Quarterly Activities Report

Brisbane, Jan 25, 2023 AEST (ABN Newswire) - The December 2022 Quarter (Quarter) and the subsequent month of January 2023 have been eventful for both the energy sector and State Gas Limited ( ASX:GAS) (

ASX:GAS) ( STGSF:OTCMKTS).

STGSF:OTCMKTS).

- International and domestic gas markets continued to perform strongly with global energy demand, particularly for gas, remaining high;

- State Gas has remained focussed on developing its projects and commercialising its resource base as quickly as possible. We continue to work towards enhancing the value of the Company's assets and generating an attractive return on capital through commercialising the Company's projects over the short to medium term.

- Federal Government intervention into domestic gas pricing has created an environment of uncertainty for the industry while attracting significant criticism from industry participants and the Australian business community more generally; and

- Notwithstanding the disruption created by regulatory price intervention, demand for domestic gas remains high and is expected to remain so for the foreseeable future as there are no reliable supply-side drivers capable of boosting supply in the short to medium term. The government's price caps will probably have the unintended consequence of increasing price volatility, thereby benefitting suppliers of spot gas.

Rougemont Well Production Testing

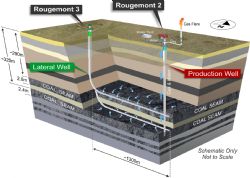

State Gas' Rolleston-West Project (ATP 2062) is targeting the Bandanna Formation coal measures. These are the same coal measures already in commercial production at Arcadia Valley to the south-east and under development at Mahalo to the North. Rougemont-3 consists of two laterals well drilled sub-horizontally through highly permeable coal seams identified by the previously-drilled Rougemont-2 well. The laterals connect to the Rougemont-2 vertical well, enabling the vertical - dual horizontal well system to be tested as a single unit.

Rougemont 2/3 has been on production testing since 21 November 2022 with the water being drawn down at a rate of around 2 metres per day. The well has been drawn down consistently and predictably to 120 metres (the first coal seam is at 356 metres depth) and we are consistently producing small quantities of gas - a good sign. The production test is producing a larger quantity of water than was initially prognosed, indicating high permeability in the coal seams within the two lateral wells, and therefore, potentially higher gas production from these coals once the water level has been reduced.

CNG Trucking ('Virtual Pipeline') Project

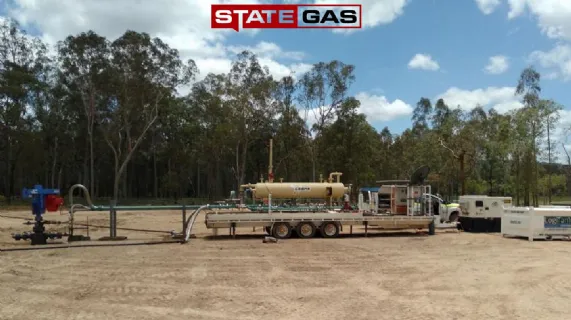

The Company made substantial progress towards achieving its deadline of delivering first gas production from its natural gas reserves located near the northern end of PL 231 with the compressor scheduled to arrive in February 2023. The project will see State Gas compress, truck and then decant the gas into existing pipeline infrastructure ("the CNG Project"). The CNG Project will allow State Gas to generate a modest positive operating cashflow and build up to delivering approximately 1TJ per day of new gas into what we expect will continue to be an under-supplied market. Engineering, design and preliminary pre-fabrication activities were completed during the quarter, allowing in-field construction and commissioning to commence in late February 2023. Gas from the CNG Project is planned to be sold into the spot market - which is not governed by the announced price cap of $12/GJ. Project operating costs are estimated to be substantially less than $12/GJ.

Proposed Federal Government Intervention into gas pricing

During the quarter, State Gas responded to substantial regulatory price intervention in the gas industry in conjunction with other industry participants and business leaders. This intervention allows the Federal Government to dictate the contracted price of gas for the next 12 months and significantly influence it thereafter. In our view, it is supply-side factors that are driving the price of domestic gas and the implementation of pricing caps will not alleviate that situation over the medium-term. We believe that price intervention will have a significant negative impact on investor sentiment in the energy sector and, perversely, exacerbate the existing challenges of reliable energy supply.

Whilst State Gas is exempted from the price caps announced in Canberra just before Christmas, the Company believes that the Government's attempts at price control - to the extent that they are effective - will stimulate domestic gas demand, exacerbating gas price volatility.

State Gas' pioneering efforts to create a demand-responsive ('capital lite') trucking solution may well be a net beneficiary of the unintended consequences of this policy.

State Gas will continue to lobby against this regulatory intervention as part of the wider industry response and will keep its shareholders updated on the impact as detail becomes clearer over the coming quarter. A copy of our submission seeking further consultation and debate was released to the ASX on 13 December 2022.

*To view the full quarterly report, please visit:

https://abnnewswire.net/lnk/KR770NK6

About State Gas Limited

State Gas Limited (ASX:GAS) (OTCMKTS:STGSF) is a Queensland-based gas exploration and development company with highly prospective gas exploration assets located in the southern Bowen Basin. State Gas Limited's mission is to support east coast energy markets through the efficient identification and development of new high quality gas assets.

State Gas Limited (ASX:GAS) (OTCMKTS:STGSF) is a Queensland-based gas exploration and development company with highly prospective gas exploration assets located in the southern Bowen Basin. State Gas Limited's mission is to support east coast energy markets through the efficient identification and development of new high quality gas assets.

It will do this by applying an agile, sustainable but low-cost development approach and opportunistically expanding its portfolio in areas that are well located to gas pipeline infrastructure.

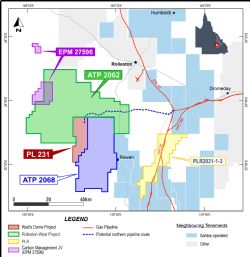

State Gas is 100%-owner of the contiguous Reid's Dome (PL-231) and Rolleston-West (ATP 2062) gas projects, both of which contain CSG and conventional gas. The Projects, together some 1,595km2 , are located south of Rolleston, approximately 50 and 30 kilometres respectively from the Queensland Gas Pipeline and interconnected east coast gas network. State Gas intends to accelerate commercialisation of these assets through the application of an innovative virtual pipeline ("VP") solution which will see the Company transport compressed gas by truck to existing pipeline infrastructure or to an end user.

State Gas also holds a 35% interest in ATP 2068 and ATP 2069 in joint venture with Santos QNT Pty Ltd (65%). These two new areas lie adjacent to or in the near vicinity of State Gas and Santos' existing interests in the region, providing for the potential of an alignment in ownership interests across the region over time and enabling synergies in operations and development.

State Gas is also participating in a carbon capture and sequestration initiative with minerals explorer Rockminsolutions Pty Ltd in respect of EPM 27596 which is located on the western border of ATP 2062. This project is investigating the potential of the unique basalts located in the Buckland Basaltic Sequence (located in EPM 27596) to provide a variety of in-situ and ex-situ carbon capture applications.

| ||

|