Funding Facility

Funding Facility

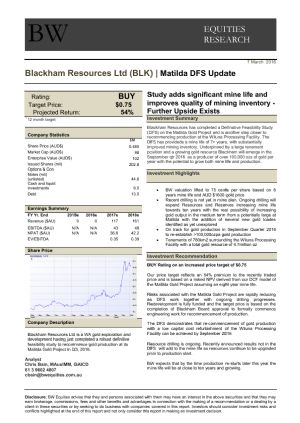

Perth, Aug 31, 2017 AEST (ABN Newswire) - Blackham Resources Ltd ("Blackham" or "the Company") ( ASX:BLK) (

ASX:BLK) ( BKHRF:OTCMKTS) yesterday released the successful results of the Expansion Preliminary Feasibility Study (PFS) on its 100% owned 6.2Moz Matilda & Wiluna Gold Operation ("Operation"). The PFS demonstrated robust economics, a large increase in reserves and improved economies of scale supporting the Operation's expansion. For further information please see ASX Announcement dated 30 August 2017 entitled "Wiluna Expansion PFS confirms robust economics for +200kozpa long mine life operation".

BKHRF:OTCMKTS) yesterday released the successful results of the Expansion Preliminary Feasibility Study (PFS) on its 100% owned 6.2Moz Matilda & Wiluna Gold Operation ("Operation"). The PFS demonstrated robust economics, a large increase in reserves and improved economies of scale supporting the Operation's expansion. For further information please see ASX Announcement dated 30 August 2017 entitled "Wiluna Expansion PFS confirms robust economics for +200kozpa long mine life operation".

Blackham is pleased to announce it has secured up to AU$72,000,000 in funds to continue to advance its Expansion Definitive Feasibility Study (DFS) and manage its balance sheet whilst it continues to demonstrate improving operational cash flows from the Operation. The funding arrangement is underpinned by the ability to draw up to AU$72,000,000 ("the Agreement") from The Australian Special Opportunity Fund, a New York-based institutional investor, managed by The Lind Partners (together, "Lind" and "Lind Facility").

The Company plans to utilise its operating cash flows to fund the Expansion but will also require a suitable funding solution. The Lind Facility provides the Company with time to choose the optimal funding solution. Blackham's final funding solution for the Operation's Expansion will ideally mean:

- the securing of a fully funded solution for the Expansion;

- minimising dilution to existing Blackham shareholders;

- providing flexible funding solutions to ensure continuation of exploration and reserve definition; and

- facilitating an increase in the Company's current hedge facilities to manage gold price risk.

Blackham's Managing Director, Bryan Dixon, stated, "As Blackham demonstrates strengthening production from its gold operations and pushes forward with the Expansion DFS, the Lind Facility gives the Company maximum flexibility in choosing the best future funding solution for shareholders to grow the Matilda-Wiluna Gold Operation into a 200,000ozpa long mine life asset. Lind Partners has long been a supporter of Blackham and we are pleased to have renewed our association with Lind."

Lind's Managing Director, Jeff Easton, said, "We have been following Blackham since Lind's first investment in 2012, shortly after it bought into the Matilda Gold Project and have seen them evolve from an explorer with a 300,000oz resource to a gold producer with a 6.2Moz resource and an impressive growth story. We are excited to return at this crucial point to fund Blackham and back management as they demonstrate the next chapter of their significant growth story."

Under the Agreement with Lind, Blackham will receive AU$1,200,000 on execution as a prepayment for fully paid ordinary shares in Blackham. Blackham has the ability to vary further monthly share subscriptions with Lind between nil and AU$3,000,000, over the next two years. Further key terms of the Agreement are detailed below.

The Expansion DFS is expected to be completed by the end of the Mar'18 quarter. The Company believes that the robust economics associated with the expansion and the discussions with potential financiers will allow financing to be gained on attractive financing terms. The Company has appointed a financing advisor who has begun engaging potential financiers with a view to re-sizing the current debt facility. The Company has received a number of expressions of interests in the financing of the Expansion plan. The Company plans to continue discussions with financiers in parallel to the completion of its Expansion DFS.

Key Aspects of the Lind Funding Agreement:

1. Maximum Flexibility

The terms of the Agreement expressly allow Blackham to carry out additional private placements of equity and debt funding facilities. In addition, the Agreement does not restrict the company's ability to enter into strategic industry partnerships. Blackham has the right to pause or terminate the Agreement at either no or minimal cost. As the Operation's production profile grows, Blackham has the flexibility to manage its funding requirements on a monthly basis, with a view of the gold price, feasibility and resource/reserve drilling requirements.

2. Certainty of access to funding at call

The facility provides Blackham with certainty of a flexible base level of funding over the next 24 months. The facility amount of up to AU$72,000,000 is to be made available to Blackham in tranches over 24 months. Shares can be purchased by Lind from Blackham, approximately monthly, which may be varied from nil to AU$3,000,000 by mutual consent, subject to compliance with the terms of the Agreement.

3. Minimising dilution

The structure of the investment allows Blackham to issue shares at prices that are linked to prices prevailing at the time, potentially at premiums to the current share price, minimising dilution for existing shareholders. The price at which shares will be issued is 90% of the average of the 5 daily VWAPs during the pricing period prior to the issuance of shares. On one occasion only, the conversion price may be 130% of the average daily VWAPs of the shares during the pricing period prior to the execution of the Agreement.

As part of the Agreement, Lind will be granted 2,000,000 options exercisable at 30.8 cents per share and will be issued 3,250,000 collateral shares that will be credited or returned at the end of the agreement. Blackham will also pay Lind a commencement fee, in Blackham shares, to the value of AU$200,000 as an offset to the initial tranche.

The Agreement contains provisions that may require the approval of shareholders as required under ASX Listing Rules 7.1 and 7.1A in the future. Shareholder approval is not required for the initial funding to proceed.

About Wiluna Mining Corporation Ltd

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:BLK) (

ASX:BLK) ( BKHRF:OTCMKTS) yesterday released the successful results of the Expansion Preliminary Feasibility Study (PFS) on its 100% owned 6.2Moz Matilda & Wiluna Gold Operation ("Operation"). The PFS demonstrated robust economics, a large increase in reserves and improved economies of scale supporting the Operation's expansion. For further information please see ASX Announcement dated 30 August 2017 entitled "Wiluna Expansion PFS confirms robust economics for +200kozpa long mine life operation".

BKHRF:OTCMKTS) yesterday released the successful results of the Expansion Preliminary Feasibility Study (PFS) on its 100% owned 6.2Moz Matilda & Wiluna Gold Operation ("Operation"). The PFS demonstrated robust economics, a large increase in reserves and improved economies of scale supporting the Operation's expansion. For further information please see ASX Announcement dated 30 August 2017 entitled "Wiluna Expansion PFS confirms robust economics for +200kozpa long mine life operation".  Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.