Successful $5 Million Placement and SPP Announced

Brisbane, Aug 8, 2023 AEST (ABN Newswire) - State Gas Limited ( ASX:GAS) (

ASX:GAS) ( STGSF:OTCMKTS) is pleased to announce the successful completion of a $5 million placement at $0.15 per share ("the Placement"). The Company also announces a Share Purchase Plan ("SPP") to provide eligible shareholders on the record date, the ability to invest in State Gas up to a maximum of $30,000 at the same price ($0.15 per share) as investors who participated in the Placement. The SPP has the provision to take up to $3 million from eligible shareholders. Both the Placement and the SPP are non-underwritten.

STGSF:OTCMKTS) is pleased to announce the successful completion of a $5 million placement at $0.15 per share ("the Placement"). The Company also announces a Share Purchase Plan ("SPP") to provide eligible shareholders on the record date, the ability to invest in State Gas up to a maximum of $30,000 at the same price ($0.15 per share) as investors who participated in the Placement. The SPP has the provision to take up to $3 million from eligible shareholders. Both the Placement and the SPP are non-underwritten.

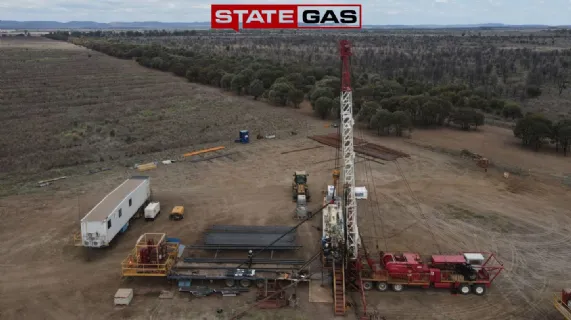

Capital raised from the Placement and SPP will fund the development of key infrastructure at the Rolleston West Project (ATP 2062), that will allow the Company to commence initial production and sale of Compressed Natural Gas (CNG). The Placement allows State Gas to commence immediate construction and commissioning of its Compressed Natural Gas Facility ("CNG Facility") which will enable the sale of CNG from the existing Rougemont 2/3 dual lateral well ("Rougemont 2/3"). The Company expects to increase daily gas production from an initial 0.5TJ/day to 1.25TJ/day through the compression and sale of production testing gas generated from:

1. Rougemont 2/3 which has already demonstrated the ability to produce a minimum of 0.5TJ/day; and

2. A further well which the Company intends to drill prior to December 2023.

Initial production will be facilitated via the Company's virtual pipeline/trucking strategy, which allows CNG to be transported using specialised CNG trailers to local third-party offtake partners and/or delivery into the Gladstone-Wallumbilla gas pipeline (less than 50 km). This initial production will allow the external verification of an initial 2P reserve which the Directors expect will ultimately support the financing of additional in-field pipeline infrastructure to the CNG facility that can enable substantial future expansion to production.

The early sale of gas from Rougemont 2/3 will enable the Company to demonstrate that the Rolleston West Project has the hallmarks of a world class development asset and, importantly, begins to unlock part of the substantial value inherent in the Company's asset base. State Gas is confident that it is on the path to delivering improved returns to shareholders on its existing assets and well positioned to meet increasing demand for gas over the short to medium term.

"Given the domestic gas shortfall coupled with the increased volatility in the gas and electricity markets, this investment positions State Gas to be at the right place at the right time. The demand for gas worldwide continues to grow unabated." said Mr Richard Cottee, Executive Chairman.

Placement Overview

State Gas has raised A$5 million in gross proceeds via a Placement at an issue price of A$0.15 per share (Placement Price). The Placement Price represents a 16.7% discount to the last close price on 31 July 2023 and a 16.8% discount to the 15-day VWAP of the Company's shares up to and including 31 July 2023.

