Kingsrose Mining Limited (ASX:KRM) Lodged Annual Report For The Year Ended 30 June 2010

Perth, Sep 23, 2010 AEST (ABN Newswire) - Kingsrose Mining Limited ( ASX:KRM) lodged its Annual Report for the year ended 30 June 2010 with the ASX.

ASX:KRM) lodged its Annual Report for the year ended 30 June 2010 with the ASX.

It is evident that great progress has been made over the past 12 months with the highlight being the all important transition of Kingsrose Mining into the ranks of low-cost gold producers shortly after the end of the financial year.

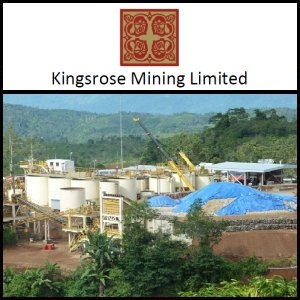

The move from explorer and project developer to producer was achieved in mid-August with the pouring of the four bars of dore, a mix of gold and silver, weighing a total of 5.9 kilograms, at the Way Linggo mine on the Indonesian island of Sumatra. The Company is now ensuring a ramp-up to full capacity and the niggling hindrances of achieving full productivity are being dealt with, including plant modifications that will resolve issues caused by the 'sticky' fine clay ores.

John Morris stated "The focus now is to steadily expand production of the project to its initial target of 45,000 ounces of gold annually at a cost of US$147 an ounce, more than US$1100 an ounce less than the current price of gold, making Way Linggo one of the world's lowest cost gold mines".

Recent exploration success close to the Way Linggo mine provides some confidence in believing that this is just the start for the project. As results from the field come to hand they will be released but it is significant to note that two recent discoveries along strike from the mine are showing evidence of gold-rich epithermal veins similar to the original mine-site discoveries.

With cash flow starting from gold production it will be possible to allocate additional funds for the exploration effort in a gold-rich geological setting.

Re-shaping Kingsrose over the past year has seen the Company make a satisfactory exit from its investment in the Comet Vale joint venture with capital liberated from that project re-invested in Way Linggo and the base metal project in Sardinia.

Mr. Morris explained "Details of what has been achieved at Way Linggo are contained in the Directors' Report but essentially we have successfully commissioned the 140,000 tonne per annum process plant, extended the internal workings of the mine, stockpiled sufficient ore on the surface and completed ample underground development work to ensure nearly 12-months of mill feed".

At the time of the first gold pour there was a stockpile of 25,700 tonnes of ore on the surface, assaying 18.3 grams of gold to the tonne, plus 214 grams a of silver, the equivalent of 3.65 grams of gold. This ore has been extracted as part of development mining and comes from the previously reported JORC compliant measured and indicated resource.

In Sardinia, work continues on the Sarinc zinc tailings project. The current focus is on drilling and assaying historic tailings dams, and in working through technical and other issues with government authorities.

In review, the past year has seen Kingsrose position itself as a low-cost gold and silver producer with excellent exploration prospects which should underwrite future expansion.

Financial Results

The Group's net loss for the year after tax was A$1,737,171 compared to a loss of A$5,562,362 in the previous year. The significant improvement in the Group's net loss position was primarily due to a gross profit from the Comet Vale project in 2010 of A$5,136,732 as compared to a loss in 2009 of A$940,320. A gain was also made on the disposal of that Project in May 2010 of A$3,181,889.

Exploration & Development

At the Way Linggo Project, mine properties and development totalled A$22,469,879 for the financial year (2009: A$7,012,335) and exploration and evaluation assets totalled A$1,558,196 (2009: A$7,408,883) whilst capitalised expenditure process plant construction, power supply, mining equipment, mobile fleet and various infrastructure totalled A$8,465,573 (2009: A$2,457,885).

Return to Shareholders

Year ended EPS (cents) Share Price 2008 (17.40) A$0.25 2009 (4.20) A$0.37 2010 (3.18) A$1.04

The improvement in the return to shareholders is reflected through the basic earnings per share that has improved over the past three years and we are confident that the favourable movement in share price will continue.

Contact

John Morris

Kingsrose Mining Limited

Tel: +61-8-9486-1149

Fax: +61-8-9486-1151

Email: info@kingsrosemining.com.au

http://www.kingsrosemining.com.au

| ||

|