Strategic expansion into the Cooper and Otway Basins

Brisbane, Dec 22, 2025 AEST (ABN Newswire) - Central Petroleum Limited ( ASX:CTP) (

ASX:CTP) ( C9J:FRA) (

C9J:FRA) ( CNPTF:OTCMKTS) has entered into binding Sale and Purchase Agreements (SPAs) with ADZ Energy (ADZ) to secure a strategic multi-basin expansion into highly prospective conventional exploration permits in the onshore Otway and Cooper Basins. The transaction involves three to four near-term exploration wells planned for drilling over 2026 and early 2027, along with significant ongoing growth opportunities through other oil and gas prospects as the permits are matured.

CNPTF:OTCMKTS) has entered into binding Sale and Purchase Agreements (SPAs) with ADZ Energy (ADZ) to secure a strategic multi-basin expansion into highly prospective conventional exploration permits in the onshore Otway and Cooper Basins. The transaction involves three to four near-term exploration wells planned for drilling over 2026 and early 2027, along with significant ongoing growth opportunities through other oil and gas prospects as the permits are matured.

The key terms of the transaction are:

- Central to acquire a:

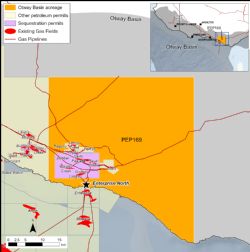

o 20% interest in the Victorian exploration permit PEP169 in the onshore Otway Basin where extensive seismic surveys have identified, among other substantial conventional prospects, the highly prospective Enterprise North ("EN") gas target. The EN exploration well (to become a production well on success) is scheduled to be drilled in mid to late 2026; and

o 49% interest in 24 South Australian Retention Leases (PRLs) and exploration permit PEL677 in the prolific Cooper Basin, where extensive seismic surveys have identified, among other substantial conventional oil and gas targets, eleven priority oil leads, with two to three exploration wells (to become production wells on success) scheduled to be drilled in late 2026 / early 2027.

- Consideration for the acquisition:

o $9.2m upon completion plus Central's participating interest share of specified back-costs;

o $3.9m success payment conditional on commercial success from the planned exploration well at EN; and

o A 5% royalty on future production from Central's 49% interest in the Cooper acreage.

- ADZ to continue as operator.

- Completion of the Sale and Purchase Agreements is conditional on consent from Central's financier and ADZ obtaining certain security releases, by 16 January 2026.

Onshore Otway - PEP169 - Enterprise North

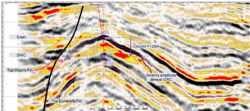

The Otway Basin in Victoria has a long history of delivering significant discoveries, both onshore and offshore. The primary target is the Waarre Formation, a high-quality sand with world-class porosity and productivity.

PEP169 contains the EN prospect, one of the most prospective onshore targets in Australia. EN is mapped on seismic as a fault block immediately to the north of the Enterprise gas field, discovered in 2020.

The Enterprise field, now producing into the Victorian gas market, is interpreted to spill into the EN structure. EN has seismic amplitude support at the Waarre A and Waarre C horizons. Significantly, all recent Waarre Formation discoveries in the Otway (onshore and offshore) are amplitude supported, including Annie-1 (2019), Enterprise-1 (2020), Artisan-1 (2021) and Essington-1 (2025). Notably, Amplitude Energy reported a 94% success rate across 17 amplitude supported exploration wells in the offshore Otway. Drilling targets, supported by seismic amplitudes, are also the subject of ongoing and upcoming drilling campaigns in the offshore Otway being conducted by Conoco Philips, Beach Energy and Amplitude Energy.

EN is ideally located within the high value Victorian gas market, and land access has been secured close to existing pipelines and three existing processing facilities (Iona, Otway and Athena Gas Plants). Given the high historic success rates in the area, the EN well will be designed as a production well, enabling rapid delivery of gas to market in a success case.

Consequently, only minimal wellhead facilities will be required to bring the gas online. If successful, Central's upfront acquisition cost is expected to be around $1/GJ (based only on anticipated EN volumes), which is very attractive relative to east coast gas prices. Further, Central's equity gas production rates are anticipated to almost double (upon first gas) in an EN success case.