The Company will issue a total of 33,333,334 shares under the Placement consisting of 26,000,000 new shares, raising approximately $3.9 million, under its available placement capacity under ASX Listing Rule 7.1 (Part 1). Subject to shareholder approval at a general meeting of the Company to be held on or around 27 September 2023, a further $1.1 million will be raised through the issue of 7,333,334 new shares to Directors who have participated in the Placement on the same terms as other investors (subject to shareholder approval) (Part 2). Part one of the Placement is expected to settle on or around 14 August 2023 with shares to be issued on 16 August 2023. The second part of the Placement, which is subject to shareholder approval, will settle on or around 28 September with shares expected to be issued on 30 September 2023.

Shares issued under the Placement will rank equally with the Company's other ordinary shares on issue.

Proceeds from the Placement will be used towards funding:

- the construction and commissioning of the Company CNG Facility;

- drilling an additional well;

- repay Director Loans;

- working capital; and

- costs associated with the offer.

Aitken Mount Capital Partners Pty Limited acted as Sole Bookrunner and Lead Manager to the Placement.

HWL Ebsworth acted as legal advisors to the Company.

SPP Overview

Under the capital raising, the Company will also offer existing eligible2 shareholders on the record date, being 7pm AEST on 7 August 2023, the opportunity to participate in the non-underwritten SPP for up to A$30,000 at the same price as the Placement ($0.15) to raise up to an additional $3 million without incurring brokerage fees. The Company intends to open the SPP on 14 August 2023 and a closing date for acceptances of 28 August 2023. Shares under the SPP are expected to be issued on or around 1 September 2023. New shares issued under the SPP will rank equally with the Company' other ordinary shares on issue.

The Company retains the right to scale back applications (in whole or in part) at its discretion, for example because the aggregate amount applied for under the SPP exceeds the $3,000,000 cap or in individual cases, taking into account the size of the eligible shareholder's shareholding at the record date, the extent to which the eligible shareholder has sold or purchased shares since the Record Date, whether the Eligible Shareholder has multiple registered holdings, the date on which the application was made and the aggregate applications received from Eligible Shareholders.

Proceeds from the SPP will be used to fund additional drilling and working capital.

Further information in relation to the SPP, including the terms and condition, is expected to be made available to eligible shareholders in the coming days, together with the SPP Offer Booklet. Eligible shareholders should review the SPP terms and conditions in full before deciding whether or not to participate in the SPP.

To view the Indicative Timetable, please visit:

https://abnnewswire.net/lnk/ZW668GWR

About State Gas Limited

State Gas Limited (ASX:GAS) (OTCMKTS:STGSF) is a Queensland-based gas exploration and development company with highly prospective gas exploration assets located in the southern Bowen Basin. State Gas Limited's mission is to support east coast energy markets through the efficient identification and development of new high quality gas assets.

State Gas Limited (ASX:GAS) (OTCMKTS:STGSF) is a Queensland-based gas exploration and development company with highly prospective gas exploration assets located in the southern Bowen Basin. State Gas Limited's mission is to support east coast energy markets through the efficient identification and development of new high quality gas assets.

It will do this by applying an agile, sustainable but low-cost development approach and opportunistically expanding its portfolio in areas that are well located to gas pipeline infrastructure.

State Gas is 100%-owner of the contiguous Reid's Dome (PL-231) and Rolleston-West (ATP 2062) gas projects, both of which contain CSG and conventional gas. The Projects, together some 1,595km2 , are located south of Rolleston, approximately 50 and 30 kilometres respectively from the Queensland Gas Pipeline and interconnected east coast gas network. State Gas intends to accelerate commercialisation of these assets through the application of an innovative virtual pipeline ("VP") solution which will see the Company transport compressed gas by truck to existing pipeline infrastructure or to an end user.

State Gas also holds a 35% interest in ATP 2068 and ATP 2069 in joint venture with Santos QNT Pty Ltd (65%). These two new areas lie adjacent to or in the near vicinity of State Gas and Santos' existing interests in the region, providing for the potential of an alignment in ownership interests across the region over time and enabling synergies in operations and development.

State Gas is also participating in a carbon capture and sequestration initiative with minerals explorer Rockminsolutions Pty Ltd in respect of EPM 27596 which is located on the western border of ATP 2062. This project is investigating the potential of the unique basalts located in the Buckland Basaltic Sequence (located in EPM 27596) to provide a variety of in-situ and ex-situ carbon capture applications.

| ||

|