ABM Secures Funding Facility from ANZ for Stage Two Mining

ABM Secures Funding Facility from ANZ for Stage Two Mining

Perth, July 29, 2013 AEST (ABN Newswire) - ABM Resources NL ( ASX:ABU) has signed a commitment letter for a back-up and stand-by funding facility (the "facility") from the Australia and New Zealand Banking Group (

ASX:ABU) has signed a commitment letter for a back-up and stand-by funding facility (the "facility") from the Australia and New Zealand Banking Group ( ASX:ANZ).

ASX:ANZ).

With ABM's staged and low capital cost approach for the development at the Old Pirate High-Grade Gold Project, the Company does not require conventional large project financing. However, in order to give the Company maximum flexibility through the vagaries of market conditions the Directors have considered it prudent to secure a stand-by facility. The Company was approached by several senior financial institutions and considered that the ANZ proposal presented the lowest cost and greatest flexibility. The facility is subject to, amongst other conditions, the completion of final due diligence by ANZ, execution of final facility documentation, and receipt of CLC approval for the granting of certain securities under the facilities. The principal details of the facility are listed below.

- A two Tranche Senior-Ranking Facility:

- Tranche 1: $5M facility. Whilst available upon finalisation of all documentation and receipt of all relevant approvals and authorisations, this facility is to be supported by a minimum cash balance held by the Company until successful completion of the Stage One trial mining and processing.

- Tranche 2: Up to $10M available upon granting of the Mineral Lease and decision to proceed with Stage Two mining to refinance Tranche 1 and provide funding for

Stage Two.

- Final maturity date of March 2015.

- A Performance Bond Facility:

- $3M facility to replace ABM's current and future environmental bonding requirements.

- Returns existing bonds back to the Company's available cash.

ABM has been able to secure competitive pricing on the facilities, reflecting the short term of the facilities and underlying aspects of the project.

Darren Holden, Managing Director of ABM Resources said, "ABM is very pleased that such a major and well respected banking group, with a strong technical team and excellent history in resource banking has agreed to offer ABM this back-up facility. ABM remains in a strong cash position and the trial mining and processing is fully funded from our current cash on hand. However, given the recent volatility in gold prices and uncertainty in market conditions the Company considers it part of a risk management strategy to put a facility in place to account for any future changes in conditions."

With the sharp down-turn in gold prices in April 2013, ABM re-adjusted all of its long-term budget workings to a base case assumption of AUD$1200 per ounce gold price. Upon completion of the Stage One trial mining and processing the Company will move to purchase several items which are rented in Stage One including the accommodation village, fuel tanks and power generation plants as well as possibly purchasing its own mining fleet (as opposed to contract mining). The Company considers the ANZ facility as a back-up in the event of significant changes in market conditions and for capital purchases. The facility could also be used to rapidly increase the processing capacity at Old Pirate. On completion of the Stage One trial mining and processing (for which the Company is already fully funded) the Company will determine the optimal mining and processing rate at Old Pirate and whether drawdown of the facility is required. If drawn down, Tranches 1 and 2 incur an interest rate of 3% above the BBSY* and the Performance Bond Facility incurs a flat interest rate of 1%.

*BBSY is the Bank Bill Swap Rate, currently ~2.6%

About Old Pirate

The Old Pirate Trend consists of a series of gold-bearing quartz veins over a 1.8 kilometre strike length, consisting of 3 distinct vein clusters of mineralisation named Old Pirate, Old Glory and Golden Hind deposits. Gold mineralisation is hosted primarily within narrow quartz veins of between 20 centimetres and 6 metres in width. Mineralised zones are up to 40 metres in width and consist of multiple veins hosted primarily within sedimentary shale horizons which are part of a turbidite sequence (interbedded sandstone and shales). Structurally the turbidite sequence has been folded into a faulted anticline.