Beyond EN, PEP169 also has significant running room for further growth with 18 further conventional prospects and leads identified, including several significant amplitudesupported targets in close proximity to infrastructure.

Cooper Basin - 24 PRLs & PEL677 - Cooper Consolidated JVs

The Cooper Basin is a mature and well-established petroleum province with numerous historic and recent discoveries. The Cooper Consolidated acreage, comprising 24 Retention Leases (PRLs) and exploration permit PEL677, covers a large portion of the basin and is relatively underexplored, with the PRLs only recently coming out of suspension in 2025. The acreage sits around, and is proximal to, multiple existing conventional discoveries, both gas and oil fields.

Significantly, much of the acreage has good seismic coverage via a combination of prior 2D and 3D surveys.

To date, 17 prospects and leads have been identified, with at least seven prospects considered drill-ready (potentially only requiring seismic reprocessing to mature). The initial focus of the Cooper Consolidated JVs will be on the higher value oil and gas targets, with plans to select two to three priority exploration targets to drill by early 2027. In a success case, Central's acquisition cost is expected to be less than $1/boe (based on the three priority targets) which is very attractive given the proximity to oil and gas pipelines and export facilities. Further, just one oil discovery could substantially increase Central's equity liquids production rates.

Importantly, discoveries in the Cooper Basin can quickly be brought online via a network of existing gas pipelines accessing the high value east coast gas market, and existing oil pipelines and trucking corridors to established refineries and port facilities.

Statement from Leon Devaney, CEO of Central Petroleum

This strategic acquisition marks a pivotal moment for Central Petroleum, shifting us from a single-basin producer focused on the Northern Territory market to a dynamic, multi-basin E&P company with immediate oil and gas drilling prospects and substantial long-term growth opportunities. Most importantly, this move gives us direct access to the high-value east coast gas market.

The partnership with ADZ is an exciting one. They are a nimble, low-cost, onshore explorer with strong technical expertise, making them an ideal partner for us. With several exploration wells in the near term, a successful outcome at any of these would significantly de-risk our permits and deliver a step-change in both production and cash flow.

In recent months, we've made several significant strategic moves to elevate Central's position in Australia's evolving energy landscape. We've secured a binding letter of intent with Power and Water Corporation with conditional gas supply term sheets which the parties intend on converting to binding Gas Sales Agreements that will significantly boost our production and secure long-term offtake for firm production through 2034. Additionally, our conditional agreement with Georgina Energy will reduce our exposure to sub-salt exploration costs in the Southern Amadeus Basin while retaining the significant upside associated with sub-salt helium exploration.

Now, with this acquisition, we will expand our footprint into two proven onshore basins with low-cost, near-term drilling opportunities. These assets give us excellent access to the east coast gas market and provide significant potential for future growth.

Looking ahead to 2026, we're excited for what's to come. Over the next 18 months, we plan to drill four production wells across Mereenie and Palm Valley and participate in up to five high-impact exploration wells including Enterprise North, the Cooper Basin, and Jacko Bore/Mt Kitty (via Georgina Energy). We are clearly entering one of the most impactful periods in Central's history.

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/Y2O450RO

About Central Petroleum Limited

Central Petroleum Limited (

Central Petroleum Limited ( ASX:CTP) is an established ASX-listed Australian oil and gas producer (ASX:CTP) with exploration and appraisal permits in the Northern Territory (NT). Central has grown to become the largest onshore gas operator in the NT, supplying residential and industrial customers in the NT and wider Australian east coast market.

ASX:CTP) is an established ASX-listed Australian oil and gas producer (ASX:CTP) with exploration and appraisal permits in the Northern Territory (NT). Central has grown to become the largest onshore gas operator in the NT, supplying residential and industrial customers in the NT and wider Australian east coast market.

Central is seeking to become a major domestic energy supplier, in addition to helium and naturally occurring hydrogen, with exploration, appraisal and development plans across 169,112 km2 of tenements the NT, including some of Australia's largest known onshore conventional gas prospects in the Amadeus Basin.

| ||

|