the first tranche of 1,000,000 LKE shares to Petra Energy SA as part of an option agreement, to be fully paid in LKE scrip, over a large block of approximately 72,000 Ha of exploration and some mining leases and applications over potential lithium bearing pegmatites and pegmatite swarms. The lithium pegmatites are part of a newly recognised 150km long belt of pegmatite swarms at low altitudes (300-800m) in Ancasti, Catamarca province, which has good year-round access.

ASX:LKE) ("Lake") is pleased to announce that it has issued the first tranche of 1,000,000 LKE shares to Petra Energy SA as part of an option agreement, to be fully paid in LKE scrip, over a large block of approximately 72,000 Ha of exploration and some mining leases and applications over potential lithium bearing pegmatites and pegmatite swarms. The lithium pegmatites are part of a newly recognised 150km long belt of pegmatite swarms at low altitudes (300-800m) in Ancasti, Catamarca province, which has good year-round access.

- Shares issued for option agreement over a large area (~70,000 Ha) of potential lithium bearing pegmatites in Catamarca Province, Argentina

- Lithium pegmatites recognised in drilling underway in adjoining leases with encouraging results anticipated

- Sampling to commence over the newly recognised 150km long belt of pegmatite swarms

- LKE shareholders gain increased asset optionality with exposure to both prime lithium brine leases and a new lithium pegmatite belt.

- LKE holds one of the largest lithium lease holdings in Argentina, the target of numerous recent transactions

- Active forward works program in Argentina is ongoing

- Continued assessment for complementary assets to strengthen portfolio

Lake has recently closed an oversubscribed capital raising to ensure the company is well funded to continue an aggressive exploration campaign of drilling and geophysics over lithium brine leases, starting at the Kachi Lithium Brine Project, together with the commencement of sampling over the pegmatites in Catamarca.

Latin Resources ( ASX:LRS) ("Latin") holds adjoining leases in the same pegmatite belt and recently announced drilling of spodumene-bearing pegmatites over substantial widths (announced 23 February 2017) together with rock samples reported from 4.9% to 7.1% LiO2 (announced 14 June 2016). LRS and LKE, should it execute the option agreement, will most likely control most of the potential belt of pegmatites.

ASX:LRS) ("Latin") holds adjoining leases in the same pegmatite belt and recently announced drilling of spodumene-bearing pegmatites over substantial widths (announced 23 February 2017) together with rock samples reported from 4.9% to 7.1% LiO2 (announced 14 June 2016). LRS and LKE, should it execute the option agreement, will most likely control most of the potential belt of pegmatites.

Lake Resources Managing Director, Stephen Promnitz, commented: "We have pleased to have successfully closed a capital raising to be well funded to continue the exploration programme over lithium brines and start on the pegmatites in Argentina. Work is ongoing at the Kachi project, the location of our first major drill program which is scheduled to commence in the coming months.

"Recent corporate transactions in the lithium sector in Argentina show that Lake is on the right track to deliver substantial upside due as the value is unlocked in our strategically located lease holdings. We actively assess opportunities to strengthen and complement our asset base."

Background on Lithium Pegmatite Belt

Lake and its subsidiaries have maintained an active watch over an area of lithium bearing spodumene pegmatites in the Ancasti Ranges of Catamarca province previously known for small scale lithium production. Initial field visits by Lake personnel have demonstrated outcropping pegmatites over a belt 150km long with coarse grained spodumene crystals 30-70cm long in a number of locations. Although data is limited, an option agreement was considered a prudent way to further assess the potential. Sampling will commence soon to assess initial areas for drilling.

Latin Resources ( ASX:LRS) announced on 23 February 2017 that its drill programme underway at present has intersected lithium spodumene in pegmatites over substantial widths. Previously LRS had released results of 4.9% LiO2 to 7.1% LiO2 from samples of spodumene from old mine workings.

ASX:LRS) announced on 23 February 2017 that its drill programme underway at present has intersected lithium spodumene in pegmatites over substantial widths. Previously LRS had released results of 4.9% LiO2 to 7.1% LiO2 from samples of spodumene from old mine workings.

Option terms over Lease holding

Lake has signed an option agreement under the following terms:

- 4 million LKE shares for a 4 month option period, with 1 million shares on signing and 3 million shares within 60 days, extendable to 6 months with a payment of a further 1 million LKE shares. (50% voluntarily escrowed for 6 months). Due diligence and initial exploration to be undertaken at LKE cost.

- 15 million LKE shares on execution of the option, paid in two tranches, with 7.5 million shares upon execution and 7.5 million shares once 65% of the areas are granted for exploration (which may be simultaneously). (50% voluntarily escrowed for 6 months)

To view tables and figures, please visit:

http://abnnewswire.net/lnk/R4270WNW

About Lake Resources NL

Lake Resources NL (ASX:LKE) (OTCMKTS:LLKKF) is a clean lithium developer utilising state-of-the-art ion exchange extraction technology for production of sustainable, high purity lithium from its flagship Kachi Project in Catamarca Province within the Lithium Triangle in Argentina among three other projects covering 220,000 ha.

Lake Resources NL (ASX:LKE) (OTCMKTS:LLKKF) is a clean lithium developer utilising state-of-the-art ion exchange extraction technology for production of sustainable, high purity lithium from its flagship Kachi Project in Catamarca Province within the Lithium Triangle in Argentina among three other projects covering 220,000 ha.

This ion exchange extraction technology delivers a solution for two rising demands - high purity battery materials to avoid performance issues, and more sustainable, responsibly sourced materials with low carbon footprint and significant ESG benefits.

| ||

|