Altura Earn In Agreement Boosts Sayonas Aust Lithium Assets

Altura Earn In Agreement Boosts Sayonas Aust Lithium Assets

Brisbane, Aug 8, 2019 AEST (ABN Newswire) - Emerging lithium miner Sayona Mining Limited ( ASX:SYA) (

ASX:SYA) ( DML:FRA) (

DML:FRA) ( DMNXF:OTCMKTS)announced today an Earn-in Agreement with leading lithium producer Altura Mining Limited (

DMNXF:OTCMKTS)announced today an Earn-in Agreement with leading lithium producer Altura Mining Limited ( ASX:AJM), which will help maximise the value of Sayona's Western Australian lithium portfolio in the world-class Pilgangoora lithium district.

ASX:AJM), which will help maximise the value of Sayona's Western Australian lithium portfolio in the world-class Pilgangoora lithium district.

Under the agreement, Altura will spend $1.5 million on exploration across the project portfolio over three years to earn a 51% interest, with Sayona retaining the remaining project interest. Sayona retains the right to contribute to project evaluation and development in the future to participate in the upside potential.

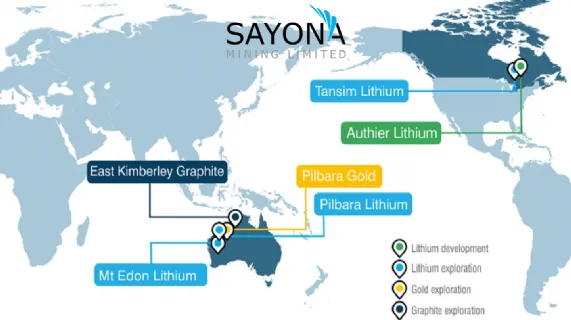

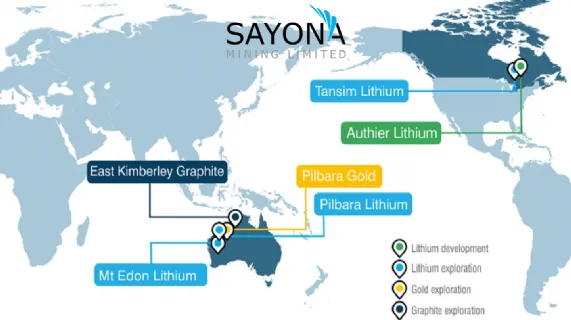

Sayona's current WA lithium portfolio comprises some 1,806 square kilometres, with its tenure in close proximity to other spodumene deposits, including Altura's Pilgangoora mine which commenced commercial production in March 2019.

Welcoming the agreement, Sayona's Managing Director, Mr Lynch said Altura was the perfect partner to crystallise value for shareholders from the Company's Australian lithium assets.

"Altura has a highly experienced in-house team that successfully led the financing, construction and commissioning of its spodumene mine at Pilgangoora," Mr Lynch said.

"It is this expertise that will ensure we derive maximum value from our exploration assets in WA."

Altura's Managing Director, James Brown (also a Director of Sayona) said the agreement was a win-win deal for both companies.

"Our common directors and shared experiences have given us a mutual understanding that will allow the potential of Sayona's Australian exploration tenements to be fully explored," he said.

"For Altura, having access to Sayona's exploration portfolio provides enormous upside in terms of our project pipeline and we are determined to advance exploration activity as quickly as possible for the benefit of all."

In addition to Mr Brown, Sayona's Non-Executive Directors Allan Buckler and Dan O'Neill are also directors of Altura.

Earn-In Agreement Terms

The Earn-In Agreement terms are as follows:

- Altura to spend $1.5 million on exploration within three years to earn a 51% stake in the tenements;

- Should it wish to withdraw, Altura must spend at least$500,000 on exploration expenditure , including at least 2,500 metres of drilling on the Mallina project and 1,000m on the Tabba Tabba project; and

- Sayona to retain a 49% stake, subject to possible future potential dilution in line with any increased spending by Altura, should Sayona not wish to participate.

Sayona's Mr Lynch added: "It is rare for such a close alignment of two companies, but this deal is truly one that benefits both, particularly given our priority on advancing our flagship Authier Lithium Project in Quebec.

"We can now ensure that our funds are maximised towards the highest likelihood of increased shareholder returns, with the added upside of any potential new discoveries in Australia."

About Elevra Lithium Limited

Elevra Lithium Limited is a North American lithium producer (ASX:ELV) (NASDAQ:ELVR) OTCMKTS:SYAXF) with projects in Quebec, Canada, United States, Ghana and Western Australia. In Quebec, Elevra's assets comprise North American Lithium (100%) and a 60% stake in the Moblan Lithium Project in Northern Quebec. In the United States, Elevra has the Carolina Lithium project (100%) and in Ghana the Ewoyaa Lithium project (22.5%) in joint venture with Atlantic Lithium. In Western Australia, the Company holds a large tenement portfolio in the Pilbara region prospective for gold and lithium.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:SYA) (

ASX:SYA) ( DML:FRA) (

DML:FRA) ( DMNXF:OTCMKTS)announced today an Earn-in Agreement with leading lithium producer Altura Mining Limited (

DMNXF:OTCMKTS)announced today an Earn-in Agreement with leading lithium producer Altura Mining Limited ( ASX:AJM), which will help maximise the value of Sayona's Western Australian lithium portfolio in the world-class Pilgangoora lithium district.

ASX:AJM), which will help maximise the value of Sayona's Western Australian lithium portfolio in the world-class Pilgangoora lithium district.