The Old Pirate Gold Deposit has a total uncut mineral resource estimate of 1.88Mt averaging 11.96g/t gold for 723,800 ounces (refer Appendix 1) and has a number of key advantages compared to other projects in Australia. Firstly, metallurgical test work indicates that up to 97% of gold can be recovered from low cost / low capital expenditure gravity processing methods (refer release dated 05/09/2012).

Secondly, there is abundant high-grade gold observed in multiple quartz veins extending from surface to depths of greater than 200m. The project has a high coarse-gold content (statistical nugget effect) resulting in a high variability of grade between samples. By trialling multiple techniques, the Company has established that the collection of larger sample sizes results in a generally higher grade assay. This sampling effect is typical in coarse gold systems where drilling generally under-calls the overall grade.

As a result, the Company is not undertaking the standard feasibility study process involving detailed desktop studies and drilling, but is instead conducting a staged approach to development where the trial mining (bulk sampling) forms a key part of determining the costs and feasibility of a full-scale mine, and allows for ongoing 'in-mine' exploration. The trial mining involves installation of a gravity gold plant that will be used and expanded in the subsequent stages.

The staged process takes advantage of the low engineering risk at Old Pirate and allows the Company to keep up-front capital expenditure to a minimum. The objective is for each stage of development to be profitable with quick payback periods, and to provide the capital required for the subsequent stages from cash flow.

ABM is well capitalised to achieve its milestones in 2013.

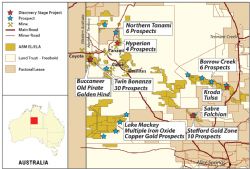

To view the project location map, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-ABU-643093.pdf

About ABM Resources NL

ABM Resources (ASX:ABU) is developing several gold discoveries in the Central Desert region of the Northern Territory of Australia. The Company has a multi-tiered approach to exploration and development with a combination of high-grade production scenarios such as the Old Pirate High-Grade Gold Project, large scale discoveries such as Buccaneer, and regional exploration discoveries such as the Hyperion Gold Project. In addition, ABM is committed to regional exploration programs throughout its extensive holdings including the alliance with Independence Group NL at the regional Lake Mackay Project.

ABM Resources (ASX:ABU) is developing several gold discoveries in the Central Desert region of the Northern Territory of Australia. The Company has a multi-tiered approach to exploration and development with a combination of high-grade production scenarios such as the Old Pirate High-Grade Gold Project, large scale discoveries such as Buccaneer, and regional exploration discoveries such as the Hyperion Gold Project. In addition, ABM is committed to regional exploration programs throughout its extensive holdings including the alliance with Independence Group NL at the regional Lake Mackay Project.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:ABU) has signed a commitment letter for a back-up and stand-by funding facility (the "facility") from the Australia and New Zealand Banking Group (

ASX:ABU) has signed a commitment letter for a back-up and stand-by funding facility (the "facility") from the Australia and New Zealand Banking Group ( ASX:ANZ).

ASX:ANZ).  ABM Resources (ASX:ABU) is developing several gold discoveries in the Central Desert region of the Northern Territory of Australia. The Company has a multi-tiered approach to exploration and development with a combination of high-grade production scenarios such as the Old Pirate High-Grade Gold Project, large scale discoveries such as Buccaneer, and regional exploration discoveries such as the Hyperion Gold Project. In addition, ABM is committed to regional exploration programs throughout its extensive holdings including the alliance with Independence Group NL at the regional Lake Mackay Project.

ABM Resources (ASX:ABU) is developing several gold discoveries in the Central Desert region of the Northern Territory of Australia. The Company has a multi-tiered approach to exploration and development with a combination of high-grade production scenarios such as the Old Pirate High-Grade Gold Project, large scale discoveries such as Buccaneer, and regional exploration discoveries such as the Hyperion Gold Project. In addition, ABM is committed to regional exploration programs throughout its extensive holdings including the alliance with Independence Group NL at the regional Lake Mackay Project.