Investment and NTA Update

Sydney, Aug 11, 2020 AEST (ABN Newswire) - In light of Dawney & Co Ltd's ( NSX:DWY) performance since the quarterly report to 30 June 2020, the Board provide the following investment update to 10 August 2020.

NSX:DWY) performance since the quarterly report to 30 June 2020, the Board provide the following investment update to 10 August 2020.

At market close Monday, 10 August 2020, the unaudited pre-tax NTA per share was $0.18, a 49% increase on 30 June 2020.

The main contributors to this performance were Tesserent Ltd (TNT) +262%, Thorn Group Ltd (TGA) +72%, Consolidated Financial Holdings Ltd (CWL) +43%, AF Legal Group Ltd (AFL) +40% and Matrix Composites & Engineering Ltd (MCE) +9%. Subsequent to the 30 June quarter, we added to TNT and TGA and initiated positions in AFL and MCE.

Tesserent Ltd ( ASX:TNT)

ASX:TNT)

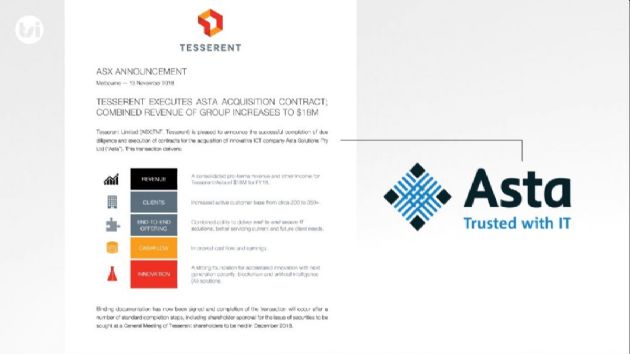

We began analysing TNT when it acquired the security assets from PS&C Limited and then Nth. Consulting Pty Ltd at the end of 2019.

The 10 December 2019 Nth acquisition announcement highlighted their "cyber360 and acquisition strategies" (the acquisition/roll up opportunity was intriguing).

At the beginning of 2020 the company appointed Geoff Lord as Chairman. In a shareholder letter on 14 January 2020 Mr Lord said, "Having built UXC, my former IT services business, into an $800 million revenue opportunity, I see potential for Tesserent to copy that trajectory in today's cybersecurity market".

Our initial investment in February was predominantly backing their ability to find, acquire and consolidate cyber services businesses. In June there was a well-reported cyber attack on government and private sector computer networks and the government responded with substantial cyber security initiatives, boosting most listed cyber security companies.

Having monitored each quarterly report since October 2019, we believed that TNT would achieve the $40 million revenue run rate to 30 June 2020 and that they would use the year end result to launch the company into the next 12 months, accordingly we added to our holding before the quarterly report was released.

On 20 July, the company announced it had achieved its FY2020 financial objective and had secured funding for future acquisitions (three that were well progressed). To date, one acquisition has been announced (Seer) and we await announcements on the other two. The stock has exceeded our initial expectations, but as time has gone by and management have demonstrated the ability to find and acquire businesses, we now see the potential for TNT to become a small cap darling; with massive government spending, the increasing requirement for cyber security, the "Covid-proof" nature of the sector and the technology/roll up premium the Australian market usually pays for companies that can deliver on their strategy.

AF Legal Group Ltd ( ASX:AFL) (

ASX:AFL) ( N1R:FRA)

N1R:FRA)

AFL's goal is to become Australia's first and largest National Family Law Firm.

AFL released their FY20 Investor Presentation on 10 August 2020, which summarises the opportunity and digital marketing strategy well. Since listing in June 2019 the company has executed on its growth objective organically and through lateral hires and acquisitions.

As evidenced by AFL's case file numbers, the family law sector is growing and largely unaffected by the Covid/economic fallout. We are keen to see what the Board and management team can do and believe our relatively fast investment gain is only the beginning.

Matrix C & E Ltd ( ASX:MCE)

ASX:MCE)

We have followed MCE for a while, as a number of value investors are shareholders. On 24 July 2020 the company announced a strategic review in response to the depressed oil and gas conditions. MCE had net cash of $14.7m versus the $16.4m market cap that we paid for our shares. We thought this was a fairly good entry point into a potential corporate situation.

This recovery has offset most of the Horizon Oil (HZN) loss that materially impacted our NTA in the first two quarters of this calendar year. We have sold down a portion of our HZN holding to reduce it's weighting in the portfolio, realising capital losses.

Moving forward, although we are cautious about market valuations and the state of the real economy, we continue to assess value focused and situational opportunities. We have also commenced to seek out opportunities in what we deem to be "covid/recession-proof" businesses, such as our investments in TNT (cyber security) and AFL (family law).

In the short term, we look forward building our cash reserves with capital returns from both CWL and 8IP Emerging Companies Ltd (8EC). The CWL 11cps capital return EGM is set for 31 August with payment planned for 8 September. 8EC announced a further capital return of 2cps, in addition to the previously received 5cps, to be paid today, 11 August.

Finally, we are in the process of finalising our FY2020 accounts, which will review a difficult period for our company. However, Dawney & Co is in now in far better shape than it was 6 months ago and, feeling like we have turned a corner, are excited about future prospects (not to dismiss the many possible corners ahead of us).

Contact

Mitch Dawney

Managing Director

Dawney & Co Limited

E: mdd@dawneyco.com.au

| ||

|