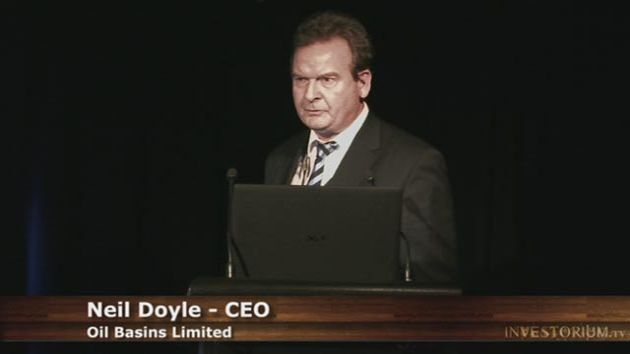

Cyrano Oil Field R3/R1 Independent Review Confirms Significant Increase in Barrow Group Resources

Melbourne, Dec 18, 2012 AEST (ABN Newswire) - The directors of Oil Basins Limited ( ASX:OBL) are pleased to make the following ASX and Media Announcement.

ASX:OBL) are pleased to make the following ASX and Media Announcement.

OBL holds 100% of Retention Lease R3/R1 in the offshore Carnarvon Basin (Figure 1). The lease covers approximately 80 km2 in relatively shallow water (~15m) - refer to Figure 1.

There are four wells in the permit: Cyrano-1 and Cyrano-2, Fennel-1 and Lindsay-1. The two Cyrano wells define an oil field containing heavy biodegraded oil (22.8 degree API) with a relatively high oil viscosity (3.95 cp) within Mardie Greensand and Barrow Group reservoirs. The majority of recoverable oil is contained within Barrow sandstones with good (porous and permeable) reservoir properties for oil production while gas occurs mostly within the overlying Mardie Greensand which has marginal reservoir properties.

The oil at Cyrano-1 is the same as that recovered from the Nasutus Oil Field (defined by the Nasutus-1 and Nares-1 discoveries in adjacent Retention Lease R5) that extends into the R3/R1 lease from the north. Fennel-1 and Lindsay-1 have only minor hydrocarbon shows.

KEY POINTS:

- A new independent resource assessment was conducted by 3D-Geo Pty Ltd (3D-Geo) for Oil Basins Limited (OBL) to define the resources in the Cyrano and Nasutus oil fields in the R3/R1 lease

- The study was comprehensive and encompassed new petrophysical evaluation of wells, identification of oil and gas pay, stratigraphic correlation, reservoir characterization and petroleum reservoir engineering with seismic interpretation, mapping and depth conversion of 3D seismic data within the R3/R1 Lease and adjacent areas.

- An important result was re-assignment of the Airlie Sandstone interpreted at Cyrano-1 and Cyrano-2 to the Barrow Group. Stratigraphic correlation with Nasutus-1 which was almost fully cored and its reservoir properties analysed, now suggests that this important reservoir unit is instead part of an Upper Barrow Group transgressive sequence with much better reservoir properties than previously assigned.

- Interpretation and mapping differ from those of the former operator and previously published geophysical work. The mapping indicates that the Barrow reservoir oil resources over Greater Cyrano are split into three (3) discrete oil pools comprising: Cyrano Central, Cyrano East and Cyrano West.

- Additional oil resources are contained in the extension of the Nasutus Oil Field into the R3/R1 Lease area from the northeast.

- The assessment resulted in a 105% increase of the Contingent (2C) P50 resource in the Cyrano and Nasutus oil fields within Barrow Group reservoirs to 1.09 MMbbls.

- Exploration upside in the Barrow reservoir has been delineated in the newly defined Elimia Prospect (previously defined as part of the Cyrano Oil Field) which is located on-trend and up-dip west of Greater Cyrano.

- The Contingent plus Probable (1C plus 1P) P90 oil resource in the Barrow reservoir for Cyrano, Nasutus and Elimia is now assessed as 1.19MMstb while the (2C plus 2P) P50 is now assessed as 2.02 MMstb.

- This work relates to Barrow reservoirs only and excludes possible additional contingent resources in the overlying Mardie Greensand reservoir.

- OBL believes that improved booked resources coupled with good reservoir properties in the Barrow Group sandstones are likely to lead to a de-risking of the preferred development method of this marginal oil field via utilisation of a stand-alone Extended Production Test (EPT) and modern development and completion technologies including deployment of a Mobile Offshore Production Unit (MOPU).

Previous Work by OBL during 2011

Immediately upon transfer of the title to OBL in March 2011, OBL commissioned an independent review of the Cyrano Oil Field (OBL, 2011)*. This resulted in a booked 1C, 2C, 3C contingent resource for combined Mardie Greensand and Airlie/ Barrow Sandstone reservoirs based upon an estimated conservative recovery factor (RF) of 15% as shown in Table 1. The reservoir splits underlying these assessed contingent resources are shown in Table 2.

* Refer to the OBL ASX Announcement dated 2 April 2011

------------------------------------------- Contingent Resources - Oil (MMstb)-------------------------------------------ReservoirHorizon 1C 2C 3C-------------------------------------------Mardie/Airlie/Barrow 0.55 1.57 3.80-------------------------------------------

Table 1: Cyrano Oil Field combined contingent oil resource (OBL, 2011)

-------------------------------------------------------------------- Contingent Resources - Oil Contingent Resources - Raw Gas (MMstb) (Bscf)--------------------------------------------------------------------ReservoirHorizon 1C 2C 3C 1C 2C 3C--------------------------------------------------------------------MardieGreensand 0.37 1.04 2.60 1.16 2.29 4.38--------------------------------------------------------------------Airlie/Barrow 0.18 0.53 1.20 0.08 0.27 0.85--------------------------------------------------------------------

The 2011 assessment found that the Mardie Greensand contained most (>60%) of the combined contingent resource. This was consistent with the view of the former operator. The Mardie Greensand also contained the majority of the raw gas resource.

This assessment indicated that the Mardie Greensand unit is a relatively tight reservoir unit. Consequently the independent expert concluded that development wells would need to be produced with very low pressure-drawdown to delay gas or water break-through and recommended against deployment of electric submerged pumps.

After renewal of the Retention Lease in early October 2011, OBL commissioned drilling engineers Du-El Drilling Services Pty Ltd (Du-El) to prepare a Development Scoping Report for development of the Cyrano Oil Field to ascertain what would be required to develop the field economically as a standalone project.

The key recommendation of the Du-El study was that the best option for a standalone, low-cost development (the Basic Concept) was an Extended Production Test (EPT). The EPT would be operated either from a central Hub or as series of EPT's using functional removable and re-deployable equipment.

The first phase of development called for the use of horizontal wells using modern Electric Submersible Progressing Cavity Pumps (ESPCPs) to increase production rates of the heavy oil in the low pressure reservoirs. In addition, Du-El indicated that recovery factors (RFs) would be considerably improved if horizontal extended reach drilling (ERD) technology, combined with the ESPCPs and using both gas and water injectors were utilized.

Du-El concluded that the most cost effective development would be using a Jack-up Rig or Barge with a modular rig to drill and production test with ERDs an approximate 1000 m horizontal section of the wells, possibly producing to an un-manned Jack-Up Storage Barge. For this initial phase of the development Du-El recommended a smaller Barge be mobilised in order to reduce the EPT operating costs. Bringing in a Jack-up Storage Barge with the capacity of 60,000 barrels would in addition reduce the costs of a Floating Storage and Offloading (FSO) vessel on site full-time.

Refer to the comprehensive OBL ASX Announcement dated 26 October 2011.

The final report was received by OBL in June 2012. It indicated that marginal oil fields such as Cyrano could be produced economically with properly sized mobile equipment and modern completion technologies. Du-El recommended that a further comprehensive assessment of the Cyrano oil reservoirs be undertaken to high-graded potential development zones with better reservoir properties to be drilled. This would assist the deployment of the ESCPs.

New Work by OBL

Encouraged by the key findings of the Du-El Scoping Report, OBL commissioned a new independent engineering evaluation of R3/R1 by 3D-Geo in late August 2012.

The scope of work aimed at examining all available geological, geophysical and engineering data to comprehensively reassess the recoverable hydrocarbon potential of R3/R1. The data set included the well data in R3/R1 and nearby oil fields and recently acquired new data including the Flinders 3D Seismic Survey now on public file in its entirety.

This work encompassed:

- Remapping (in TWT) of the Flinders 3D Seismic Survey.

- Depth conversion using seismic velocities tied to wells.

- Stratigraphic re-evaluation.

- Correlation of well stratigraphy.

- Wireline log evaluation (petrophysics) with net pay (oil and gas) identification.

- Reserve estimation with Contingent and Probable resource allocation in accordance with SPE-PRMS Guidelines (see Appendix 2).

- Petrophysical reservoir characterisation.

- Monte Carlo simulation performed in Petrel across a range of key reservoir variables in the assessment of each resource category using 500 simulations performed per data point.

- All Barrow Group RF assessments assuming water injection. The low case assumes relatively cheap vertical wells and the medium and high cases assume deployment of ESPCPs and in addition the medium case assumes short reach horizontals and the high case assumes long reach horizontals by ERD. In addition, there is presently un-assessed scope for deployment of gas-lift sourced from raw gas from the shallower Mardie Greensand.

One of the important findings of the evaluation was recognition of the Barrow Group reservoir as the principal oil reservoir in both the Cyrano and Nasutus oil fields. Stratigraphic correlation of Cyrano-1 and Cyrano-2 with Nasutus-1 (which was almost fully cored and palynology for age dating defined and its reservoir properties analysed for porosity and permeability) now suggests that the Airlie Sandstone (as previously defined) is likely to be part of an Upper Barrow Group transgressive sequence with much better reservoir properties than previously assigned.

Seismic Interpretation and mapping differ from those of the former operator and previously published geophysical work. The new mapping indicates that the Barrow reservoir oil resources over Greater Cyrano are split into three (3) discrete oil pools: comprising Cyrano Central, Cyrano East and Cyrano West delineated by two wells Cyrano-1 and Cyrano-2. Additional oil resources are contained in the extension of the Nasutus Oil Field into the R3/R1 Lease area from the northeast (Figures 2 and 3).

Exploration upside in the Barrow reservoir has been delineated in the newly defined Elimia Prospect (previously part of the Cyrano Oil Field) which is located on-trend and up-dip west of Greater Cyrano.

Principal findings of the 3D-Geo independent review are:

- Interpretation and mapping of the Flinders 3D Seismic Survey coupled with new petrophysics has confirmed that most of the recoverable oil resources in R3/R1 are contained in the Barrow Group reservoir.

- The Mardie Greensand with its poor reservoir properties may not contribute significantly to overall reserves - addition work is required to better define its potential.

- The Airlie Sandstone at Cyrano is now correlated with the upper part of the Barrow Group.

- New petrophysical and engineering studies and correlation with core from Nasutus-1 suggests much better reservoir properties in the Barrow reservoir (which includes the Airlie Sandstone as previously defined) are expected at Greater Cyrano, the Elimia Prospect and the Nasutus Oil Field than previously considered.

- The oil recovery factor of the Barrow Group sandstones has been assessed at being similar to the former operator (P50 oil RF = 30%) and double that of the previous 2011 study (P50 oil RF = 15%).

- Recovery Factors for the Barrow Group (Airlie / Barrow) have been re-estimated as follows:

-- Low 17%

-- Medium 30%

-- High 45%

- The present 3D-Geo view is that the tight zone between the Mardie and Airlie probably acts as least as a production barrier or is possibly a seal. Consequently, the oil in the highly permeable Barrow Group is geologically isolated from the overlying Mardie gas-cap. The Barrow gas-cap is likely to be small and have little adverse impact on oil recovery from the underlying Barrow reservoir.

- The previous assessment (OBL, 2011) treated the Airlie and Top Barrow reservoirs oil in an oil rim with reservoir characteristics and recovery factors similar to those of the Mardie Greensand.

- This work relates to the Barrow reservoirs only and excludes possible additional Contingent and Probable resources in the overlying Mardie Greensand reservoir.

Summary of Assessed Resources - Barrow Group

The previously assessed booked 1C, 2C, 3C contingent resources attributable to the Airlie/Top Barrow Sandstone (re-defined as Barrow Group reservoir by 3D-Geo) in the Cyrano Oil Field are found in Tables 1 and 2.

Cyrano Central (Cyrano-1 discovery)

The new 3D-Geo assessment of contingent resources within R3/R1 is presented in Appendix 1 (Table 8). With respect to the Cyrano Central (Cyrano-1 discovery) the assessed contingent resources within the prognosed productive Barrow reservoir is presented in Table 3.

All assessments assume a 60/40 split or oil fill versus gas fill as suggested by Cyrano-1.

When excluding contingent resources in the Mardie Greensand, this new assessment for the Barrow reservoir in Cyrano Central increases 2C contingent resources by 43% from 0.53 MMstb to 0.76 MMstb.

------------------------------------------ Cyrano Central Contingent Resources - Oil (MMstb)------------------------------------------ReservoirHorizon 1C 2C 3C------------------------------------------Barrow 0.48 0.76 1.00------------------------------------------

Table 3: Cyrano Central Contingent oil resources

Nasutus Extension

This is the first assessment of the Nasutus Extension into R3/R1 from neighbouring Permit TP/7 (2) and Retention Lease R5 (Figure 1). Excluding potential Mardie Greensand Contingent resources, 3D-Geo assessed 1C, 2C, and 3C Contingent resources within the highly productive Barrow Group are shown below in Table 4.

When including the Nasutus Extension, the booked 2C contingent resources within the Barrow reservoir increased by 105% from 0.53 to 1.09 MMstb (Table 8).

------------------------------------------ Nasutus Contingent Resources - Oil (MMstb)------------------------------------------ReservoirHorizon 1C 2C 3C------------------------------------------Barrow 0.20 0.33 0.49------------------------------------------

Table 4: Nasutus Contingent oil resources.

Greater Cyrano Oil Field

Overall risked Greater Cyrano Oil Field (Cyrano Central, Cyrano East and Cyrano West) Probable resources within the Barrow reservoir are shown in Table 5.

------------------------------------------ Greater Cyrano Probable Resources - Oil (MMstb)------------------------------------------ReservoirHorizon 1P 2P 3P------------------------------------------Barrow 0.79 1.38 2.01------------------------------------------

Table 5: Greater Cyrano Probable oil resources.

Elimia Prospect

The new Elimia Prospect mapped by 3D-Geo has some 35 m of vertical closure. Risked Probable resources within the Barrow reservoir are shown in Table 6.

------------------------------------------ Elimia Prospect Probable Resources - Oil (MMstb)------------------------------------------ReservoirHorizon 1P 2P 3P------------------------------------------Barrow 0.20 0.31 0.49------------------------------------------

Table 6: Elima Prospect Probable oil resources

Overall Barrow Group Contingent and Probable Resources contained within R3/R1

The 3D-Geo independent resource assessment of the overall Barrow reservoir for Contingent and Probable resources contained within R3/R1 is shown in Tables 7 and 8.

These reserve numbers do not consider (exclude) possible additional Mardie Greensand Contingent and Probable resources.

------------------------------------------------- R3/R1 Total Contingent & Probable Resources - Oil (MMstb)-------------------------------------------------ReservoirHorizon P90 P50 P10-------------------------------------------------Barrow 1.19 2.02 2.99-------------------------------------------------

Table 7: R3/R1 total Contingent and Probable oil resources

Impact of New Assessment

The Directors of OBL believe this new independent study, with the primary focus on assessing the possibility of high-grading recoverable resources within the highly productive Barrow Group, to be a major upgrading of the Cyrano Oil Field for possible development. Subject to further reservoir simulation studies planned in 2013, this should greatly enhance the ability of early development of this marginal oil field via the preferred development option of an Extended Production Test (EPT) and a stand-alone development (refer to OBL ASX Release dated 26 October 2011).

- New petrophysical studies and correlation with core from Nasutus-1 suggests much better reservoir properties in the Barrow reservoirs at Cyrano than previously contemplated. Reservoir properties and hence the recovery factor for the Barrow Group are significantly greater than previous assessments.

- The 3D-Geo independent resource assessment for the stand-alone Cyrano Central (Cyrano-1 discovery) of the Barrow oil pool increased 2C contingent resources 43% from 0.53 to 0.79 MMstb. Inclusion of the Nasutus Oil field extension increased 2C contingent resources by 105% from 0.53 to 1.09 MMstb.

- Excluding possible additional contingent resources in the Mardie Greensand, the 3D-Geo resource assessment of the overall Barrow reservoir (combined contingent plus probable resources) for P90, P50 and P10 cases contained within the R3/R1 Lease was assessed at 1.19, 2.02 and 2.99 MMstb respectively.

- In OBL's opinion, the improvement in reservoir combined with the resource increase has made it possible to consider a much simpler first stage EPT development program focused initially on Cyrano Central. This could use cheaper vertical wells fitted with modern ESPCPs that can handle associated gas.

- All new Barrow reservoir Recovery Factor (RF) assessments assume water injection. The low case assumes relatively cheap vertical wells while the medium and high cases assume deployment of ESPCP's. The medium case assumes short-reach horizontals and the high case assumes long-reach horizontals by ERD. In addition, there exists un-assessed scope for deployment of gas-lift using gas sourced from the shallower Mardie Greensand unit.

- OBL believes that improved booked resources coupled with good reservoir properties in the Barrow Group reservoir sandstones are likely to lead to a de-risking of the preferred development method of this marginal oil field. This would involve a stand-alone EPT with modern development and completion technologies including the potential for a possible deployment of a modern Mobile Offshore Production Unit (MOPU).

- Oil Basins believes that this study has de-risked previous reservoir uncertainties at Cyrano Central. This will greatly assist in concept planning for an initial multi-staged EPT oil development using Cyrano Central as a potential Hub location. In addition, the study has defined the upside incremental recoverable resources potential of the field extensions and a prospect.

View the complete Oil Basins announcement including Tables and Figures at the link below:

http://media.abnnewswire.net/media/en/docs/ASX-OBL-383936.pdf

Contact

Oil Basins Limited

T: +61-3-9692-7222

F: +61-3-9529-8057

WWW: www.oilbasins.com.au

| ||

|